Although this presentation by Milei takes place after the data on the consumer price index (CPI) for August, which was expected to be below 4% andsurprised upwards compared to July (since it was 4.2%), optimism remains that the slowdown will continue going forward, although there are still some doubts in the execution of the program.

Budget 2025: the city’s view

In dialogue with Scope, Adrian Yarde Bullerchief strategist of Facimex Valuesargues that the Government has already anticipated the general fiscal objectives and some interesting ideas such as “the rule of tax reduction in case the collection exceeds the forecasts.” In relation to this, for the analyst, it will be interesting to see How the economic team plans to deepen spending cuts and what taxes could be cut.

And it is that, in the city, it is rumored that this Sunday, Milei will announce a new tax reductionas it foresees that 2025 will be a year of significant economic recovery, with a growth of the Gross Domestic Product (GDP) of between 3% and 5%. This recovery will increase tax collection, which will improve the fiscal balance and allow the elimination of taxesas the economic team expects.

Yarde Buller reminds us that it will also be very important to pay attention to any possible signals regarding the possible definition of a new monetary and exchange rate regime, or at least information that could provide clues as to the next steps in terms of exchange rate policy.

Javier Mieli Lenses.jpg

Javier Milei will present the 2025 Budget in Congress.

For its part, Martin D’Odoricodirector of Guardian Capitalslides, in line with Yarde Buller, that this is a crucial period to outline projections on growth, inflation, exchange rate, monetary regime and fiscal scenario.

D’Odorico comments that the budget is expected to include a year-on-year inflation projection below the 127% for December, as well as an estimated exchange rate of $1,016 for the end of the year“The plan contemplates a monthly inflation of up to 3.9% and a monthly devaluation of 2% until December 2024,” analyzes the strategist.

And he adds that, after the inflation data for August of 4.2%, the prompt dismantling of the exchange restrictions is diluted. “The end of the currency restrictions will be more for 2025 than for this year, since the Government He doesn’t want to risk lifting it early. and the goal of slowing inflation is compromised,” he says. For D’Odorico, “the market sees the 2025 Budget with good eyes and this is demonstrated by the sharp rise in bonds and stocks in recent times.”

Budget 2025: the drivers the market is really looking at

Ayelen Romeroanalyst at Rava Stock Market, He explained in statements to this newspaper, and in line with what D’Odorico said, that the local market has been on an upward trend since the beginning of September. And the fact is that investors are mainly looking at the the results of money laundering and the impact it may have on the Central Bank’s reserves. Two drivers that the city is closely following, as they could disrupt what is outlined in the 2025 Budget.

Since the beginning of this month, there has been an increase in the amount of dollars that banks receive through this channel and it is expected that a large volume of this incorporation of capital will occur. is turned to the market through the special brokerage accounts for the regularization of assets (CERA), says Romero, who adds that another of the main axes that the market follows are dollar reserves.

This “does not represent an encouraging outlook for investors. That the BCRA is a seller”, however, he assures that, for now, does not affect the upward rhythm. For Romero, what the market really looks at in this context and that has a key impact is “both the reserve situation and the advance of money laundering”. Therefore, while the presentation of the 2025 Budget could inject volatility into the market, Rava’s analyst expects it to be to a lesser extent.

Inflation and reserves at the Central Bank

Along the same lines, he thinks Federico Victoriocofounder of Andean Investments (IA)who points out that expectations surrounding the 2025 Budget are high from a social perspective and even more so since the President himself will be the one to present it and present it to Congress.

Despite this, he assures, which does not imagine significant market reactionsunless some news comes along that nobody expects. And for Victorio, as for Romero, the key to the market It is inflation and reserveswhich “are two issues that are currently generating a bit more noise than the rest of the variables and where there will certainly be much more noise” for the market, he comments. And the reasons why he considers these axes to be essential are:

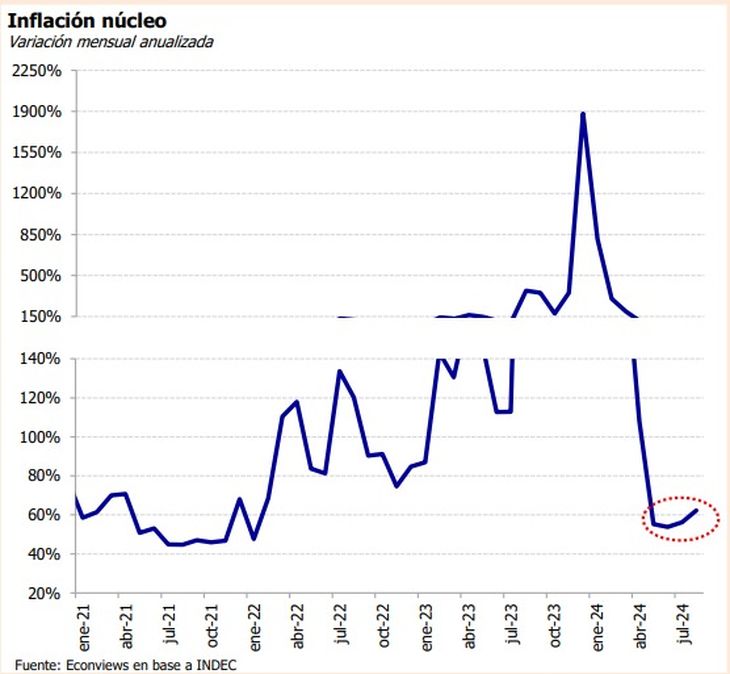

- inflation: because, despite the fact that expectations continue to be adjusted downwards, Victorio analyses that it is difficult to break through the 4% floor, even despite the tremendous recession. “It will be very important to see if, with the reduction of the PAÍS tax, from September onwards we can have a better figure in the following months, in which we imagine a figure closer to 3.5% going forward. In any case, there was also a lot of correction in relative prices, so it is a figure to follow very closely, but not to be alarmed, yet.”

- Reservations: Because, since the Government decided intervene in the foreign exchange market, In order to contain the gap, “the exchange rate balance has become more complicated,” says Victorio. In a context in which we are still talking about negative net reserves and with large maturities starting in 2025, “it is essential to accumulate reserves again sooner rather than later,” he says.

Core inflation – Econviews.jpeg

In short, for the strategist there is a market that in recent weeks has become a little more optimistic by validating the strong defense of the fiscal surpluswhich is a flag of this Government, so Victorio does not see a ‘driver’ in the Budget. “Where do we see it? If flows come from abroad, if an agreement is reached with the International Monetary Fund (IMF) or if the lifting of the restrictions is announced,” says the analyst.

And that is what the market really cares about, the rest is just projections. So the City is looking favourably on the Government’s promises and intentions, which lie in recognising the fiscal objectives and the intention to reduce taxes. However, the real challenge lies in the execution.

Although the Budget 2025 projects optimism, the market remains in “wait and see” mode. Fiscal sustainability and reserve accumulation are critical goals, so until actions outweigh words, the market will be wary of the government’s ability to meet its goals.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.