After the Founder recorded in the consumer price index last month -2.8% in April to 1.5% in May-, in government sources emphasizes the context in which this lower inflation was achieved. This is the lowest variation in five years at a time when economic activity -destacan- is in full expansion, growing at a rate of 6% per year. The last time the indicator was 1.5% was in May 2020, but in a very different situation since at that time the Coronavirus pandemic led to a paralysis that imposed a brake on prices. If the pandemic is neglected, you have to go back to November 2017 to find a minor variation (1.4%).

A second aspect that highlights in the Palace of Finance is that the variation of the consumer price index decreased in coincidence with The lifting of exchange restrictions. While the stocks are still maintained for companies, the release of controls for natural persons did not cause – as some feared – a shooting of the dollar and, consequently, an increase in inflation, when, on the contrary, it remained stable.

In addition, and not least, they point out that inflation continues to fall despite the process of correction of relative prices that the authorities have been carried out. A report from the University of Buenos Aires has just been known in which it is indicated that the intermennsual inflation of the services exceeded that of the goods in eleven of the twelve months of the first year of government, which made it made that The services would take approximately 33% in relative terms.

In favor of the lower increase in CPI in last month some seasonal products played. For example, The price of lettuce fell 25% in May in relation to April, while the Pope retreated 8%.

It is also observed A hurry minor to continue with tariff recomposition with delays in the increases of services such as gas that contributed to the slowdown in the index.

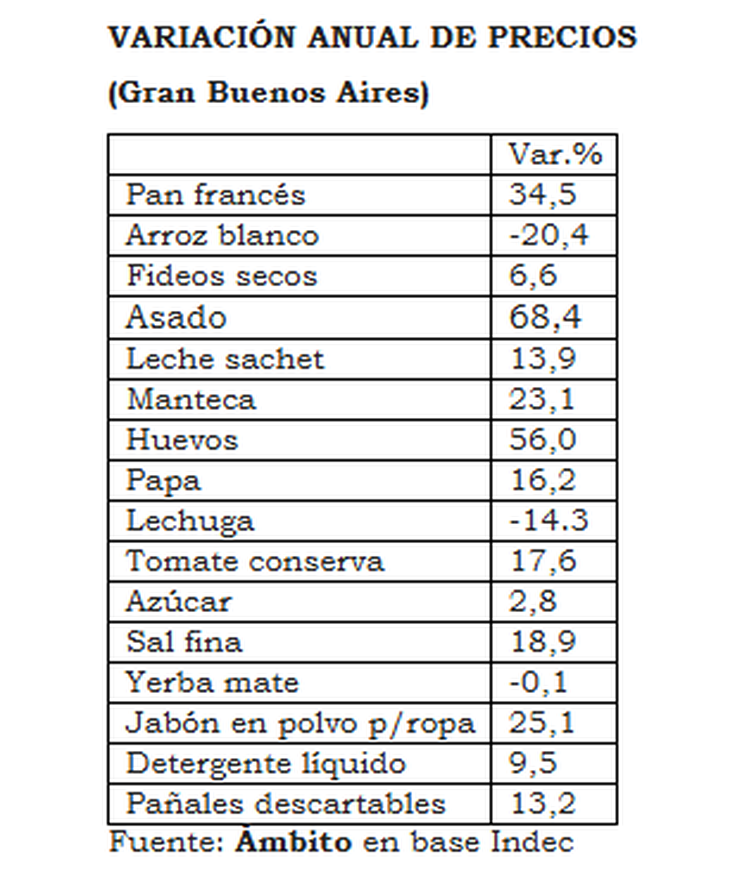

From a greater perspective, considering the last year, the prices of different products show significant variations. Scope selected some for the area of Greater Buenos Aires and it is observed that, against a rise in the global index of 43%, In the last twelve months the meat is among the items with the highest increases -the roast rose 68% -together with the chicken eggs -with an increase of 56% -. At the far end, White rice was reduced 20% and the price of lettuce fell 14%.

May prices (CABA) .png

Inflation and dollar: the perspectives

Beyond stating that at some point inflation “It will collapse” For monetary restriction policy, the government is reluctant to make forecasts. However, in the 2025 budget project (not approved) a rise in prices of 18.3%was contemplated. So far this year, that is, to May, inflation accumulates 13.3%. So, Not to pass this goal would have to rise 4.5% in the missing months, at a rate of 0.6% monthly.

The consensus of economists does not believe that inflation will be so low in the coming months, but anticipates a descending trajectory. The last projection of the market expectations survey (which includes the forecasts of the main consultants and entities) It expects the year to end with an inflation of 28.6% with monthly rates from 1.9% in June to 1.6% in November.

The internal projections of the Ministry of Economy are more optimistic, as it has transcended, with decreasing variations that would locate monthly inflation around 1% at the end of the year.

In favor of the growing price stability, the fiscal equilibrium policy and monetary restriction maintains the government plays. However, in private media, doubts are raised due to the level of the exchange rate, since the dollar is a key reference for pricing.

Recent history shows that when the dollar value was (at today’s prices) below the $ 1,000 there were exchange tensions that gave rise to corrections, as happened in 2014 or 2018.

Appealing to indebtedness, the conduct of the Ministry of Economy avoids intervening in the change market with the objective of rebuilding reservations by buying dollars from the commercial surplus. In this way, the exchange rate is maintained by “ironing” favoring lower inflation, although the authorities also point out that they do not bet the dollar go to the band’s floor.

Nevertheless, The operators are attentive to what may happen in the coming weeks when the offer of the agricultural sector, for seasonal reasons, and possibly raise the demand for currencies for coverage reasons as it usually happens as it usually happens in the anteroom of electoral processes. And even more so if investors perceive that the dollar is cheap.

Annual prices (GBA) .png

Source: Ambito