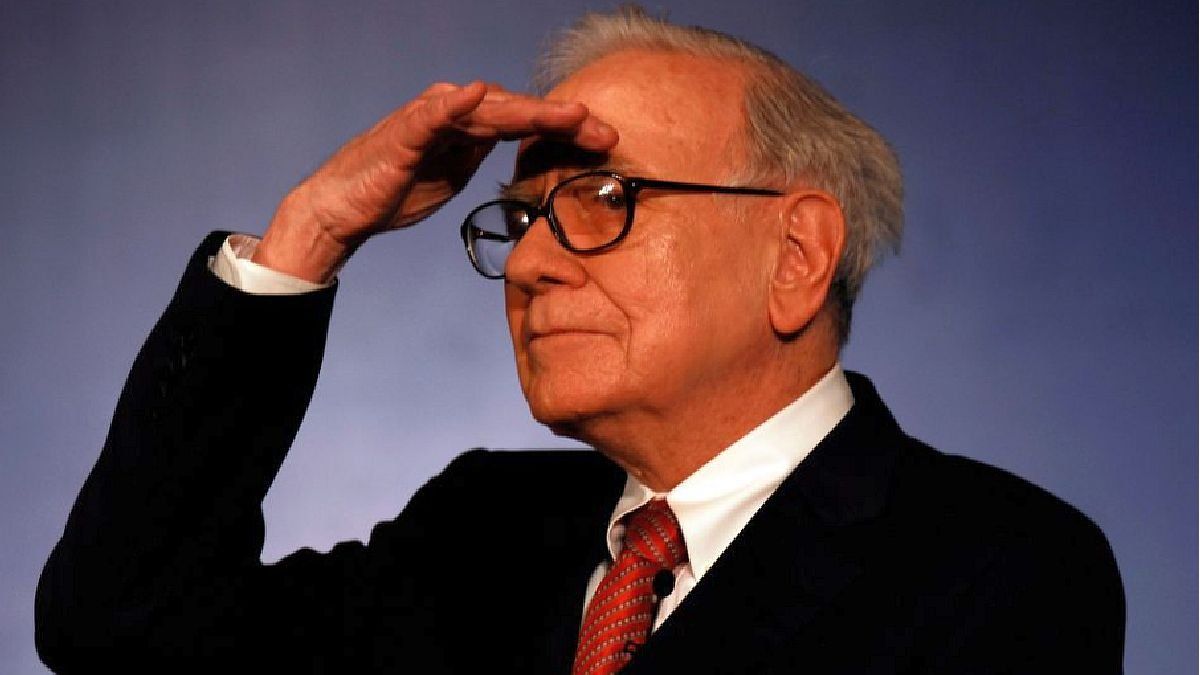

Berkshire Hathaway’s recent sale of Bank of America shares indicates a strategy to reduce its stake without losing its position as the largest shareholder. Despite these sales, the bank continues to show solid performance in the market.

Warren Buffett’s Berkshire Hathaway (BRKa.N) sold another $228.7 million worth of Bank of America shares as the conglomerate continues to reduce its stake in the second-largest U.S. bank.

The content you want to access is exclusive for subscribers.

Berkshire, late on Tuesday, disclosed that it sold approximately $5.8 million of BofA shares between Sept. 6 and Sept. 10. This brings the total shares sold to approximately $1.8 million. $174.7 million since mid-July, raising $7.19 billion, according to LSEG data.

Berkshire, which remains BofA’s largest shareholder, must continue to report sales regularly until its stake falls below 10%. It currently stands at 11.1%.

Warren Buffett: The Context

The 94-year-old billionaire, one of the world’s most revered investors, began investing in BofA in 2011, when Berkshire bought $5 billion of preferred stock. The stock sales come more than a year after Buffett praised BofA and its CEO, Brian Moynihan.

Moynihan said Tuesday that Buffett has been a “great” investor for the bank, but that he did not ask him about the recent stake sales.

“I don’t know exactly what he’s doing because, frankly, we can’t ask,” Moynihan told investors at a financial conference in New York.

Bank of America.PNG

Bank of America shares were down 0.8% in premarket trading on Wednesday.

A Deutsche Bank analyst had said last week that Berkshire may be looking to reduce its stake to just below the 10% threshold to avoid regulatory scrutiny.

The actions of Bank of America were down 0.8% in premarket trading on Wednesday. The lender’s shares have lagged the broader markets since Berkshire began its selling spree.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.