The Palacio de Hacienda will make the call this Monday for the first tender of October. The city, attentive to the renewal percentage and the interest rate.

The Ministry of Economy will announce this Monday the conditions for a new debt tender in pesosthe first of October. The operation will come after an important milestone: in the last auction in September, the team of Luis Caputo It only renewed 67% of the maturities. It is within this framework that the market will closely follow this week’s result.

The content you want to access is exclusive to subscribers.

The tender to be announced this afternoon will take place on Wednesday and will be settled next Monday. According to calculations by Portfolio Personal Investments (PPI), that day The Treasury will face maturities of nearly $5.1 trillioncorresponding to a fixed rate bill and a bond tied to inflation.

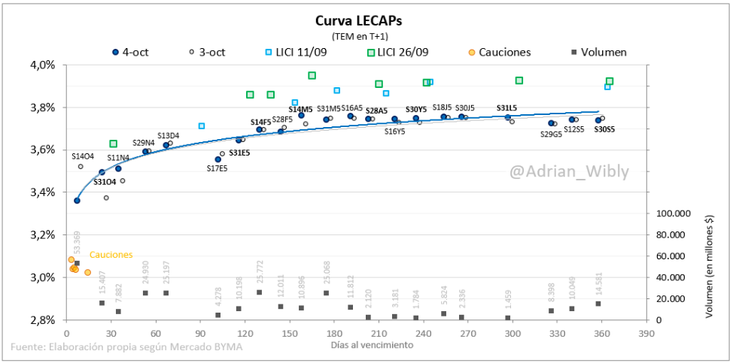

Market attention will focus today on the instrument menu to put the Ministry of Finance into play, which leads Pablo Quirno. On the last occasion, it appealed to a broad combo of fixed-rate capitalizable bills (Lecap) and inflation-indexed bonds (Boncer).

Debt: why will the city be pending the tender?

For him Wednesdaytraders and analysts will closely follow two central points: on the one hand, What percentage of maturities does the Treasury manage to renew? on this occasion; on the other, What rate signal does it send to the market prior to the publication of the inflation data? September by INDEC.

The first point will have particular attention because, In the last auction in September, Economía was barely able to refinance 67% of the maturities. The Government argued that this was due to a desired effect of the economic plan: that the banks decided to obtain liquidity to supply the growth of the loans in pesos to the private sector.

In the market they give credence to the idea, but they doubt how much liquidity can finally flow to private credit with an economy that is unable to consolidate a rebound path that will take it out of the pit to which the recession led it.

image.png

Regarding rates, a central point will be to see how much inflation projections influence. In the secondary market, there was some compression of the Lecap rate since the last Treasury placement.

This Monday, the inflation index of the City of Buenos Aires marked 4%. The Survey of Market Expectations (REM) published by the Central Bank last Friday projected a National CPI for September of 3.5% and a path with oscillations during the following six months, but always above 3%.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.