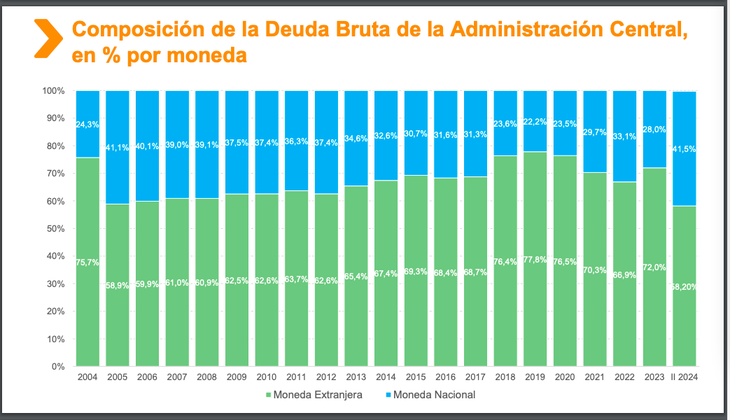

Official data show that, for the second quarter of 2024, (latest data available), the debt in national currency (41.5%) represents the highest percentage with respect to the total since 2005when it was 41.1%. Meanwhile, the percentage in pesos with respect to the Gross Domestic Product (GDP) in 2024 is already 46.2%, the highest in 20 years, above that of 2023 (43.8%) and worse than that of 2005, which was 33.1%.

The amount increased by 2.4% compared to 2023 and it should be noted that, between 2006 and 2022, it had not exceeded 30%. And, although both the market and the Government focus on the debt in hard currency, for analysts, with these numbers, the ruling party adds a challenge that can disrupt some of the pillars of the economic plan, mainly, the dismantling of exchange restrictions (stocks) and the objective of keeping inflation at bay.

At the outset, it must be said that debt in pesos is “less worrying” than debt in hard currency, but the city warns that, if short-term maturities are not “rolled over”, it will be more difficult to stabilize the economy and control price dynamics.

The debt in pesos under the city’s magnifying glass

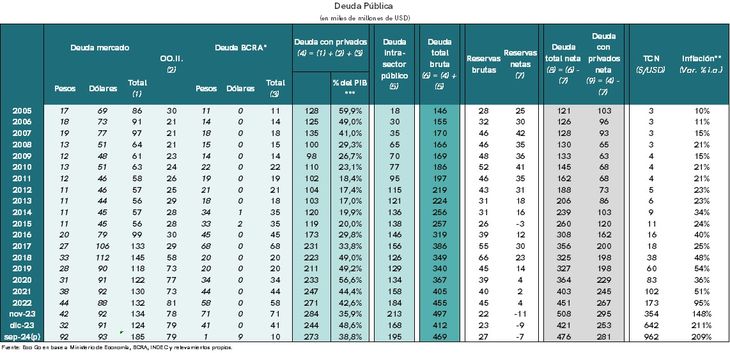

In dialogue with Ámbito, Sebastián Menescaldi, director of EcoGoexplains that part of the increase observed today in financial commitments in pesos comes from the transfer of debt from the Central Bank (BCRA), specifically in remunerated liabilities, to the Treasury. This justifies the jump to historical levelssays the economist.

However, he slips that “It is true that the volume of debt in pesos that the Treasury maintains with the market is historically high and reaches almost US$90,000 million.”, an amount equivalent to the dollar commitments it has with the bondholders. Furthermore, he highlights that around 80% of this liability matures within a year, which adds extra pressure to the Government, “especially if what you want is to lift the exchange rate”, he warns.

Treasure.png

The economist explains that, with the current restrictions, the debt in terms of GDP does not increase. This, according to the analysis, is due to the fact that the nominal rate is negative and remains “more or less” on par with economic growth. However, if exchange restrictions were released, payment of this debt at a rate of between 10% and 12% could “destabilize” the financial accounts.

Furthermore, if the real interest rate were 10%, the fiscal result would imply the payment of an additional US$9,000 million annually in interest, “which represents a significant challenge for the future”, he assures. Finally, he warns that “this panorama complicates the possibility of getting out of the trap, since the effects of taking that step would negatively impact both the dynamics of the debt and public finances.”.

Debt adjusted for inflation and the stocks

Claudio Caprarulodirector of the consulting firm Analyticsanalyzes that debt in local currency is, to a large extent, adjusted for inflation, despite the fact that the share of fixed rate debt increased. In this context, he maintains that the exit from the stocks could trigger inflationary dynamics and so? would increase the public debt burden adjusted by that variable. “This effect would be partially offset by fixed-rate debt with longer maturities, since its returns would be more negative in real terms,” he indicates.

On the other hand, he estimates that Removing capital controls could redirect some private sector liquidity to other financial instrumentswhich would make the “roll-over” of Treasury debt difficult. “This would put greater pressure on the need to maintain a good fiscal result, which until now has contributed to reducing the risk associated with debt in pesos.”

The risks associated with debt in pesos

The economist expresses himself along those same lines Federico Glusteinwho assures that it is always preferable to leverage in local currency than in foreign currency, since it is easier to raise or generate the debt necessary to meet obligations. Besides, “The State has control over the interest rate in local currency, which provides greater flexibility”, he analyzes.

Glustein highlights the trend of recent months in which the stable dollar made peso rates attractive. This caused a change in the placement of financial instrumentswith a transition from investments in dollars to pesos.

However, he warns that having “rolled” debt at high rates compared to future inflation, as happened in the last Treasury tender, could represent a challenge. For the economist, this could imply the need for a greater adjustment, which would affect the recovery of economic activity in 2025.

In addition, there is a risk that excess pesos will migrate from local currency positions, which would generate additional pressures. Thus, for Glustein, although debt in pesos is less worrying than debt denominated in dollars, “if short-term maturities are not rolled”, it will be much more difficult to stabilize the economy and lower inflation: two key axes of the economic plan.

Debt Ecogo.jpeg

Argentine debt. Source: EcoGo

Finally, Adrian Yarde Buller, chief strategist Facimex Securitiesindicates that, “although the Treasury debt in pesos is at maximum levels,” it is important to focus attention on two key aspects.

First, this increase reflects the Treasury’s significant effort to clean up the BCRA’s balance sheet. “If you look at the consolidated debt between the Treasury and the BCRA, the levels of obligations in pesos, in relation to GDP, are currently lower than at the end of last year,” he maintains.

And, secondly, “it is essential to remember that approximately half of the debt in pesos is in the hands of the public sector itselfwhich considerably reduces the real burden of debt in pesos,” concludes Yarde Buller.

Thus, in this challenging scenario, the debt in pesos stands as a double-edged sword: on the one hand, it allows greater control and flexibility, but, on the other, it becomes a time bomb that, If it is not deactivated with a firm strategy, it can put the fragile economic balance in check.. The coming months will define whether Argentina manages to navigate these turbulent waters.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.