In its first year of management, The government made a much more aggressive fiscal adjustment compared to previous cases from countries that faced plans to stabilize inflation. In the first months of 2025, the Ministry of Economy maintained its discipline in terms of expenses, although the debate among economists grows: Is there room to relax the surplus and thus encourage greater and more sustainable growth, or puts at risk the disinflation path?.

After accumulating a Primary fiscal surplus equivalent to 1.8% of the internal gross product (GDP) over last yearbetween January and April the National Public Sector (SPN) returned to register a favorable balance, of 0.6%. Likewise, the financial result (which includes the interests of the debt) of 2024 gave positive for the first time in 15 years (+0.3%), while, so far this year, the figure already represents 0.2% of the product.

In April, Primary expenditure scored its first fall of the year in annual termswhile the income grew, although it should be clarified that the recent May data showed a weak collection due to the high comparison base, to which the elimination of the country tax was added, and casualties of withholdings and import tariffs.

In the official discourse, the “chainsaw” is the main reason why inflation yielded considerably and for which the markets trust the plan of Minister Luis Caputo. In that sense, The Executive Power would not seem willing to negotiate this element of economic policy.

The government fiscal adjustment exceeds that of successful stabilization plans

A report of Interdisciplinary Institute of Political Economics (IIEP) of the University of Buenos Aires (UBA) He did not doubt that “fiscal consolidation is a necessary condition to successfully stabilize an economy with chronic inflation.” In addition, he said that in the Argentine case “it allowed the elimination of monetary emission, decreased the debt needs and reduced the pressure on the exchange rate.”

However, the work written by economist Joaquín Waldman remarked that both the variation of the fiscal result and the surplus level exceed those observed in other stabilization plans. As an example, he stressed that, In successful cases, the primary fiscal balance of the year after the start of the program revolved around 1.2% of GDP, while the financial balance gave a negative of -0.5%, figures quite lower than those presented by Argentina in 2024.

image.png

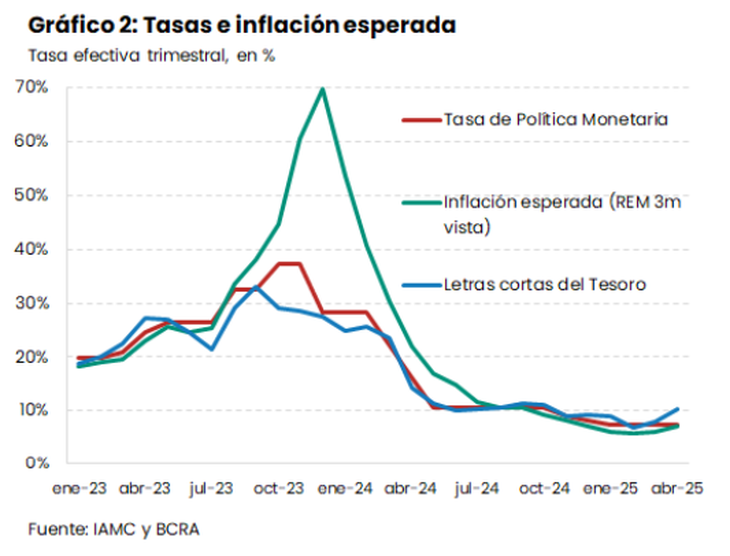

The researcher at the Center for State and Society Studies (CEDES) exhibited that the surplus is being used fundamentally in financial investments and that It has a “doubly contractive” character for the economysince not only implies a reduction in public spending but is also deriving in an increase in the interest rate. The latter is due to the fact that the treasure is not using the weights that it absorbs to cancel debt in local currency, but in the last tenders sought to refinance it, validating higher yields than analysts expected.

An unnecessarily large fiscal surplus?

In that context, Waldman suggested that Economy could relax fiscal hardness to stimulate economic activityFor example Through public works (something that is contemplated in the agreement with the IMF) or to give medium term sustainability to growth Via accumulation of reservations or wisdom.

“The surplus is unnecessarily large. Today the Treasury has resources to increase a bit expenses that are fundamental and today are slowed, without generating an excess of the emission or an over -indebtedness. Alternatively, debt could cancel, but we understand that this is not doing with the intention that the interest rate is high and thus discourage the purchase of dollars, “he said in dialogue with Scope.

image.png

The specialist added that “IMF himself is asking the government to relax a little financial surplus”

With a somewhat different look, the economist José Ignacio Bano said there is not too much room to relax the surplus And he said that it is difficult to clearly measure that “trade-off” between the benefits of contractive policies and their negative impact on growth.

Disinflation vs Growth: The Trade-Off that the Government faces

The analyst reminded this medium that this duality became particularly noticeable at the beginning of last year, “when there was a lack of huge weights, they closed all monetary growth, they absorbed weights like crazy and the economic parate felt.” “We must recognize that today we are not at that time, since The monetary base does not continue to go down as was happening At that time, “he said.

Bano thinks that, given the recent trajectory of inflation in Argentina, The economy could “quietly” 1.5% monthly inflation. “From there you have to see how far you should continue drying the pesos square And how much it should be done with a certain level of inflation for a while, because at some point you have to finish lowering it, “he said.

Even so, see that economic activity is showing growth symptoms, although “we all want it to be faster and deeper.” Within that framework, he said that “The government can measure that pull and loosen, and how far can we push inflation to the extent that it see that the economy continues to grow“

Anyway, it is worth noting that The recovery of the activity is motorized by sectors not very intensive in employment generation. Meanwhile, real salary of the private sector are stagnant (at extremely low levels) and private consumption does not rebound, a combo that could increase tensions in social terms.

Source: Ambito