The AFIP heeded the request of the taxpayers and extended the payment of the advance payment of Profits and Personal Assets, which impacts the self-employed. How the calendar turned out.

The AFIP also clarified the means of payment.

freepik.es

The Federal Public Revenue Administration (AFIP) confirmed that he postponed the expiration of the first installment of the advance payment of Income Tax and Personal Property for self-employed workers. He did it through General Resolution 5584/2024published this Monday in the Official Gazette.

The content you want to access is exclusive to subscribers.

In the recitals, the AFIP assured that this extension was given as an “exception” to comply with the obligation to pay the first and second advance of Profits and Personal Assets, which corresponds to the 2024 fiscal period.

“Due to tax administration reasons in order to facilitate compliance with the tax obligations of taxpayers and responsible parties, it is advisable to extend until October 25 the deadline for the payment of the first advance payment of income tax,” he explained.

AFIP: how is the Earnings advance payment schedule?

Income Tax

First Advance

- CUIT Completion: 0 to 9

- Expiration date 10/25/2024

Second advance

CUIT Termination – Expiration Date

Expiration date: 11/13/2024

Expiration date: 11/14/2024

Expiration date: 11/15/2024

personalgoods.png

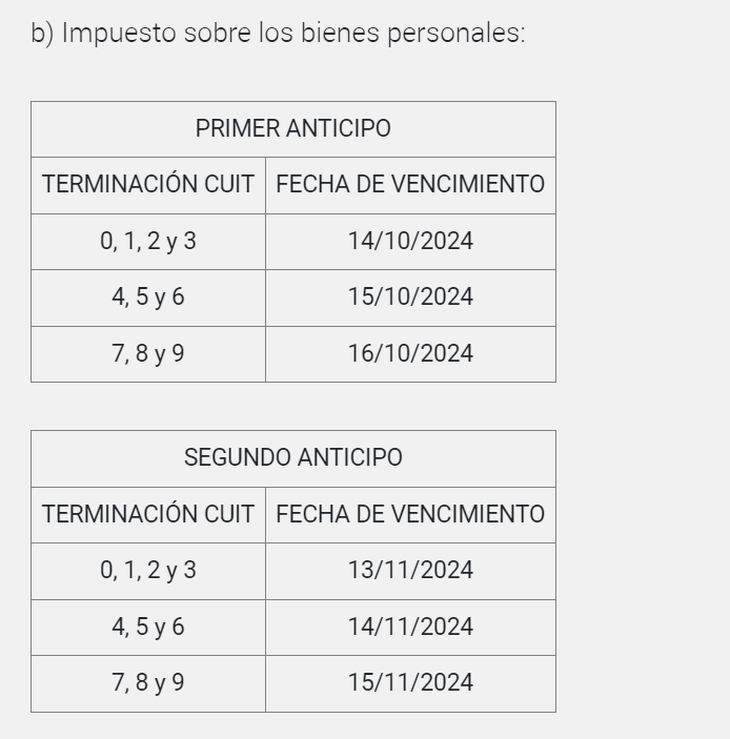

Personal property payment schedule

Finally, the AFIP clarifies on the first advance of profits, that automatic debit and telephone payment using credit cards will not be enabled, nor will the debit option through ATMs be enabled.

It should be remembered that the advance of Earnings for self-employed It is estimated based on the previous settlement of the tax and on this basis the 5 monthly installments of 20%. At the end of the period, the balance is completed based on the tax determined for the current period.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.