Thanks to the impulse of the more than US$12,000 million in cash that entered the laundering, Argentina’s financial conditions improved and they established themselves at a point where they are beginning to offer greater confidence to investors about their ability to pay their debt.

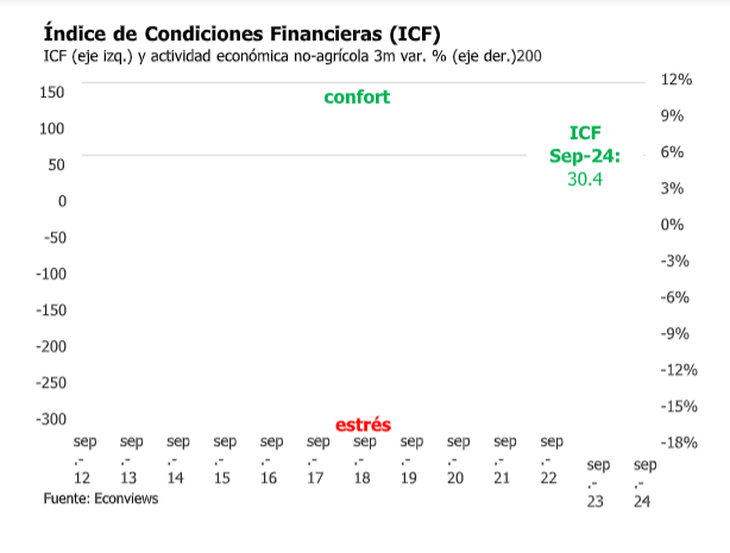

This is indicated by the Financial Conditions Index (ICF) prepared by the consultant Econviews for the Argentine Institute of Finance Executives (IAEF), which rose 21 points in September and is establishing itself in its “comfort zone.”

“He measured 30.4 points, his best mark since June. The rise was almost entirely thanks to local conditions, which rose 20 points to 17.8 and reached the highest level since PASO 2019. On the other hand, external conditions gained just 1 point and did not recover from the shock of August, although they remain in the comfort zone at 12.5 points,” the report states.

icf.png

The index is prepared based on the evolution of a series of national and local economic-financial variables.. Point 0 is neutral. What is below that level is a “stress zone,” which implies problems paying the debt, and what is above indicates a “comfort zone” and fewer problems meeting commitments.

The work indicates that “Almost all local variables rose.” He himself adds that “seven out of 10 gave up in September, but the three that worsened (the Badlar rate, the spread between local law and foreign law bonds and bank liquidity) had marginal declines, less than one point.”

Whitening effect

“In local conditions, stage 1 of ‘relevant and palliative fiscal measures’, which ended on September 30 and was later extended until October 31, was very helpful,” the report notes. It says that “40% of the monthly improvement came from dollar deposits from the private sector, which increased by US$12,000 million (+68%), the highest level since PASO 2019, within the regularization program of assets”.

“Another leg of money laundering, the advance payment of personal assets until 2027, probably contributed to reducing the exchange gap (from 37% to 29% on the average for the month) to the extent that taxpayers had to exchange dollars for pesos to pay the tax. Between the extension and the fact that Personal Assets were paid in two installments, 75% and 25%, part of the positive effect of money laundering will continue in October,” the work indicates.

Financial spring

The work also points out that “Beyond the deterioration of recent days, in the September average the Merval index rose from 1,200 to 1,400 dollars, a maximum since April 2018 when the exchange crisis began.”

“The country risk compressed from 1,600 to 1,300 between August and October. The other high-risk countries (Ecuador, Egypt, Sri Lanka, etc.) moved in the same direction, but Argentina’s decline was more marked,” says Econviews’ work for the IAEF.

He also points out that “another variable that supported the ICF was “core inflation, which seems to have once again pierced the 4% monthly floor after the 10-point drop in the PAIS tax.” However, the figure of 4% in CABA shows that we are far from having won the battle against inflation, with inertia still high” – adds the report.

The world breathes

Regarding the variables related to the exterior, the study says that “After falling 23 points in August (its worst month since the invasion of Ukraine), external conditions recovered in September.”

“In the middle of the month, the Federal Reserve lowered the interest rate by 50 bps, from 5.50% to 5%. The US employment data removes the fear of a recession, but the war in the Middle East and the elections are a volatility factor that should not be underestimated,” says the work.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.