In mid-September, the Treasury had transferred some US$1,528 million to the Central Bank (BCRA) to pay debt and this Friday, the monetary regulator sent US$998 million and the equivalent of about US$60 million in euros to a bank in New York. It is to cancel interest from January 2025 on global bonds in dollars (GD), according to what you learned. Scope.

In total, the funds that were transferred amount to about US$1,054 million. This was reflected in the gross reserves of the BCRA, which fell by US$918 million and stood at US$28,313 milliondespite the fact that the monetary entity bought about US$53 million on the day and on Thursday it had pocketed another US$110 million.

“The interest payment is US$1,528 million, but it is the total and the dollars and euros that were sent abroad are to cancel the global bonds in dollars in January of next year,” he explained. Sebastián Menescaldi, Eco Go economistto this medium.

Global bonds: the interest maturities that the Government will pay

The funds went to a Bank of New York (BONY) account so that they are kept safe until January, when the Government has to pay interest to bondholders for more than US$1,000 millionaccording to the following detail:

- GLOBAL BONUS/U$S/1.00%/07-09-2029 (GD29): US$13 million

- GLOBAL BONUS/U$S/STEP UP/01-09-2038 (GD38): US$285 million

- GLOBAL BONUS/U$S/STEP UP/09-07-2030 (GD30): US$52 million

- GLOBAL BONUS/U$S/STEP UP/09-07-2035 (GD35): US$421 million

- GLOBAL BONUS/U$S/STEP UP/09-07-2041 (GD41): US$183 million

- GLOBAL BONUS/U$S/STEP UP/09-07-2046 (GD46): US$43 million

Regarding maturities in euros, the contemplated payments are as follows:

- GLOBAL BONUS/EUR/0.125%/09-07-2030 (GE30): €1 million

- GLOBAL BONUS/EUR/STEP UP/01-09-2038 (GE38): €18 million

- GLOBAL BONUS/EUR/STEP UP/09-07-2035 (GE35): €6 million

- GLOBAL BONUS/EUR/STEP UP/09-07-2041 (GE41): €25 million

- GLOBAL BONUS/EUR/STEP UP/09-07-2046 (GE46): €5 million

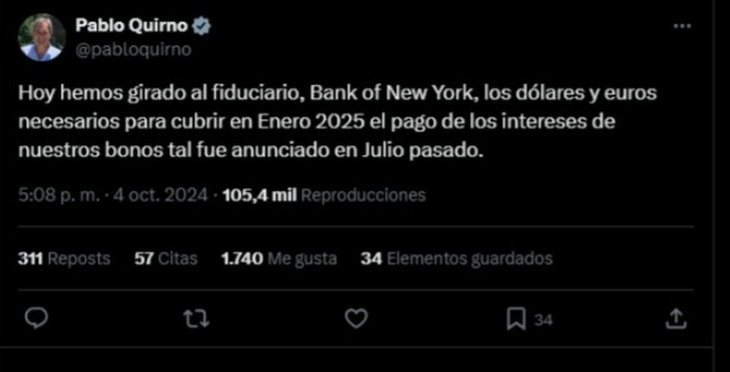

This information was confirmed -after the publication of this note- by the Secretary of Finance, Pablo Quirnowho stated from his social network X (ex Twitter): “Today we have transferred to the trustee, Bank of New Yorkthe dollars and euros necessary to cover the payment of interest on our bonds in January 2025, as was announced last July.”

image.png

A sign of confidence in the market, although with a negative effect on reserves

With this step, the Government tries to ensure that it will make the interest payment on the global bonds. You will have to pay US$1,527 million, of which some US$450 million remain in Argentina. “That corresponds to interests, but the US$2,817 million still needs to be obtained of capital amortization, which must be paid on the same day,” warns Menescaldi. And he details that almost the entire bulk corresponds to the GD30 (US$1,166 million) and AL30 (US$1,087 million).

“This generates a positive impact on the market because it shows that maturities will be met and shows that the Government is willing to honor its obligations. It is a favorable message for the Government,” confirms the analyst Elena Alonso.

And, as Menescaldi points out, “with this step, the Government tries to give a signal of confidence to the market and reduce country riskalthough the flip side of this is that reserves fell: the net ones, which remain negative at US$5,000 millionwhich is the level of February”. Thus, they are left in a weak situation, but it highlights that, “In principle, it is positive newsespecially if you take into account that the BCRA is on a buying streak.”

Dollars to pay interest: an opportunity cost

Likewise, it mentions that The early sending of funds to pay off debt interest has an opportunity cost because you lose the chance to generate interest, for example by investing in US bonds or another asset. This implies an implicit economic opportunity cost in pursuit of giving a good signal to the market and, at the same time, there is less liquidity in the BCRA’s reserves.

It should be remembered that the BCRA has accumulated six consecutive days of purchases. bagged US$53 million in it Single and Free Exchange Market (MULC) this Friday and accumulated a positive balance of US$508 millionthe highest since the end of May.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.