The funds of venture capital are returning to Latin America to invest in some of the thousands of startups that arise constantly. But they do it with extreme caution and rigor when selecting proposals. And also with an updated search approach: Artificial Intelligence developments now appear at the top of the preferences, advancing over fintech in the competition for the main place on the podium.

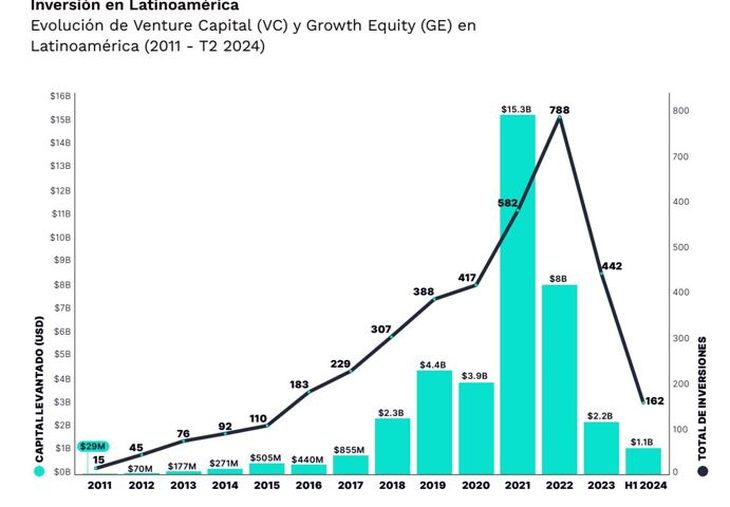

The most recent figures on this process indicate that in the first half of this year the amount invested increased 30% compared to the same period last year, although the number of investment rounds (162) was reduced by 63%.

The fact that the amount of capital raised has grown despite the drop in the number of investment rounds suggests a greater concentration of investments in more advanced stages and in strategic sectors.

The total investments in the mentioned period It was US$1.1 billionbut the distribution of these capitals was quite uneven. The bulk was allocated to startups in Brazil, that raised US$591 million through 89 investment rounds in the period analyzed.

Mexico managed to raise US$225 million in 26 rounds, while Colombia raised US$237 million in 18 investment rounds. Argentina came in fourth place, with a total of US$54 million in 9 rounds. Behind the pack was Chile, which raised funds for US$43 million through 20 rounds.

The data comes from a survey carried out by Endeavor Mexico and Glisco Partners for a study titled “Venture Capital and Growth Equity in Latin America”, in the first half of 2024.

The 30% rebound in investment figures was celebrated as a success as it was taken as a good indication that The situation of previous years began to reversewhich showed a sharp drop globally, not only in Latin America.

According to the report, between 2020 and 2024 capital rounds in Latin America plummeted 72%, while they fell 69% in Southeast Asia, 67% in Europe and 60% in the United States.

VC EVOLUTION IN STARTUPS.JPG

This also means that recovery expectations be moderate for this year. “After the sharp drop in VC activity observed between 2022 and 2023 where global fundraising fell by 40% and Latin America reached minimum levels since the last five yearsthe data indicate that the cooling of the ecosystem will continue through 2024,” highlights the report.

“The ecosystem is in a stage of less favorable macroeconomic conditionswhich represents a challenge for the development of regional entrepreneurship. These adjustments in the financing environment, driven by factors such as higher interest rates and greater uncertainty, force startups to prioritize profitability and operational discipline”, he adds.

In any case, despite the not very optimistic diagnosis, a glimmer of hope remains open for the sector: “It will be key to monitor the evolution of the coming quarters, since the ecosystem could resume a growth cycle in the region.”

Artificial Intelligence displaces fintech in the startup ecosystem

The report highlights as a milestone that for the first time, the Artificial Intelligence sector surpassed fintechs in terms of capital raised. 34% of investment rounds focused on AI, reflecting a change in investor preferences towards technological solutions that span multiple industries.

This sector is being driven by demand for automation and the adoption of new technologies in key sectors such as fintech, e-commerce and financial services.

Fintech, although They continue to be a relevant sectorrepresented only 17% of the total rounds but captured 37% of the invested capital. This data underlines that fintech continues to be fundamental for the financial development of the region, although the attention of investors is diversifying towards other technological areas.

Another relevant point of the report is the change in the investment criteria of the funds. 70% of investors have adjusted their valuation metrics, prioritizing startups with scalable business models, profitability and operational efficiency, instead of accelerated growth at any cost.

This trend highlights the importance of financial and operational discipline in a high interest rate environment, which has forced startups to rethink their growth strategies.

In this framework, growth is also observed in “dry powder” (uninvested capital), which increased by 68%, reaching US$3.7 billion. This shows that the funds They are being more cautious and selectivereserving capital for future investments in more mature startups with greater potential for profitability.

The regional environment presents challenges and opportunities for entrepreneurs

Regarding the regional macroeconomic environment, the funds They continue to consider it challenging and with a high degree of uncertainty. The survey indicates that 80% of the funds declared that high interest rates affected their investment strategiesslowing the flow of capital to early stages and increasing the time between financing rounds.

Currently, the average time between a “Seed” round and a Series A went from 9 months in 2021 to 15 months in 2023, which generates a more competitive environment for entrepreneurs who go out to seek financing.

However, these conditions also generated opportunities in emerging sectors. AI and information technologies are showing great potential to attract capital and generate growth in the region. Brazil continues to lead in terms of capital raised, with 50% of the total for 2024, while Colombia emerges as an innovation hubsurpassing Mexico in capital raising.

Despite the context, the report’s conclusions suggest that the recovery of the Venture Capital ecosystem in Latin America will continue to recover at a slow but steady pace.

It is expected 64% growth in capital raised between the first and second quarters of 2024, which could anticipate a normalization of economic conditions towards the end of 2025 and beginning of 2026.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.