The government is trying to send some positive messages about lifting the restrictions, but fears that it will go wrong mean that it is moving very slowly. The market welcomes the steps, but wants more.

Although in Reading the 2025 Budget showed that the restrictions will continue to be in force in general termson the other hand, the market is beginning to see that The Government is moving forward with a gradual lifting of some exchange restrictions and is enthusiastic, since it is one of the points that he most demands from the Executive.

The content you want to access is exclusive for subscribers.

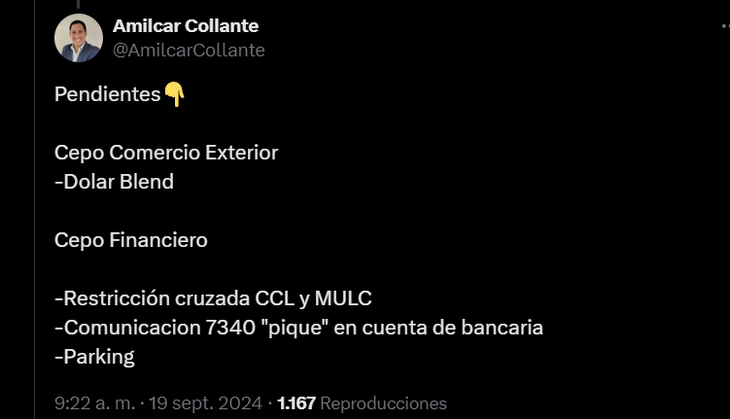

This is reflected, for example, in a publication by Economic and market analyst Amílcar Collante on his social network X (formerly Twitter), who points out that Progress was made in lifting the restrictions on foreign tradewith the measure in August to reduce the payment of imports from 4 to 2 installments and, in September The PAIS tax was lowered from 17.5% to 7.5% and there is a promise to completely eliminate that tax in December.

However, he warns in the following post that it is still pending to lift the dollar blend in foreign trade and some elements of the financial trap, such as the cross-restriction between the dollar Contado Con Liquidación (CCL) and the official exchange market (MULC), which establishes the Communication “A” 7340 of the Central Bank (BCRA), the “pique” in bank account and the “parking”. This refers to all the processes that hinder the operation of buying official and financial dollars in the Argentine market.

image.png

Collante’s post with the pending issues regarding the cepo.

A new step was taken by the CNV

However, The market looks favorably on the small steps taken by the Government in lifting the restrictionssuch as the decision taken by the National Securities Commission (CNV) to end two restrictions:

- The first measure was the relaxation of the limitation to process and/or settle sales operations of negotiable securities with settlement in foreign currency – both in local jurisdiction and in foreign jurisdiction – when clients maintain, in dollarspositions taking precautions and/or passes and/or any type of financing through operations in the capital market. (it was a 2023 measure that sought to prevent investors from They will leverage guarantees to obtain pesos and then buy financial dollars.

- The second change is linked to the scheduling regime: the need for Five days’ notice for transactions exceeding $200 million for residents and in general operations for non-residents.

The president of the CNV, Roberto E. Silva, highlighted thatand “we are working daily to lift restrictions on the capital market“and that “it is very important for this Board to remove the obstacles that still exist in operations.”

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.