The BCRA bought US$784 million so far this month. The number is “unusually high.” for this time of year”, as analyzed by the Economic Studies Management of the Province Bank. To measure, it is the highest value since 2010 and “between 2020 and 2023 the average of October operations was -US$400 million,” he expressed in a report.

“While in October 2020 to 2023 the purchase of foreign currency due to the increase in loans to private individuals had been almost zero (its flow averaged -US$150 million per month), in 2024 it contributed US$200 million in the first ten days of October (latest data available), to which must be added the issuance of ONs in dollars by some companies,” added the Banco Provincia report. As this medium pointed out, it is a “inflated supply” of foreign currency that the economic team clings to to get through the seasonally most challenging months.

image.png

Source: Banco Provincia, based on BCRA.

Reserves: how much reserve do the BCRA purchases have?

Anyway, Last week there was a slowdown in the pace of purchases by the monetary authority: bought US$140 million, a positive balance but lower than the US$230 million of the previous week and the US$507 million of the previous week. This Monday, it bought US$23 million.

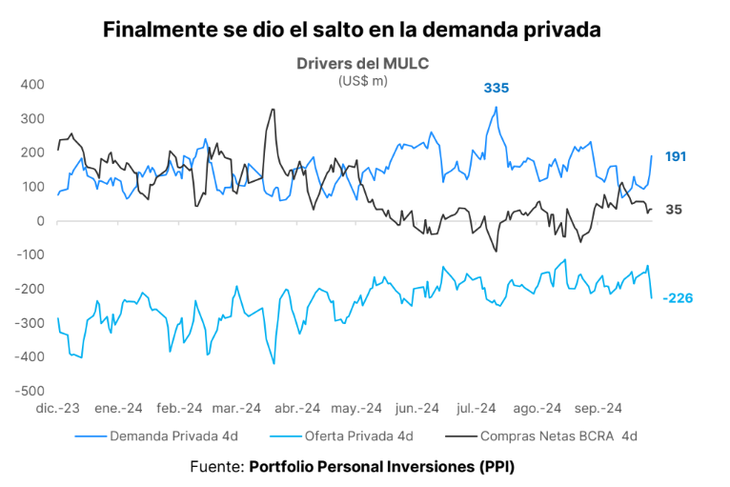

Personal Investment Portfolio (PPI) analyzed what happened: “In the last four days, private demand accelerated noticeably up to US$191 million daily from a recent low of US$69 million reached on October 3. Finally The deferral of imports began to have an impact in August due to the expectation of lowering the PAIS tax without compensatory devaluation and overlapping import payment schemes. This translated into the BCRA facing larger fees in October than in September.”

The report, sent to its clients, refers to two phenomena expected by the city. Due to the rollback of the PAIS tax, which came into force in September, many companies had postponed purchases abroad during August waiting to bring in merchandise with a lower rate. This was evident in the imports reported by INDEC: in August they had fallen 12.2% monthly and in September they jumped 32%. Since the majority are paid from the 30th, it is during October when they impact the demand for foreign currency.

The other phenomenon is the overlap of two import payment schemes: that of four monthly installments of 25%, which was in effect until August, and that of two monthly installments of 50%, which came into effect at that time.

“At the moment, the BCRA can buy reserves because private supply continues to compensate for greater private demand. If it had not escalated from around US$150 million per day to US$226 million (four-day moving average), this would not have been possible. The BCRA benefits from the fact that private supply is driven mainly by financial flows. Here whitewashing played a big role, allowing the loans in dollars and ON placements. Both provide an extraordinary offer at the MULC,” PPI stressed.

image.png

But The relaxation of the restrictions on the payment of imports announced last week, which came into effect this Monday, will give an additional boost to the pressure on reserves. Now, the payment period for imported goods is unified at 30 days, except for the few that have immediate access, such as energy.

“This will add greater pressure to private demand only between the end of November and December. Therefore, going forward, it will be key to see if private supply continues to remain at these high levels and compensate for the greater private demand, since this is what will allow the BCRA to continue buying,” PPI noted.

This flexibility respond to various objectives. Guillermo Michel, former director of Customs, highlighted that the end collection: As the PAIS Tax expires on December 24, this measure would avoid “losing the collection of no less than $500,000 million between now and the end of the year,” he estimated.

It also has to do with the commercial opening. It is combined with the reduction of tariffs and customs deregulation, which has already put sectors of the industry on alert. “The Government is progressively encouraging the opening of imports: to the lowering of the PAIS tax rates, the recent reductions in tariffs and simplification of processes are added, in a context of greater exchange rate delay. This suggests that, Even at the cost of resigning the scarce reserves, imports will gain momentum,” said the consulting firm LCG.

Deposits, loans, agriculture, climate and dollar supply

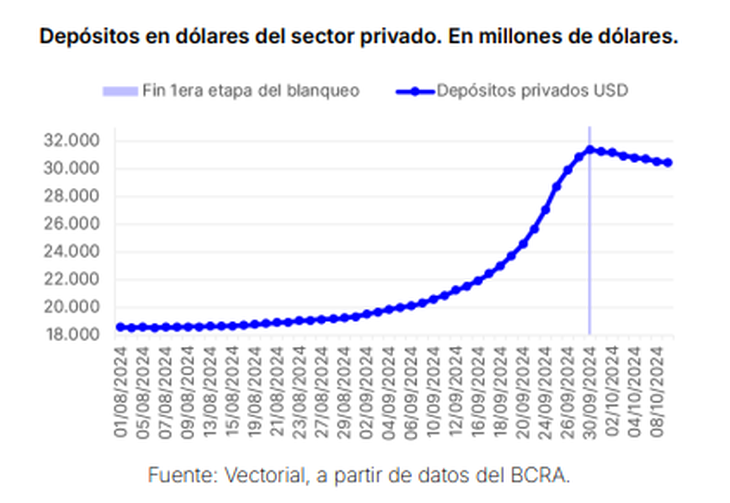

To a large extent, The continuity or exhaustion of the BCRA’s purchasing balance will depend on whether the currencies that entered the banks due to laundering continue to be recycled. of capital, the first stage of which closes in ten days. Until now, local bank loans in dollars were a key contribution (along with ONs), but in the coming weeks everything indicates that demand will continue to rise. For Luis Caputo’s bet, it will be decisive that this dynamic is sustained.

In that sense, the Consulting firm Vectorial focused on the drop experienced in dollar deposits since October 1when the withdrawals of cash entered into the regularization of assets were enabled: “Of the total of US$12,482 million deposited between August 1 and September 30, US$922 million have already been withdrawn from the financial system, that is say, 7.4% of the total. “This withdrawal discourages the Government’s expectation that these dollars would remain within the local financial system.”

“According to bank sources, The amount withdrawn from CERA accounts amounts to 20% of the total received from laundering. The difference with what was withdrawn from the financial system is now located in normal savings banks, which could indicate that the drop in deposits would continue throughout the month,” added Vectorial and linked this dynamic with the prospects for the continuity of the exchange rate due to For a long time the market has read the Government’s signals, beyond the specific flexibility announced last week.

image.png

To all this combo is added another determining factor: the climate. The lack of rain already predicts a more complicated 2025 than originally expected for corn and soybeans. AND for summer badges (with wheat as the main crop), producers point out that The magnitude of the rainfall announced for this week could be key when evaluating the yields of the fine harvest.

Looking ahead to 2025, the main unknown is the future of blend dollar. The export exchange rate causes 20% of exports to be settled in the CCL and, therefore, do not enter the reserves. It is a trap: maintaining it implies giving up the bulk of the trade surplus and eliminating it will imply extracting a strong key supply from the financial dollars that could cast doubt on the stability of the exchange gap. It will not be an innocuous topic in the negotiation with the IMFwhich called for its elimination by the middle of this year.

For now, 2025 is approaching with external debt maturities that exceed US$20,000 million between commitments of the private sector and the national and provincial states. Today, Net reserves are negative by around US$6 billion and the foreign exchange hole to cover, if the Government maintains the exchange status quo, is considerable.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.