The new 5G mobile communications standard should bring Germany a big step forward in mobile Internet. And apparently faster than planned. Even the cell phone providers are surprised.

When it comes to major projects such as the construction of a capital city airport, people in Germany have been used to a healthy amount of skepticism when assessing schedules in recent years. So it’s all the more pleased if things can be done differently: The German providers are well ahead of schedule with the expansion of the new 5G mobile communications standard – and are therefore doing pretty well in an international comparison.

“The 5G network is growing faster in Germany than all cellular networks before,” confirms Hannes Ametsreiter, CEO of Vodafone Germany stern. “We will expand 5G twice as fast as the previous 4G standard,” said a pleased Telefónica spokesman.

Vor Plan

In fact, all three major providers are currently ahead of their current plan. “When Vodafone activated the first 5G network in Germany in 2019, we set ourselves the goal of reaching around 20 million people with 5G where they live by the end of 2021,” explains Ametsreiter. This goal has long been exceeded – months before. “Our 5G network is currently available to 25 million people – more than 30 million people will be able to use it at home by the end of the year.”

It looks similar at Telefónica. More than 60 cities have already been connected, there were five at the start of 2020. “By the end of 2021 we will be supplying over 30 percent of the population with 5G, and by 2025 all of Germany,” said the group’s spokesman. Telekom recently reported that it could already reach 66 million people with its 5G network.

Not the front runner, but at the fore

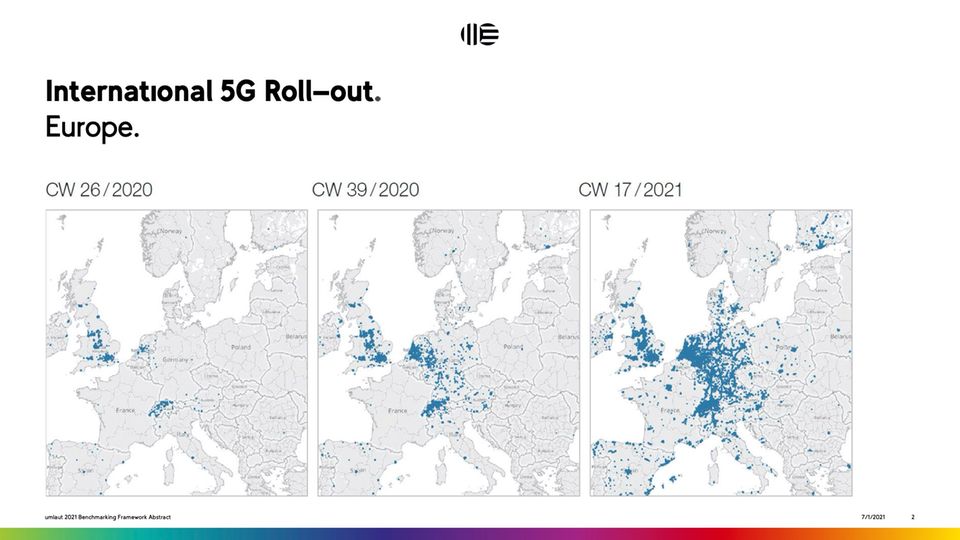

Germany is also doing well in an international comparison. “That went really well this time and is still going on,” confirms Hakan Ekmen, whose agency “umlaut” regularly examines mobile networks worldwide for their range and performance. According to a study carried out by the company together with the trade journal “Connect”, 21.53 percent of connections in Germany are already over the 5G network, and 4.89 percent of the country is therefore already covered by the 5G network. That doesn’t sound like much, but the providers are currently concentrating primarily on the metropolitan areas and not the area of the country.

Ekmen finds comparisons with countries such as South Korea or Qatar, which achieve significantly greater area penetration of 80 percent with 5G shares, unfair. “The market conditions and the landscape are just completely different,” he explains stern. “If you look at countries with similar conditions, the Netherlands, Austria and Switzerland are traditionally to be mentioned in Europe as countries that are still further. But then comes Germany too.”

Learned from the past

Ekmen believes that one reason for the faster expansion is the learning process on the part of the government. “Since the introduction of UMTS, there has been a lot of understanding how one can make the providers’ work easier. For example, by simplifying approval processes or taking measures to close dead zones,” he praises. “There has really been a lot going on, and that will also become important in relation to the expansion of fiber optics. I definitely see a positive development.”

The expensive frequency auctions also played a further role in the past, believes Vodafone boss Ametsreiter: “The UMTS auction in 2001 was the most expensive of all times. The money that the network operators paid here was missing for many years for the expansion of real Infrastructure. That was noticeable in the quality of the networks for a long time. ” Telefónica also sees it that way. “The frequency costs are a factor in the company’s ability to invest and are decisive for or against rapid network expansion,” explains the group.

The consequences of the UMTS frequency auctions could be felt in the industry for years. The providers paid almost 60 billion euros for the licenses in 2000, a lot of money that was ultimately missing when the network was expanded. The corporations had learned from LTE that they only paid 5 billion euros into the treasury for the 2010 and 2015 campaigns. When 5G licenses were auctioned for the first time in 2019, a total of 6.5 billion were paid.

And the next auctions are due in 2023, warns Ametsreiter. “We finally have to talk seriously about new procurement procedures,” says the Vodafone boss. “An extension of the existing licenses for the further use of the radio frequencies could ensure that more money is invested in new radio masts instead of in the state coffers.”

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.