The world economy is on its way to decelerating 3.3% from last year to 2.9% in 2025 and 2026, The OECD said, which cut its March estimates, which foreseen a 3.1% growth this year and 3.0% next year.

However, Growth prospects would probably be even weaker if protectionism increases, which would stimulate inflation, would interrupt supply chains And shaking financial markets even more, said the organization based in Paris in its last economic perspectives.

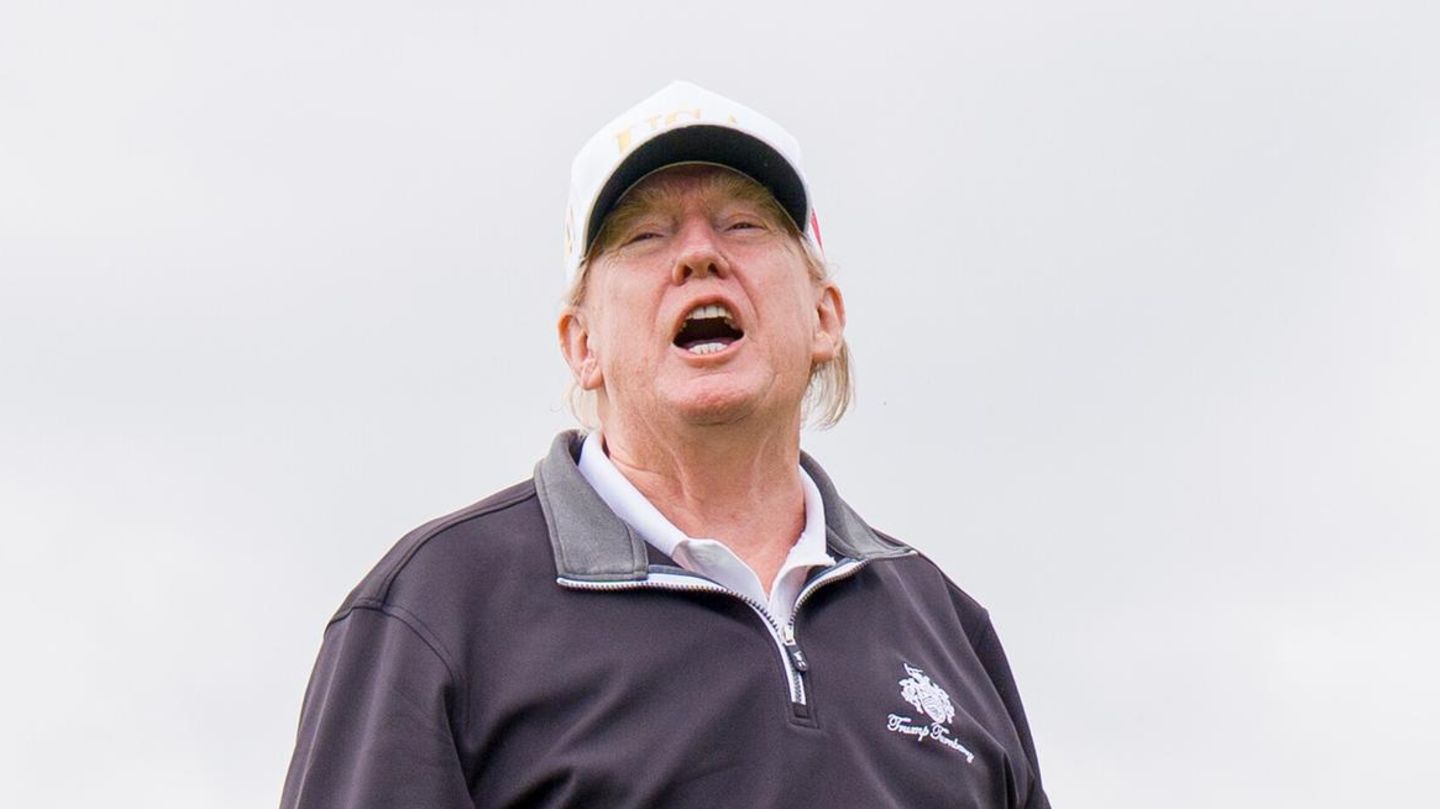

The tariff ads of the president of the United States, Donald Trump, since he assumed office in January The world economic uncertainty has already stirred and agitated the financial markets, which has forced him to reverse in some of his initial positions.

Last month, The United States and China agreed to reducing tariffs, and Trump also postponed the 50% tariffs to the European Union until July 9.

The OECD predicted that the US economy would grow only 1.6% this year and 1.5% next, assuming to make the calculations that the tariffs in force in mid -May would remain thus during the rest of 2025 and 2026.

By 2025, the new forecast is a considerable cut, since the organization had previously planned that the world’s largest economy would grow 2.2% this year and 1.6% next.

Trump tariffs April 2025

The tariff announcements of the president of the United States fueled world economic uncertainty

Although new tariffs can create incentives to manufacture in the United States, The increase in import prices would reduce the purchasing power of consumers And the uncertainty of economic policy would stop business investment, warned the OECD.

Meanwhile, the highest tariff income would only partially compensate for lost income due to the extension of the 2017 fiscal cuts and jobs law, new tax cuts and weaker economic growth, he added.

The repercussions of tariffs according to the OECD

The Wide Law on Trump Tax and Expenses Cuts It will raise the US budget deficit to 8% of economic production by 2026, one of the largest fiscal deficits for a developed economy that is not at war.

As tariffs stimulate inflationary pressures, it is considered that Federal Reserve will maintain interest rates during this year and then will cut them up to 3.25-3.5% at the end of 2026.

In China, The repercussions of the upload of tariffs in the United States would be compensated in part by government subsidies to a consumer goods exchange program, such as mobile phones and appliances, and for the increase in social benefits, according to the OECD.

It is estimated that the second world economy, which is not a member of the OECD, will grow 4.7% this year and 4.3% in 2026, which represents a minimum change compared to the previous forecasts of 4.8% in 2025 and 4.4% in 2026.

The prospects for the euro zone did not vary compared to Marchand provide a 1.0% growth this year and 1.2% the next driven by the resistance of labor markets and the cuts of interest rates, while the highest public spending in Germany would boost growth in 2026.

The United Kingdom’s prospects improved slightly compared to March, With a growth forecast of 1.3% this year and 1.0% in 2026, slightly downward compared to March estimates, which anticipated 1.4% in 2025 and 1.2% in 2026.

Source: Ambito