The lack of dollars continues to be the main concern of the market. Even in weeks marked by calm in parallel exchange rates. A private report warned that the “exchange spring” could be left behind in the last quarter. According to this analysis, the path until the end of the year could be marked by greater tensions on the official square, which would imply a continuity in the bleeding of net reserves. However, the main warning is the foreign exchange hole that the Government would need to finance to maintain the exchange status quoas officials assure.

As already highlighted Scope, The most challenging months are coming for the administration of the flow of currencies, where they will be combined higher import payments (due to the overlap of the old and the new quota scheme for access to the official dollar) and the low seasonality in agrodollarsamong other factors.

“After the turbulence of July, the Government managed to chain a financial spring that continues to this day. To achieve this, a better global financial climate and the effects of money laundering on the prices of local financial assets were combined,” highlighted the latest monthly report of the CP consulting. In this framework, the compression of the exchange gap stands out, which had exceeded 55% two months ago and has now breached 30%. But the firm they run Pablo Moldovan and Federico Pastrana believes that this good weather may soon be behind us.

CP explained that the positive performance that the BCRA in the official exchange market in the last two months could be explained like this: “An attempt was made to bank a significant portion of hoarded dollars (laundering) and put them into financing operations that allow an impact on the exchange market (credit, ‘endogenous dollarization’). ‘). In this way, the aim is to compensate for the deterioration of the current exchange account that has been observed in recent months. The scheme proposes that residents’ dollars finance the economy’s external deficit”. But for analysts, even so, “the scenario looks challenging” both for the remainder of the year and for 2025.

Dollar: they warn that the bleeding of net reserves will continue

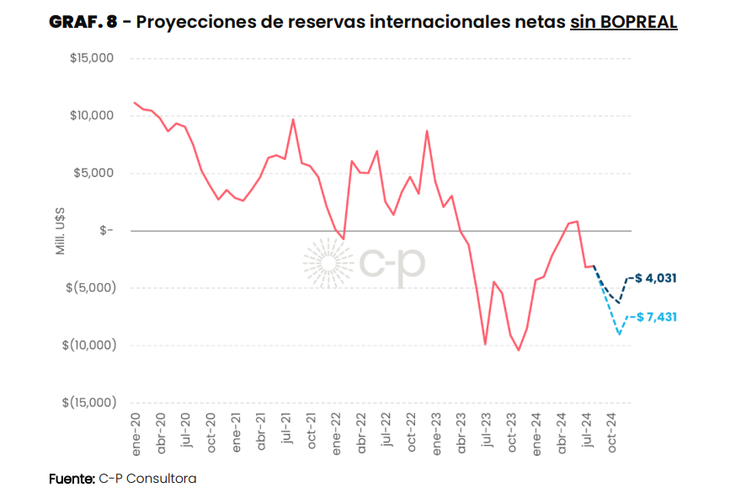

While the money laundering gradually impacts gross reserves As the banks fit the bills into the BCRA, analysts They project a selling balance for the remainder of the year that will affect net reserves.

Portfolio Personal Investments (PPI) warns about what could happen in October: “The dynamics of the official market will become more challenging for reserve accumulation. On the demand side, the effect of having deferred imports will no longer play in its favor. Now imports postponed from August to September will begin to be paid. The BCRA will go from facing quotas of 125% (25% of imports accrued from May, 25% from June, 25% from July and 50% from August) to 150% in October (25% from June, 25% from July, 50 % of August and 50% of September)”.

image.png

CP outlined two scenarios: that the money laundering dollars are channeled into local financing and slow down the evolution of sales and net reserves of the BCRA, or that the contribution of local financing in dollars is moderated, worsening the results. Depending on how that happens foresees a sales balance of between US$500 million and US$1,000 million monthly average until Decembermonth in which the balance would be in surplus.

“Under the proposed scenarios, Net international reserves would deteriorate towards the end of the year between an additional US$1,000 and US$4,000 million depending on the response of the financial flows of the private sector,” the consulting firm warned. This implies that, without counting BOPREAL’s pending payments in the coming months, Net reserves would end 2024 in negative territory for a sum of between US$4,000 million and US$7,400 million.

Reserves: the dollar hole for 2025

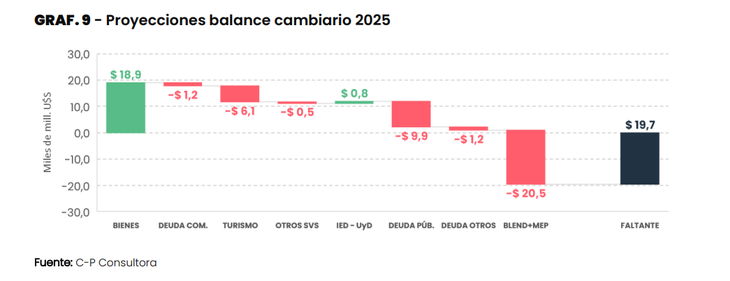

Now, the big question that everyone in the market is asking is How much room does the Government have to stretch the exchange status quo?which implies the continuity of the exchange rate, the exchange rate table of 2% monthly (or less if inflation pierces that level) and the blend dollar, which implies diverting 20% of exports to the CCL and prevents it from impacting reserves. CP considers that it is “unlikely” that this scheme can be sustained due to a large foreign exchange hole of almost US$20 billion that the economic team would need to finance.

“The exchange rate scenario for 2025 is even more challenging. Without the contribution of commercial debt that made the difference in the first part of 2024, with substantial debt maturities, declining international export prices, rising service imports due to exchange rate appreciation and the incorporation of some degree of rebound of economic activity, projections for the external sector look inconsistent,” the report states.

image.png

The projection indicates that, even if a repo for US$3,000 million were closed to cover capital maturities with private bondholders in January, the BCRA would have to assume a drop in net reserves of around US$1,400 million on average monthly. next year. “The general result allows us to estimate a foreign currency shortage of around US$19.7 billion for all of 2025. Given the starting point of negative net reserves mentioned in the previous section, the scenario looks extremely complex,” the consultancy warned.

As a result, he hopes that there will be some definition of the exchange rate scheme, which will moderate possible pressures regarding the electoral process. As a hypothesis, he proposes three possible decisions to be made by the Government:

- The endogenous dollarization that Milei proclaims: it would imply a reinforcement of the monetary squeeze and the attempt to finance the external deficit with the injection of dollars from the private sector,

- Continuity of the trap and disassembly of the blend: given the magnitude of foreign currency lost through this means (CP estimated US$20.5 billion by 2025), the entire hole could be covered if it were eliminated,

- Devaluation, exit from the stocks and unification.

All of them have associated risks. CP highlighted that the first scenario implies a very recessive approach “with a negative impact on credit, payment chains and public debt in local currency”; The second means withdrawing a considerable supply of financial dollars and threatens to “raise the exchange gap to levels that could destabilize the official market and financial prices”; The third “implies a setback in the disinflationary process and assuming a new round of social costs.”

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.