A Riojan with a rustic appearance who reproduced Facundo Quiroga had emerged as the leader of Peronism. The surprise came when the president appointed Miguel Roig, CEO of Bunge & Born, a corporation that is an arch-enemy of Peronism, as Minister of Economy. The deputy minister, also from the B&B group, was the distinguished economist Orlando Ferreres. The minister imagined the adjustment, with a relative price structure, of the order that the establishment wanted. He also set the dollar at 655 Australes. The first Minister of Economy, only 8 days after taking office, due to his death (RIP), was succeeded by the CEO who had taken his place at B&B, Nestor Rapanelli.

As with the LLA-PRO government today, the financial situation was getting worse (right now, public debt has increased since December 10, 2023, by around US$ 85 billion). Daniel Marx (an official of Alfonsín, Menem, De la Rúa) had issued a considerable amount of debt (a lot, but less than Caputo). Roberto Lavagna had called it: “bond festival”. The resistant Lavagna was Alfonsín’s Secretary of Commerce, had been an official of Gelbard and returned as a minister with Néstor Kirchner.

Menem had the lowest level of reserves in the previous period (better than the BCRA today), and thus a process of capital flight was accentuated, with exporters beginning to pressure to increase the exchange rate. Although the economic contraction had meant a significant decrease in imports (as currently), it was estimated that the difference between the existing US$ 5 billion of the trade balance and the loss of reserves was about US$ 1.8 billion (fleeing the country), at an average of US$ 30 million per day (today deposits in dollars are increasing, which allows for negative net reserves).

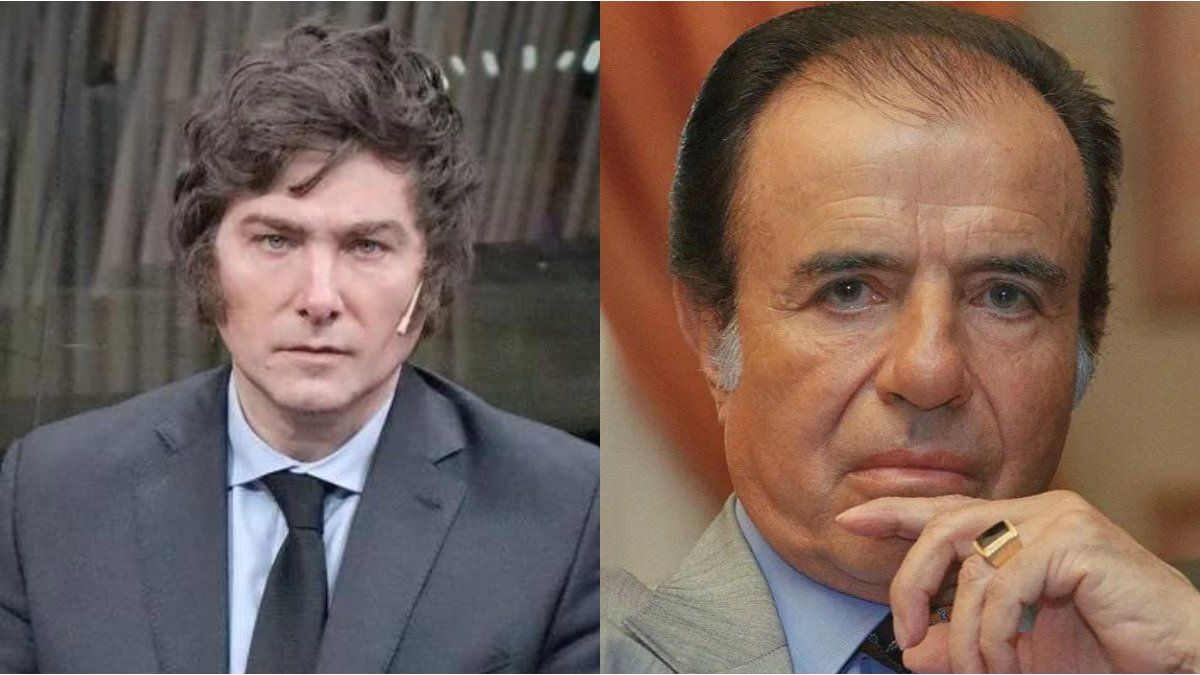

In December 1989, Antonio Herman González took over the Treasury Palace. On December 18, 1989, Argentina reopened the markets and the dollar fell by 28%, from 1,800 Australes to 1,300 Australes (Milei does not dare to lift the cap). However, the markups shook the shelves of the shops, which did not stop raising prices. The confusion was total. Everything had gone from cheap to expensive in dollars. – Does this sound familiar? – The illusion did not last long, because on December 27 the dollar was worth 2,000 Australes; the city celebrated, as it does now in these almost 9 months of Javier Milei’s government. They did “carry trade” and “turned around”, suddenly, again and again (today they have gained more than 60% in dollars).

The idea of going for Convertibility was beginning to emerge. My professor at the Institute of Applied Political Economy of the Catholic University of La Plata, Dr. Eduardo Curia, was working on it, with the collaboration of Raúl Cuello “Cuellito” and Saúl Bouer. The scheme provided for strong salary compensation and other social assistance measures, in an attempt to cushion the initial impact of the program (quite the opposite of Milei). On the last day of 1989, the monthly interest rate was 600%, while there was talk of dollarizing the economy and seeking financial assistance from the U.S. (the same as Milei and Caputo, they failed). They could not get the commitment of the U.S. authorities or the banks. (There was no credibility. There is no credibility.)

From the failure to obtain dollars to dollarize, the alternative of “strengthening the national currency” arose. They used to be dollarizers; suddenly no one defended dollarization anymore (the same as now), so they gave way to the “Bonex Plan” (Ferreres knows what he is talking about: today “a kind of Bonex Plan”), the implementation of which caused enormous transfers of income from one sector to another and produced an abrupt break in the payment chain… of course, company sales were exploding (a little less than today). If the economy was in a state of collapse, with the application of the Bonex Plan it was completely destroyed. This is what could happen if there were some compulsory reprofiling of public debt securities. Remember that today they represent 40% of the banks’ assets. The stock market went into a tailspin; some leading stocks lost around 50% and, in February 1990, another rise in the dollar began.

In a new attempt to control economic variables and obtain a fiscal surplus, decree 435/90 was issued on March 4, 1990. Program of economic stabilization and State Reform. Measures tending to its continuation and deepening. Tax regulations and modification. The real change of direction occurred in November 1990, when decree 2.476 of November 26 was issued: “Rationalization of structures. Non-permanent plants. Deregulation of markets. Privatization. Ministries of Defense, Education and Justice. Institutional strengthening. Improvement of customer service. Privatization of non-essential services. Technological modernization of public administration. Hierarchy of public administration. Complementary reductions of staff. Administrative control. Labor reprimand. Privileged retirements. General provisions.” (Sturzenegger copy of Dromi). Stereotyped from the original, a “duplicate” of the imitator team, enthralled by Dromi, it turned out: “Sturzenegger, Juntos and the model of country that they wanted (and now want) to impose. An article by the economist published yesterday dangerously evokes the idea of totalitarian and fascist management of the State, while proposing a return to the criminal and persecution practices that affected the Indalo Group” (ambito.com, March 6, 2023).

We financial managers were stressed

When Herman Gonzalez finally acknowledged the exchange rate delay (as could soon happen with “Toto” Caputo), a storm broke out that took the dollar to 5,800 Australes. Remember, they started with 650 Australes (an increase of almost 9 times). Thus the end of Minister Gonzalez was approaching (as the end of Caputo could come, if the devaluation or the market does not renew the $80 billion that expire in the next 6 months).

In January 1991, working in an agro-food export group, with a trading desk, commodities, futures and options, was not very healthy, although that holding company was wonderful, the summer was terrible. “The City” was shaking, Domingo Cavallo was coming. I arrived from Reconquista and Mitre with the news. Most of the CFOs (Financial Managers) remembered his past “liability blender” (1982) and expected the same. However, that did not happen. As soon as the market challenged Cavallo, taking the dollar to 12,000 Australes; he sold US$ 250 million at 10,000 Australes and, a week later, he bought back those same US$ 250 million, even with some profit, at 9,880 Australes. The exact opposite of what happened with Caputo and Sturzenegger in 2018 under Macri, who lost $20 billion in a couple of months and never recovered it. In 3 months, Macri expelled them both.

Convertibility

In April 1991, the Convertibility of the Austral and the opening of the economy would take place. The dollar at 10,000 Australes left some sectors with no alternative but to do first and second generation reengineering, “financial” and “downsizing”, in that orderIf the peso appreciation were to continue, it could be the same, although there would be less time to react. Today companies have to restructure because they will not be able to pay; most must do a “first and even fourth generation reengineering” (financial, downsizing, cultural and business).

And, although in 1991 the exchange rate parity did not satisfy the agro-exporters, they were happy with the reduction of withholdings, the decrease in the costs of imported inputs and the selective reductions in tariffs. However, the industry was seriously affected by imports. In November 1991, decree 2284 was signed (Economic deregulation, tax reform, 31-10-1991, published in the National Bulletin of 01-Nov-1991). In short; economic deregulation of internal trade of goods and services of foreign trade; tax reform; capital market; single social security system; collective bargaining; general provisions, through which an important transfer of profits was produced in the different sectors of the economy.

After several hot summers, in February 1992, the CFOs (financial managers) went on vacation again. The dollar maintained the price it had held since Minister Cavallo had taken office. In April of that year, Argentina entered the Brady Plan, with the return of Daniel Marx, the son of General Liendo (Cavallo’s former boss during the civil-military dictatorship), Horacio Liendo (h) and Rafael Iniesta. Fixed rate for 30 years not higher than 6% or 35% reduction. In a country toned down by the gymnastics of evasion, tax collection reached US$ 18 billion in 1991, 40% above 1989.

The damage was catastrophic; companies were completely destroyed, SMEs uprooted (as they are now), SOMISA workers and engineers driving taxis or renting paddle courts everywhere. The damage was very significant for a large part of the population; a few began to pay for their Asian and European appliances with credit cards. With the cheap dollar, a smaller part began to buy German cars, eat French cheeses and wear Italian suits, wearing high-end Swiss watches, with only ¼ of the GDP per capita of Europe (that is what could come, if a lot of dollars come in).

Director of Fundación Esperanza. https://fundacionesperanza.com.ar/ Professor of Postgraduate Studies at UBA and Masters in private universities. Master in International Economic Policy, PhD in Political Science, author of 6 books, @pablotigani

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.