September comes with the retrogression of the PAIS Tax rate, more pressure on reservations and rate increases. Although also with the Most challenging peso debt maturities of the year. As a result of the migration of liabilities from the Central Bank to the Treasury, the commitments for the month amount to more than $14 billion. The Ministry of Economy will have to test the market’s willingness to refinance them and is already preparing two tenders. Although, given the magnitude of what is due, in recent days it anticipated increasing the liquidity buffer which is held as a guarantee of payment.

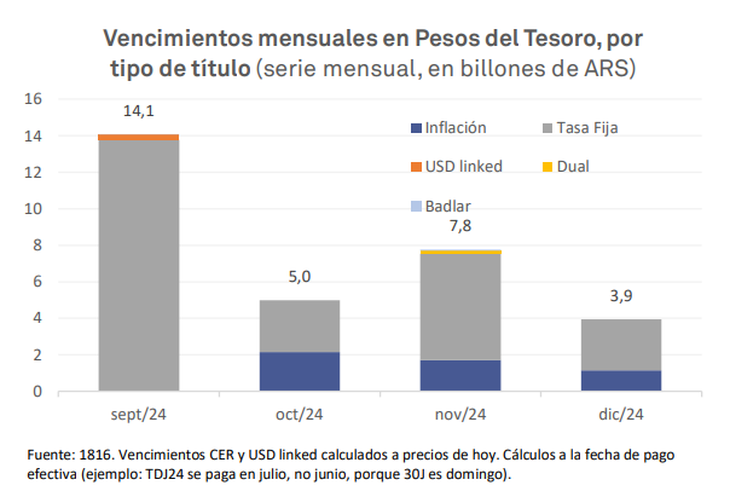

The wall of local currency Treasury maturities over the next four weeks totals $14.1 trillion. Almost all of it (more than $13.8 trillion) corresponds to two fixed-rate bills (LECAP), which expire on September 13 and 30. The rest corresponds to small interest payments on various securities and about $300 billion to the amortization of the dollar linked T2V4 bond. To try to roll them over, The Ministry of the Economy has scheduled two tenders to be held on September 11 and 26.

In general, City sources believe that, given the continuation of the exchange rate restrictions and with the banks as the main creditors, the Ministry of Finance should not have any significant problems when trying to renew these maturities. But it will not be an easy task either. And the Government needs to avoid possible difficulties in refinancing that could add pressure on the parallel dollars at a time when Luis Caputo It seeks to show a downward path for the exchange rate gap in an attempt to convince the market that there will be no devaluation.

The focus will be on this, as the Government has sought to ensure its ability to pay. With the funds from the fiscal surplus (through adjustment) and part of the net debt issued in recent months, it has built up a large “liquidity cushion” that maintains deposited at zero rate in the BCRA. As of August 26, these deposits totaled $16.7 billionof which $15.9 billion were in pesos.

This week, Following the last tender for debt in pesos in August, the Ministry of the Economy decided to increase this cushion as a precautionary measure. The Secretary of Finance, Pablo Quirnoannounced that the net financing placed over Friday’s maturities (about $860 billion) would also be deposited in the Treasury’s account at the Central Bank.

In that last auction, the Government received offers for $4.84 billion, of which it decided to award $4.47 billion. 93% of the amount placed was concentrated in four LECAPs and the remaining amount went to an inflation-linked bond (BONCER) for December 2026. On the other hand, it declared a BONCER for 2027 and two dollar-linked securities maturing in the first half of 2025 void.

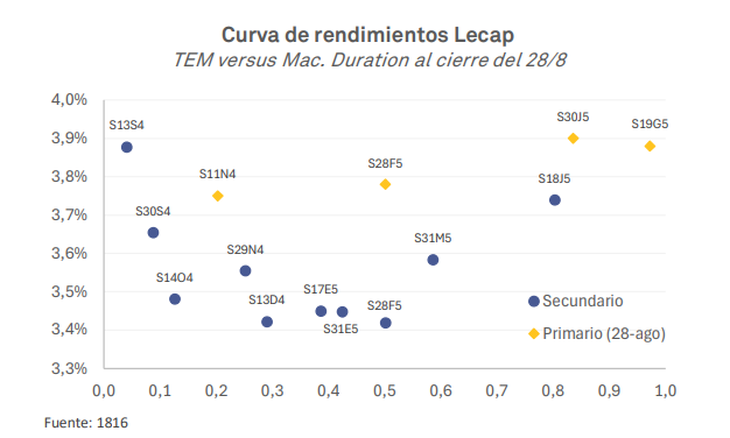

In the case of the LECAP, it achieved a slight drop in rates of interest Regarding the last tender: all cut between 3.75% effective monthly (TEM) and 3.9% TEM, below the 3.95% of the longest letter of the previous auction. However, he had to acknowledge higher returns than those traded on the secondary market during the same Wednesday of the tender.

image.png

There were two interpretations regarding the attitude of the Finance Ministry. “This time, the Treasury was inclined to take the largest number of offers, which explains the premium in the rates awarded over those of the secondary market. Thus, it would have focused on seeking additional financing, considering the payments of the next months,” he said. Personal Investment Portfolio (PPI) in a report for their clients.

Instead, SBS Group He stated: “All TEMs were below the minimum TEM of 3.95% of the previous tender, although with a premium compared to the secondary market in comparable tranches. We consider that this shows that the Government could have prioritized continuing to signal decreasing rates instead of attracting greater net financing.”

Debt: upcoming maturities

In this context, In the last four months of 2024, the Government will face maturities of $30.8 billion, almost all of it with private creditors. The $14.1 trillion in September is joined by $5 trillion in October, $7.8 trillion in November and $3.9 trillion in December. If you zoom in, the debt payment schedule in pesos from now until the end of Javier Milei’s term, it will amount to around $280 billion: In addition to this year’s payments, $114.8 billion will be added in 2025, $80.5 billion in 2026 and $53.9 billion in 2027, although with a greater weight of commitments to public bodies.

image.png

The accumulation of maturities, especially short-term ones, are partly the result of the strategy of Debt migration from the BCRA to the Treasury. In the first half of 2024, the Government encouraged banks to dismantle passive swaps and subscribe to LECAPs placed by the Ministry of the Economy, a process that culminated in July with the elimination of the remaining stock of remunerated liabilities of the Central Bank and its replacement by LEFIs (also issued by the Treasury).

The strategy was to end the endogenous issuance that represented the payment of interest on the BCRA’s liabilities. But, at the same time, the handrail implied weakening the financial position of the Treasury by increasing its commitments. That is why some analysts consider that “the dependence on the cepo remains intact.”

This is what Eco Go, the consulting firm, said. Marina Dal Poggetto: “Transferring the debt from the BCRA to the Treasury is useless if the country risk does not collapse and if the Treasury cannot put together a financial program that does not depend on the currency controls to refinance the largest debt maturities.”

To the mountain of debt in pesos, is added By the end of 2027, foreign currency maturities amounting to US$61.6 billion between payments to the IMF, bondholders and other creditors. An external debt that, in a significant portion, is also a legacy of Caputo’s previous management during Mauricio Macri’s government. With net reserves in the red, the possibility of accessing international markets to refinance it becomes increasingly remote.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.