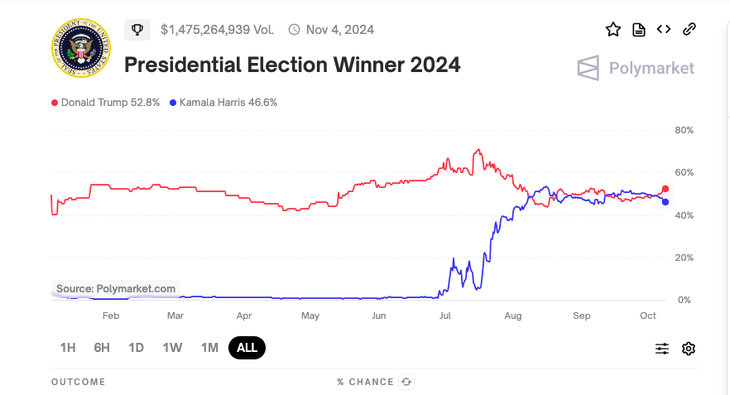

Trump’s boost in October prediction markets comes after a September in which he gained ground against Harris in several key states, with significant gains in Arizona and Georgia, plus North Carolina (a state that Trump carried twice), as he lost in 2020 in both states to Joe Biden.

Harris, for his part, maintains tight leads in Nevada, Wisconsin and Michigan. Pennsylvania, where Trump will campaign this Wednesday, is in a tie, according to the RealClearPolitics average. Thus, on several betting sites, Trump now leads Harris. This is seen for example in Bovada, Points Bet and Polymarket. Harris is behind 47 to 48 on Betfair, while they are tied on Bwin and Smarkets, making the result strictly an even bet.

Polymarket.png

Trump now leads Harris like on Bovada, Points Bet and Polymarket.

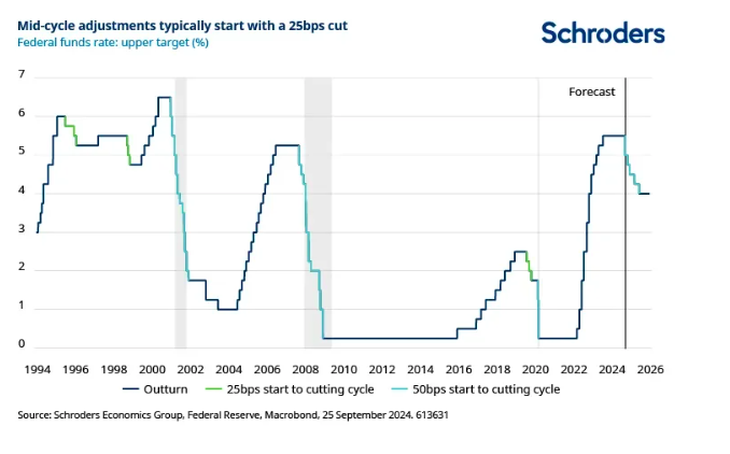

Fed rate cut and uncertainty on the agenda

George Brownsenior US economist at Schroders, explains in its latest report that, when the Federal Reserve (Fed) begins a cycle of cuts with a reduction of 50 basis points (bp), it is usually a cause for concern. It did so in January 2001 and September 2007, just three or four months before the US economy entered recession, as well as in March 2020, at the beginning of the global pandemic.

For the strategist, although he understands the reasoning of Jerome Powell, president of the Fed, he considers that an aggressive pace of relaxation is not justified. However, he warns that if aggressive rate cuts are implemented and the US economy is more resilient than expected, rates could become too lax, preventing neutrality from being achieved and would revive inflation. A “driver” that adds to the uncertainty due to the electoral contest.

Surveys arrive from Wall Street

And, as you well analyze Pedro Moreyradirector of Guardian Capitalin conversation with Scopesurveys on Wall Street show mixed results and “uncertainty generates a clear lack of consensus.” On the one hand, there is the survey data (from CNBC) in which they consider that Trump is better prepared to face economic challenges such as inflation.

However, a recent report by Committee for a Responsible Federal Budget points out that the Republican candidate’s political proposals “could almost double the burden of the American debt,” comments the strategist, compared to Kamala Harris’ plans.

Fed Rates.png

Moreyra maintains that, based on those results, Trump’s proposals would increase the national debt by $7.5 trillion by 2035, while Harris’ plans would add about $3.5 trillion. “It is important to highlight that according to the last debate, and according to the last speeches, Neither candidate has any concrete plans. to address the national debt, and his policies are expected to increase deficits and debt, no matter who gets to the White House,” he slides.

For its part, Ayelen Romeroanalyst at Rava Stock Markethighlights in statements to this medium that the US market shows volatility in its prices, since the candidates changed after Joe Biden abandoned his re-election plans, this added volatility and uncertainty. Well, as the analyst explains, when the dispute was between Biden and Trump, “there the polls pointed to a clear winner and the market responded coherently. Today, the polls show minimal differences between the two candidates.”

Romero explains that Trump has a nationalist economic policy and the investing public, which continues to consider him for the most part as the winning candidate, It leans towards purely American companies because they could benefit.

What the historical data says and what to bet

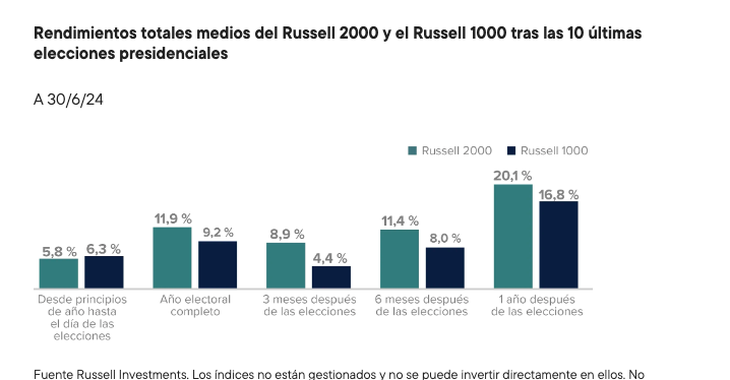

The available data shows that, historically, in presidential election years, The performance of small caps on Wall Street, as represented by the Russell 2000 index, outperformed large caps.

And although history does not always repeat itself, This pattern offers an incentive for small business investorsdespite political uncertainty. Recent market developments expose the resilience of small caps, suggesting attractive opportunities regardless of the election outcome.

Moreyra indicates that the sectors that could benefit if Trump wins, They would mainly be energy and any sector or company that is “affected” by competition against other non-American giants.

“An example in the semiconductor sector would be that of Intel (INTC) vs. Nvidia (NVDA)where today the clear winner is the last, but if we go back to July 18 of this same year, we had a demonstration of how more ‘protectionist’ measures would impact the US,” he maintains.

Russell 2,000 vs. Russel 1,000.png

Historically in presidential election years the performance of small cap companies on Wall Street outperformed that of large cap companies.

And remember that on July 18, when news broke that tougher restrictions on exports of advanced semiconductor technology to China were being evaluated, and supported by Trump’s comments in which he said that Taiwan, a key production center in the generation of chips, should pay Washington for its defense.

In this context, TSM, ASML, NVDA, AMD, QCOM, AVGO and ARM were affected. While the exceptions in the sector are in companies with chip manufacturing operations in the US. Companies such as Intel (INTC), Global Foundries (GFS) and Texas Instruments (TXN). Finally, Romero adds in line with Moreyra that the company Micron technology (MU) could also benefit, because it has American capital.

Thus, in the final stretch of the close electoral contest, The markets become the scene of a battle as intense as the election itself. With investors leaning towards protectionist policies that favor US companies, while volatility dominates and the future of US debt raises doubts.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.