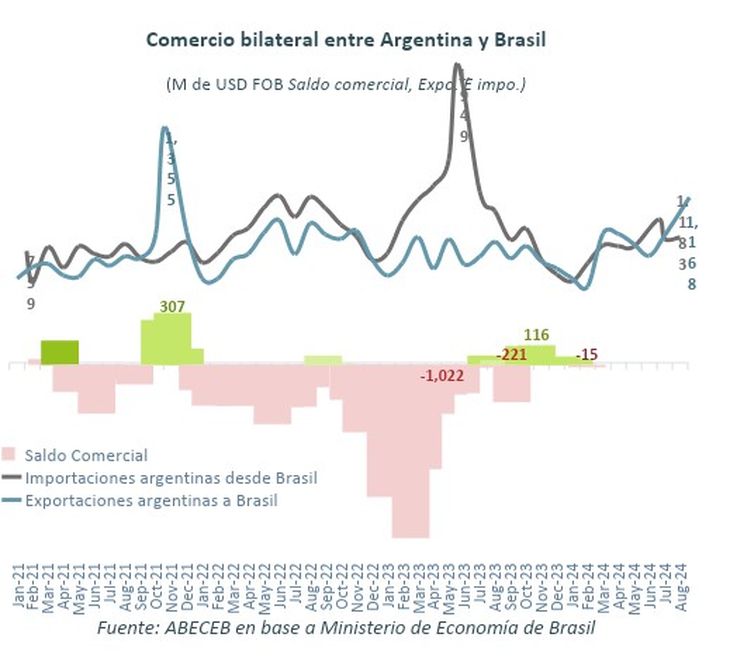

Beyond the calm exchange rate reflected in financial dollars, the external front continues to add complications to the Government’s plans. In August, trade with Brazil again left a deficit for Argentina after five months of surplus and added more pressure on reserves.

Last month there was a Trade deficit of US$15 millionthe first since February, according to data from the Ministry of Economy of the neighboring country. The data comes at a time when the Government insists that it will keep the exchange rate scheme unchanged, but various market players warn about the lag in the real exchange rate.

“This slight deficit occurs in a context of relative improvement in bilateral trade flow: : the aggregate trade between Brazil and Argentina totaled US$2,351 million, a decrease of 8.5% annually compared to the US$2,568 million reached in August 2023 (in line with the historical values taken for the eighth month), but better than the 9.5% annual decrease in July, or 31.6% annual decrease in June or 28.1% in May,” the consultancy highlighted. ABECEB in a report.

Imports from Brazil slowed their decline

The imports from Brazil totaled US$1.1828 billion in August. This represented a 17.2% year-on-year drop due to the recession, but also an improvement compared to the 27.8% decline recorded in July.Despite accumulating thirteen consecutive months of declines, the August figure was the lowest since 2023and there is a cumulative annual drop of 33.4%,” ABECEB highlighted.

In sectoral terms, the branch automotive The dynamics were mixed. Purchases of passenger motor vehicles increased by 92% year-on-year (US$88.6 million). Purchases of motor vehicles for the transport of goods increased by 40.8% year-on-year (US$14.3 million). On the other hand, foreign purchases of motor vehicle parts and accessories decreased by 25.6% year-on-year and those of piston engines and their parts decreased by 8.7%.

In energyimports of fuel oils from petroleum or bituminous minerals (except crude oils) showed a strong rise of 688.6%. On the contrary, purchases of electric energy fell by 62% in August, from US$72.1 million last year to US$27.4 million in 2023.

As for the agricultureexternal purchases of soybeans showed a 100% decrease compared to August 2023 (drought year). Thus, they fell from US$100.3 million (7% of the total imported) to zero. “This occurs in a context in which it is no longer necessary to import as last year when there was a shortage of the oilseed in the domestic market due to the drought, such that the item has accumulated a drop of 95.8% in the year (US$-1,789.6 million),” ABECEB highlighted.

In metalworkingpurchases of iron ore and concentrates fell 66.4% in the month, falling to US$18.3 million, while semi-finished products, ingots, or other primary forms of iron or steel showed a 94% year-on-year drop to almost US$1.2 million (with a share of close to 0.1%).

ABECEB.jpg

Sharp slowdown in exports

Besides, Exports to Brazil slowed sharply in August. They totaled US$1,168 million and grew 2.5% compared to the same month of the previous year. ABECEB highlighted that this was the “smallest increase since March”; in July they had grown by 20% year-on-year. In the year-to-date, foreign sales have shown a year-on-year rise of 4.6%.

According to the consultancy’s analysis, the agricultural sector had a strongly positive performance: exports of unmilled wheat and rye grew by 53.7% in August, to US$52 million, and represented 4.5% of total shipments; cheese and curdled milk grew by 48.4% year-on-year, to US$23.7 million.

The automotive sector had an uneven performance, but more positive than in previous months. There were increases in parts and accessories for motor vehicles (27.5% year-on-year), passenger motor vehicles (19.3%) and motor vehicles for the transport of goods (12.7%). On the other hand, sales of road vehicles fell (40.2% year-on-year).

Aluminum exports grew by 224.7%. Finally, the Argentine petrochemical industry showed a generally negative performance: sales of fuel oils from petroleum or bituminous minerals fell by 75% annually, while sales of liquid propane and butane fell by 60.4%.

Exchange with Brazil and reserves under pressure

The dynamics of trade with Brazil will be key for reserves who will go through months of pressure. In this regard, ABECEB projected: “For September and the fourth quarter, import levels are expected to remain compressed thanks to a lower level of economic activity and consumption than the previous year in Argentina.. Despite this, the incipient recovery of the economy, the accumulated appreciation of 46% in the peso and the recent reduction of the PAIS tax to 7.5% could marginally stimulate import demand in the coming months. The appreciation of the Brazilian real in the last month and expected for the rest of the year will therefore be an incentive, as it would take pressure off both the real exchange rate and the multilateral exchange rate (as Brazil is Argentina’s main partner).”

The consultancy firm also said that “the growth prospects for the Brazilian economy (around 2%) will have a balanced impact on bilateral trade” since “they imply a slowdown compared to 2023 (2.9%), in response to better consumption and investment prospects.” “Despite this, higher than expected inflation and the sharply depreciated real in June and July imply that the Central Bank of Brazil will not reduce the reference rate again this year,” it added.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.