“We radicalized the cut in monetary issuance. And now wholesale inflation is 2.1% per month,” he celebrated. “That is why Caputo will be remembered as the best economic minister in history.” (…) We are going to tame inflation, that is underway,” he said.

“When the inflation induced by the capital control program disappears, We will be able to get out of the trap without any problems“because they will no longer have bullets to load the weapons that can destroy macroeconomic stability,” said the president.

MILEI-USA.jpeg

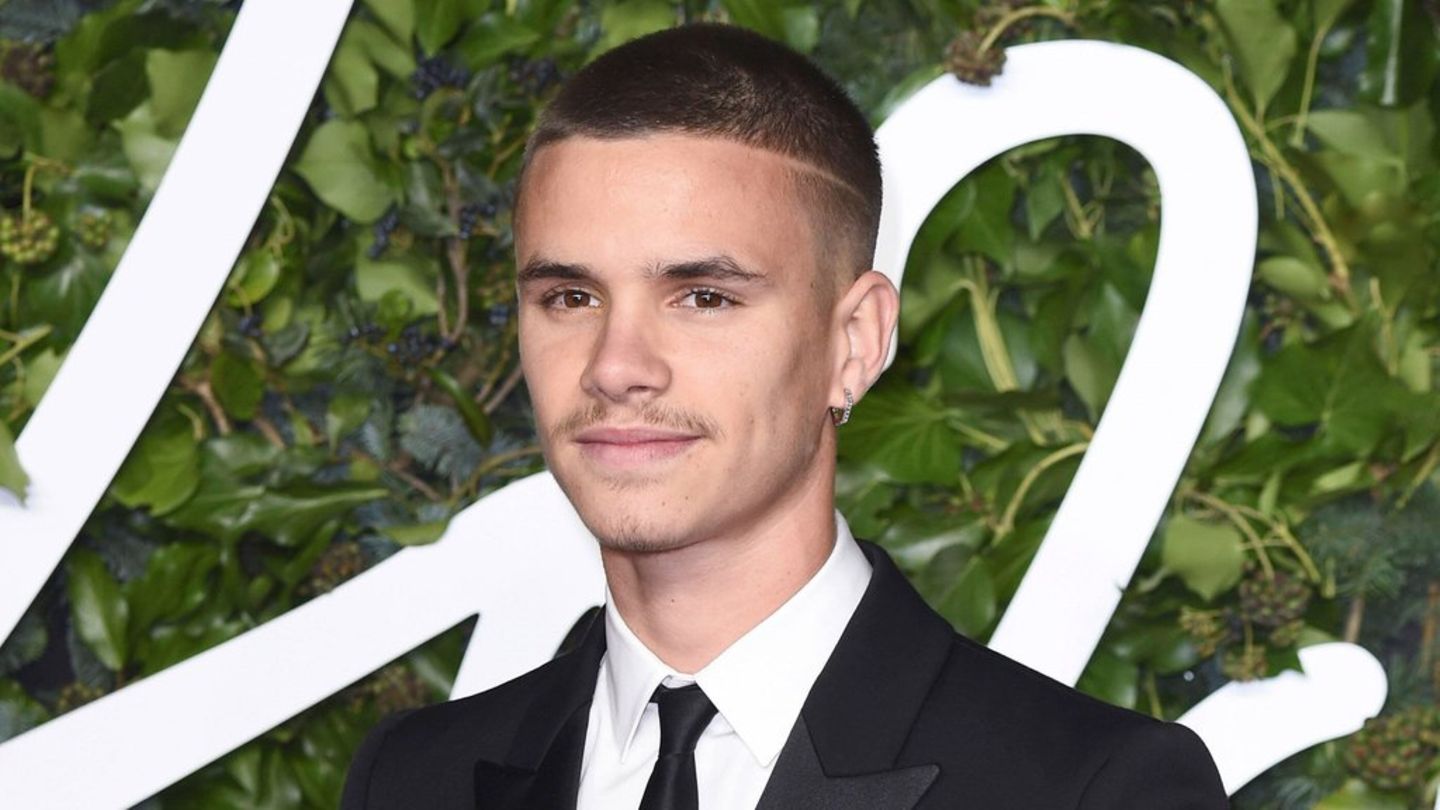

Javier Milei opened the trading day on Wall Street.

Along the same lines he added: “We will lift the restrictions when the inflation rate in the macroeconomic program is zero.”

“Unlike all the other experiences that came out with the official exchange rate to the parallel, we are showing that it can be done from the parallel to the official (…) The day we finish lifting the restrictions, the excess demand for foreign currency will be closed and, therefore, the excess supply in the bond market will be closed,” Milei commented, according to the media Infobae.

Javier Milei rang the bell on Wall Street and opened the trading day

The president, Javier Milei, participated in the opening of the trading day at the New York Stock Exchange, where he also He rang the traditional bell to indicate the start of operations.

Received by the head of the entity, Lynn MartinThe president attended accompanied by the Secretary General of the Presidency, Karina Mileithe Minister of Economy, Luis Caputoand the Argentine Ambassador to the United States, Gerardo Werthein.

MILEI-USA.jpeg

Javier Milei opened the trading day on Wall Street.

Wall Street: S&P 500 advances to new highs, after a historic day for the Dow Jones

Wall Street is in slow progress on Monday as investors focus on a new jobs report due later in the week. The broad market index is up 0.2%, while the Nasdaq Composite is up 0.3%. The Dow Jones Industrial Average is holding near the flat line.

Stocks rebounded slightly on Monday after excitement over last week’s interest rate cut sent the Dow to a record closing high. The S&P 500 and Nasdaq Composite posted gains of 0.2% and 0.3%, respectively, while the Dow hovered around the flat line.

The moves come after a winning week on Wall Street, centered on the Federal Reserve’s decision to cut interest rates by 50 basis points, its first cut in four years. Despite some volatility following the initial announcement, stocks rallied in the days that followed.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.