One of the ways that an investor or saver has to obtain a return in dollars it is through the private debtu Negotiable Obligations (ON)which are within what is known as fixed income instruments. Another alternative, from the local market, is to buy cedarswhich are mirror shares of companies listed abroadwhich are purchased in pesos, but They are tied to the dollar Cash with Settlement and even some of them pay dividends.

The Negotiable Obligations They are instruments of debt issued by companies and They can be purchased with both pesos and dollars. Being fixed income They already have the interest payment percentage predefinedand when they will be done but They pose some risks to take into account.

The economist Elena Alonsoin a conversation with this medium, explained how they work: “The Negotiable Obligations They are an alternative for those who does not want to get involved in sovereign risk and yes, have the security of the amortization, the interest, the frequency and how much they are going to pay you.

Among the risks is the fact that “the possibility of paying that Negotiable Obligation It depends on the company’s compliance capacity, so there are several things to evaluate: What sector does it operate in, what is the future of that company and the political decisions that may affect it?“Alonso added.

image.png

Cedears: which ones to choose to build a competitive portfolio in October

The cedars (Argentine Certificates of Deposit) are actions mirror of companies listed abroad and that are tied to the price of the Dollar Counted with Settlementtherefore, Even though most are purchased in pesos, it depends on their price.

Among the advantages of this instrument it is found that They remain outside the vicissitudes of local politics and are dollarized assets but, Among the disadvantages, There is the fact of how they are in the framework of variable income (it can operate with volatility) depending on the mood of the international marketand if the CCL price falls, so will Cedears.

In conversation with this medium, Emilse Cordobadirector of Bell Stock Market, said that “taking into account the foreign reference markets and the sustained highs in the main indices, We are in a moment of uncertainty as to how much longer it can continue at maximum levels. This is why “We prefer to get rid of the assets known as ‘big tech’ even as these assets continue to rise.”

Among the Cedears, those that are most attractive to you, They are those that are furthest behind in prices. “It is the case of Googlewhich still has an upward journey to just reach its maximums. and of Viewbecause there is the expectation of what will happen with the oilan asset that adjusted a lot and is already resuming the increases,” Córdoba added.

“For those who can take a little more risk, Bioceres and Coinbase. Both have been punished recently and have a long upward journey just to approach their highs. A route that will take time to reach. Taking into account the rate drop and speculation that another drop will occur at the next meetingthat would be beneficial for commodities, which is why investing in Bunge It would be another very good option, he concluded.

How to build a balanced portfolio with Cedears

image.png

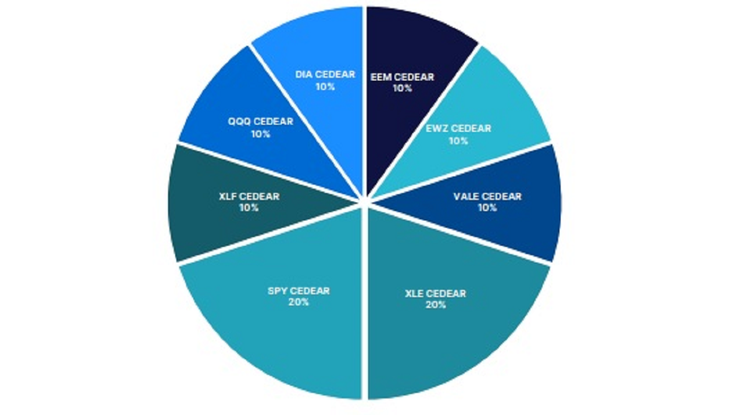

In relation to the portfolio of cedars recommended by PPI for October, they explained: “After the recent announcements by the People’s Bank of China and the Politburo seeking to stimulate the economy to reach its target of 5% annually, we take a more aggressive position regarding emerging markets and commodities”.

“While we believe that we may be partially late for direct trade, we add a 10% position in the Cedear ETF EEM (emerging markets). At the same time, seeking to benefit indirectly, we add EWZ -Brazil- (+10pp) and the mining company Vale -VALE- (+10pp)for being business partners and their exposure to metal production,” they expanded.

Finally, “expecting that energy demand will increase with the acceleration of China and the escalation of the conflict between Israel and Iran, we add the EFT XLE – energy- (+20pp). On the other side, we reduced the positions of the Dow Jones ETF (DIA), Nasdaq (QQQ) and the XLF ETF -financials- to 10pp per side, and the S&P 500 ETF (SPY) to 20pp“, they closed.

In turn, since IOL investonlinethey recommended two companies for this month and a ETFs. One of them was Alphabet (GOOGL) since they highlighted that it presented solid results in the second quarter of 2024, and then they chose Vale (OKAY)because it is one of the largest mining companies in Brazil and in the world.

“The company has been affected in recent months by the drop in commodity prices and the instability of Brazil’s macro-political panorama. which left the company trading at attractive valuation ratios“, they explained from this broker. Finally, they recommended taking a position in the SPYone of the most important benchmark stock indices in the United States.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.