The battery of measures and the direction that the official strategy is taking reflect that The slowdown in inflation and calm in the financial markets are today the “obsessions” of the economic team led by Luis Caputo and leave other fundamental objectives in the background.. The stagnation of wages and the increase in unemployment put a ceiling on an economic activity that constantly intersperses positive data with negative data.

Last week the INDEC reported that the manufacturing industry added its second consecutive monthly improvement in August. On the contrary, the construction He ended a streak of four improvements in a row and fell back compared to July.

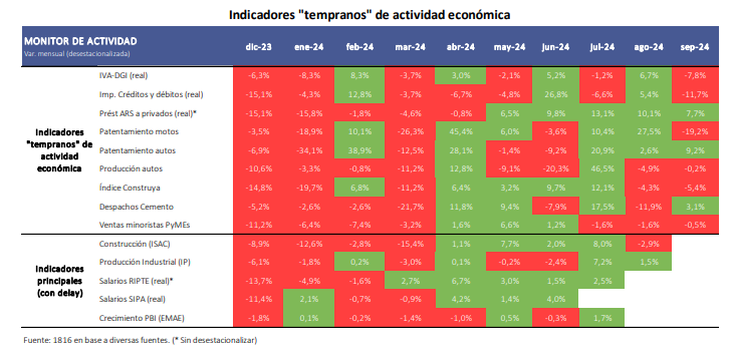

The first previews of September once again showed a great disparity between sectors. Regarding the industry, the automotive production gave up 3% but steel it grew 9% seasonally adjusted, according to the consulting firm Econviews. At the same time, construction could suffer a new deterioration in its activity, since although the cement dispatches improved 3.1%, the Index Build –which measures the evolution of volumes sold to the private sector of products manufactured by 12 leading companies in the manufacture of inputs for the sector – fell 5.4% according to data from the consulting firm 1816.

Activity Econviews.PNG

Looking ahead to the coming months, among construction businessmen there are already more optimists (25% of those surveyed by INDEC) than pessimists (9%) for the construction segment. private workswhile the bulk of the sector remains uncertain. The case of the public work It is more uncertain, since 28.7% expect the situation to get worse, while only 14.8% believe it could improve.

Inflation falls and credit grows, but salaries and employment remain in crisis

This “saw mode” that the Argentine economy shows occurs while inflation in September was 3.5%, the lowest in 34 months. This slowdown explains why Credit to the private sector is one of the few indicators that has been showing a “V” reboundreaching October 2023 levels.

Activity 1816.PNG

“Until now, the Government has prioritized disinflation and appears to measure the success of its management under these terms. The delay in the unification of the exchange market is aligned with this strategy. However, The latest surveys reflect a change in people’s concerns: inflation is no longer the main problem, giving way to poverty and low wageswhich are now positioned as the main concerns according to the survey by the University of San Andrés. Maybe it’s a good time to prioritize growth. To do this, we believe that it is necessary to unify the exchange market, although this may generate a temporary increase in inflation,” they stated in Econviews.

For her part, the economist Laura Testa he remarked in dialogue with Scope that today all the political will is focused on lowering inflation and fiscal balance, two objectives that “are not incompatible with economic growth but with the strategy that the Government is carrying out”, since ““The fiscal balance is being implemented through the adjustment of salaries, pensions, transfers to the provinces and public works, and the slowdown in inflation is being achieved by stepping on devaluation expectations through a recession that depresses the demand for imports.”

The latest data from the Taxable Remuneration of Stable Workers (RIPTE) published by the Ministry of Labor showed that in August saw the first real contraction in six months. Although most analysts agree that this is not the best indicator to measure salary dynamics, other estimates also showed similar behavior.

Indeed, the indicator of the CP consultancyprepared based on the average salaries of the collective bargaining agreements, showed that the income of formal workers contracted 0.1% in the eighth month of 2024. “The joint ventures since July have been stagnant as a result of downward negotiations with inflation that remains at 4%,” they had previously warned.

In parallel, Formal salaried employment suffered its tenth consecutive drop in Julyaccording to official figures from the Argentine Integrated Pension System (SIPA). Since Javier Milei assumed the presidency, almost 200,000 jobs have already been lost, the majority corresponding to workers registered in the private sector, mainly in the construction and manufacturing industries.

“The calm in inflation and the order of the economy help, but If businessmen do not see a consumer agent on the other side, I do not believe there will be a decision to increase productive investment.“Testa noted in front of the scenario described.

Will Milei be able to sustain the exchange rate anchor and reduce the gap at the same time?

The fiscal anchor and the exchange rate anchor are the two fundamental pillars of the disinflationary strategy; Today the market not only discounts that the Central Bank (BCRA) will respect the “crawling peg” of 2% per month for the price of the official dollar, but the possibility of it being reduced even further to lower the price floor is beginning to gain weight. variation of the Consumer Price Index (CPI).

Precisely, Milei has stated that Their intention is to leave the stocks when inflation approaches 2.5%. However, for this to occur without interrupting the declines in CPI increases the gap between the official dollar and the parallels should be close to zero. To date, the spread between the wholesale and financial exchange rates is around 20%, when in July it was close to 60%.

This collapse had to do, in the first instance, fundamentally with the direct intervention of the BCRA in contributions with the use of reserves and, later, with the contribution of money laundering. The end of money laundering and the possible reduction of “crawling” put this decline in the gap in check, and could put pressure on devaluation expectations.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.