Menu

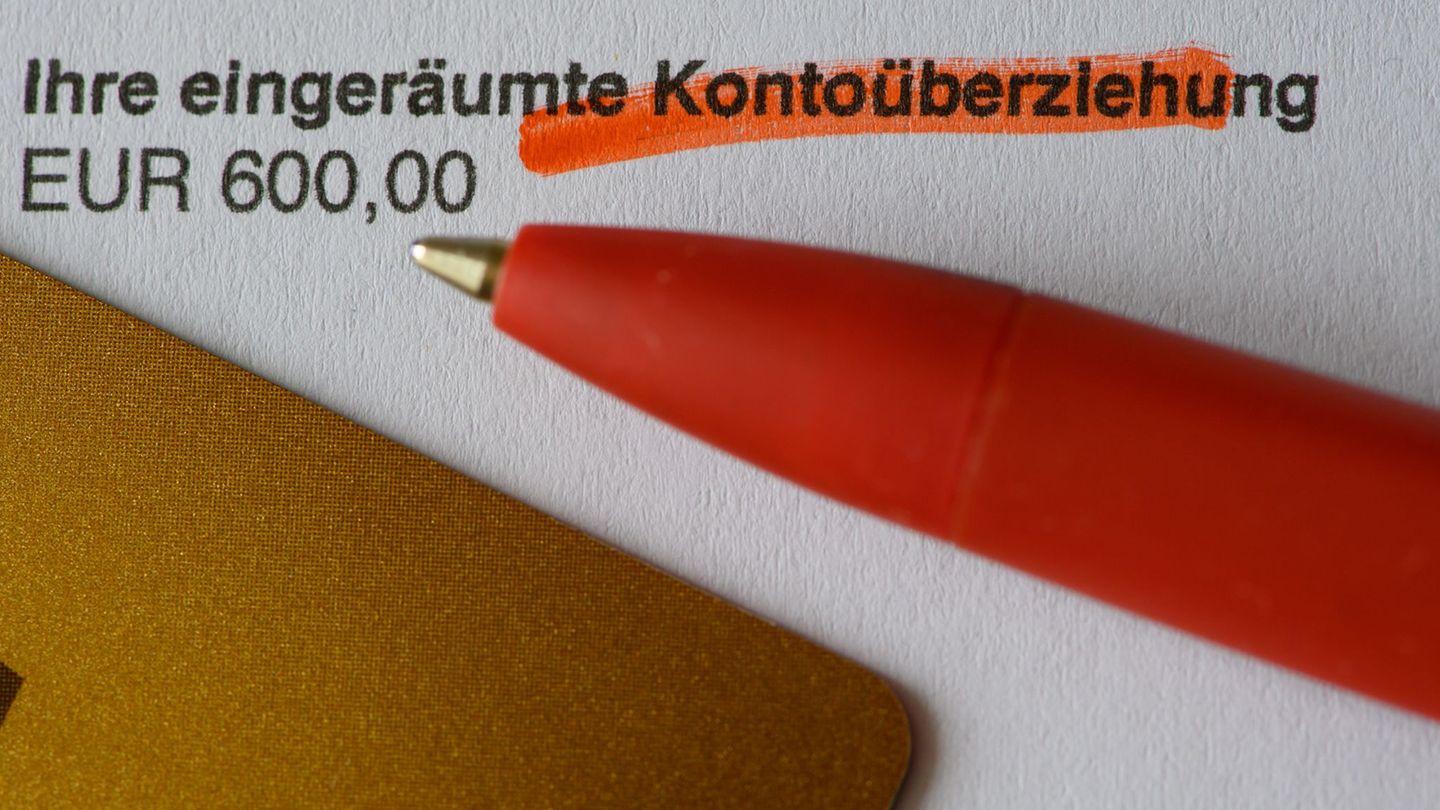

Consumer protection: Bank customers should get more rights from the overdraft facility

Categories

Most Read

Prices: Cartel Office initiates proceedings against Temu

October 8, 2025

No Comments

How to apply to the DNI account discount on butchers this Saturday, October 11, 2025

October 8, 2025

No Comments

This is the bank that pays more interest this Wednesday, October 8

October 8, 2025

No Comments

Cockpit Association: Top-level talks aim to avert strike at Lufthansa

October 8, 2025

No Comments

Expensive four-legged friends: Pet food has been more than a third more expensive since 2020

October 8, 2025

No Comments

Latest Posts

Bear rioted in Japanese supermarket

October 8, 2025

No Comments

Video footage shows the bear on the way to the supermarket. The bear almost climbed into the fish freezer. The predator suddenly appeared in the

How children perceive their parents when they are little and why that feeling changes as they grow up

October 8, 2025

No Comments

October 8, 2025 – 16:00 During different stages of life, emotional maturation, the search for independence, and life experiences affect intrafamily ties. freepik During the

Kristalina Georgieva praised the Government’s adjustment as an example in the world, but left a warning ahead of the elections

October 8, 2025

No Comments

October 8, 2025 – 15:55 The managing director of the IMF is part of the negotiating tables between Luis Caputo’s economic team and US Treasury

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.