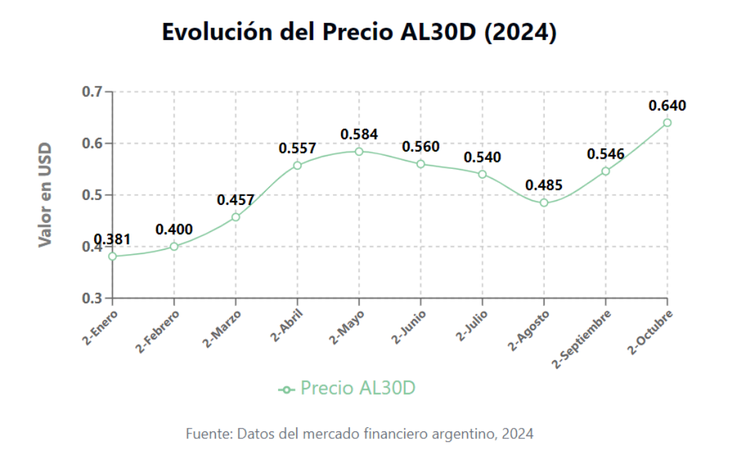

After a busy September, with strong rally in Argentine stocks and bonds Added to the sharp decline in the dollar in all its variants (blue, MEP and CCL), October does not slow down and predicts good news for the government. Will everything remain the same in November and December?

To a greater extent, Stage 1 of money laundering generated foreign currency income into the financial system and much of it was destined for the purchase of local bonds (in pesos and dollars).

image.png

This directly impacts the Country Risk index, causing it to drop below 1,100 points, to 1,044 last Tuesday. To take into account the positive aspects of this data, it is important to remember that Argentina has not been able to break 1,100 since August 9, 2019, the Friday before the PASO of that year, and since then the index has moved away from three figures. .

Bull or Bear last two months?

At Insider Finance we maintain that there is still room for a further rise in local bonds, beyond the rise that occurred in September.

If we take as reference the AL30D with a 18% IRR, the GD30D 17% IRR and the bonds maturing in 2035 that today offer an IRR of 14% and we propose an optimistic scenario with the Country Risk piercing 1,000pts, these bonds They should achieve an IRR of 10%.

It should be noted that this rise would occur more slowly than the rally we saw in the previous month and so far in October.

image.png

Confidence injections on the way

There are a couple of events that we have marked on the calendar. “Important Events to Come.” One of them is the elimination of the PAIS Tax, announced by the government at the end of December of this year. This would be one more seasoning that would help push inflation downwards and, with a stable outlook and also bearish inflation, Argentine securities will be even more boosted.

The other marked event will occur in January: the payment of the Bonares and Globales. The market will be very attentive to ensure that there are no surprises with this appointment and – if there are no complications – the execution of that payment by the government would generate an injection of confidence in the market, generating a short-term valuation of local securities.

Where is the dollar going?

Although Stage 1 of laundering has been showing very good figures, we see a decrease in the amount of assets that are entering in recent days, which in part explains the rise in financial dollars since the supply gradually decreases.

If we try to draw a stable line, the parallel dollar should be the reference (today at $1,220) towards which the MEP (today MEP $1,180) will converge, in a short-term horizon.

CEO of Insider Finance.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.