image.png

What are Luis Lucero’s prospects for copper?

According to Luis Lucero, copper projects are a universe in themselves because they take much more time to plan and develop. “Generally speaking, we are talking about investments that mean a capital expenditure to start them up, build them and put them into operation, which always exceeds 3 billion dollars, and longer too.”“, said.

“The maturation times for a copper project are longer. Everything has another dimension and copper itself is going to be a challenge to test the perseverance of our legal and political system.”he stressed.

In that sense, he said that the Mining Investment Law “The RIGI remains in force, with its notion of stability, and we certainly have enormous expectations that this regime will be an incentive for the large investments required by lithium, copper and other projects.”

What are Luis Lucero’s prospects for lithium?

Lucero stressed that the region has lithium from brines“The cost of producing lithium from brine is much lower than the cost of producing lithium from rock, which is mainly the case in Australia, the world’s largest lithium producer,” he said.

In this framework, the secretary assessed that “Today, lithium and copper are more visible and attract more attention from the investment world” and confirmed the launch of a new project next October. “Argentina will increase its installed capacity for lithium hydroxide carbonate production by 50%. We have had a first inauguration of a plant in Salta by the company Eramine -a Chinese-French Joint Venture-, and the inauguration of a lithium hydroxide production plant is announced for the end of October. GOSSAMERa Korean company,” he described.

Lithium: What is POSCO doing in Argentina?

GOSSAMERthe fifth largest business group in South Korea and a global leader in the steel sector, supplying 10% of all the world’s steel for the automotive industry. The company has a presence in 53 countries and 100,000 employees worldwide, with a turnover of more than 100,000 euros. US$70 billion annually.

In Argentina, GOSSAMER has the most ambitious project outside its country in the last 60 years. It is about “Golden Salt”, Located in the Dead Man’s Salt Flatbetween the provinces of Salta and Catamarca. After several years of research, the Koreans developed their own technology in 2010 for the lithium extraction.

Mining posco.jpg

But it was not until 2017 that they manufactured in South Korea and they brought to assemble in the Puna a pilot plant with a production capacity of 2,500 tons of lithium per yearThe following year they formed Posco Argentina and opened offices in Salta and later in Catamarca. For this they obtained financing from US$280 million.

The project of Posco Argentina It is divided into two phases: the first consisted of a commercial plant of lithium phosphate and a commercial plant of lithium hydroxidewith investment of US$800 million.

In January 2023 the company received another financial backing from US$412 million for the construction and development of a lithium plant as part of Phase 1 of the project, including financing for infrastructure and certain imports of goods. And in April 2024 it received a new loan for US$668 million from a pool of international banks (BNP Paribas; Citibank Hong Kong; Crédit Agricole Corporate and Investment Bank; JPMorgan Chase Bank; HSBC; Bank of America; and the Bank of Korea KEXIM), for the development of the second phase.

image.png

At 4,000 meters above sea level, in the salt flat, will produce about 25,000 tons of lithium phosphate per year. That volume is equivalent to the amount needed to manufacture batteries that could power 600,000 electric vehicles.

But the plant that will be inaugurated in October is located in the industrial park of the Salta town of General Güemes. and has an initial production capacity of 25,000 tons per year, which will convert Posco Argentina the first company to produce lithium hydroxide in the country. In the second and third phases they will seek to reach 100,000 tons.

The objective of Posco Holdings is to become one of the world’s top three lithium producers by 2030.

Posco lithium hydroxide plant Salta General Güemes

POSCO’s lithium hydroxide carbonate production plant in the Salta town of General Güemes.

How much lithium is produced in Argentina?

The total lithium production in Argentina increased 56.7% last July, compared to the same month last year, and accumulates an increase of 62.3% so far this year.

According to the National Institute of Statistics and Census (Indec) through the Mining Industrial Production Index (IPIM), 4,991.1 tons of “lithium carbonate”which registered an increase of 47.4% compared to the same month in 2023.

This production corresponds to only three projects currently in activity: Olaroz and Phoenixfrom Arcadium Lithium, and Caucharí-Olarozfrom EXAR Mining. Centenary Micefrom Eramine South America, is still in testing periods and is set to begin production before the end of the year.

The decline in lithium production is linked to a sharp decline in the value of the mineral. Currently, one tonne of lithium is worth 1000 tons. Lithium carbonate equivalent (LCE) is quoted at US$10,483, less than a third of what it was worth a year ago and far from the peak of US$80,909 registered in November 2022.

How much does a ton of lithium cost?

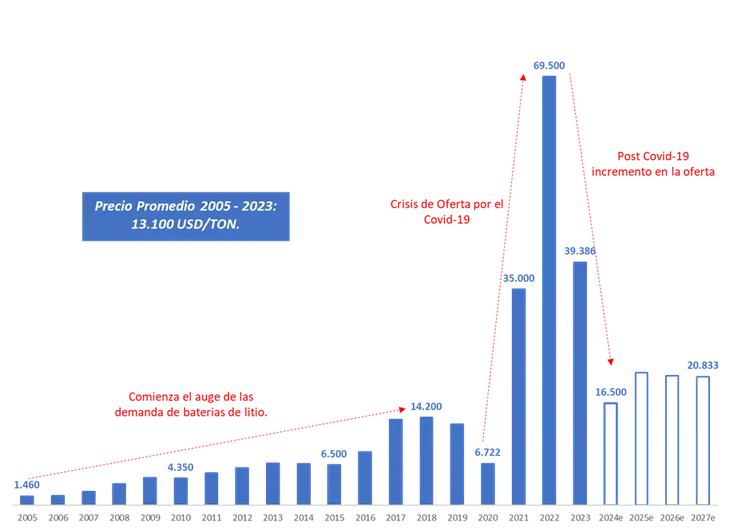

Since 2006, prices for lithium carbonate increased significantly, driven by the demand for batteries that was not being met by the pace of expansion of supply. Almost a decade later, they went from an average price from US$6,500 per ton in 2015 to US$14,200 in 2018.

It was not until 2019 that the market situation reversed: supply rose for a given level of demand and prices fell. The tight supply due to COVID in 2021 led to a new recovery, which brought prices to extraordinarily high levels in 2022 (average of US$69,500 per ton), beginning a period of great volatility.

image.png

However, the expansion of supply in a context of a lower than expected demand increase is increasing stocks, which has led to the current significant drop in prices. For 2024, a final average of US$16,500 per ton is estimated, although on the spot market it is currently trading at around US$10,000. Many of the supply contracts were signed in previous years – up to 3 years before – at average prices, which today allow this industry to sustain its activities. On the one hand, these were minor trade agreements during the boom of the US$80,000 tonne, but today they are greater than the market record, which is why they bring some relief to Argentine production companies.

And while there is still some uncertainty about price behavior in a changing international context, the latest market estimates indicate that Between the period 2025-2027 they would be around US$20,800 per tonwhich places them 53% above the 2005-2023 average.

Why did the price of lithium drop?

The fall in prices is mainly due to an excess of supply and moderation in sales of electric vehicles worldwide, whose production depends largely on lithium for batteries. The main contraction in the international price is mainly due to the elimination of Chinese government subsidies for the purchase of electric cars in that country.

Given this adverse scenario for the lithium industry, Mining companies began to implement “cost reduction” strategies to ensure the viability of their projects.

Lithium: When to use “soda ash”

The “soda ash” It is used in three main degrees: light, medium and dense. They all have the same chemical properties, but differ in physical characteristics. In the case of the lithium value chain, it is used in the post-extraction phase and during primary production.

He sodium carbonate (Na2CO3) is used in the process of extracting and purifying lithium from mineral sources (“carbonate process”), which involves converting lithium ore into lithium carbonate, which is a more soluble and easily processable chemical form.

Sodium carbonate reacts with the lithium brineresulting in the formation of lithium carbonate (Li2CO3), which precipitates as a solid. This lithium carbonate is then separated and subjected to further purification processes.

Once obtained the lithium carbonate -or purified lithium hydroxide- is used as a raw material for the manufacture of intermediate products, such as cathode and anode materials, electrolytes and other components of the famous “lithium ion batteries”.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.