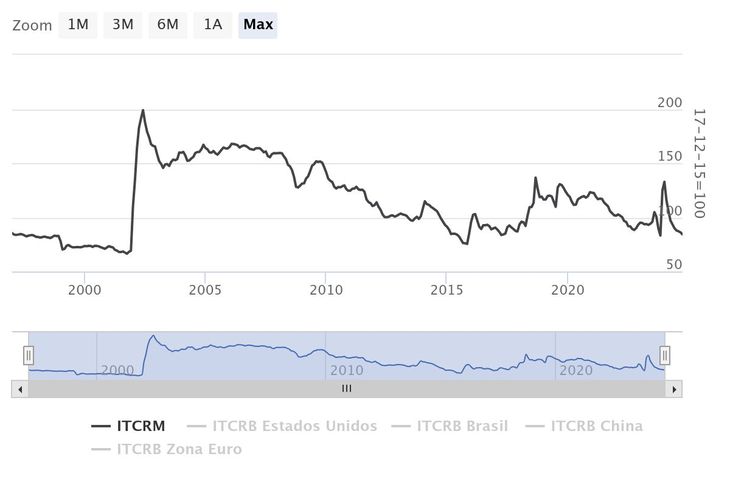

He BCRA reported that on Monday, October 21 The real multilateral exchange rate was at 82.8 points. The indicator was on the verge of reaching 81.5 points on December 7last business day of Alberto Fernández’s mandate. And it has even already pierced the average level of November 2023 (83.2). To measure the appreciation registered throughout the year, after the exchange rate jump of 118% in a single day decided by Milei and Caputo, on December 14 the TCRM had climbed to 162.2 points. A mega devaluation whose exchange competitiveness has already finished liquefying.

TCRM.jpeg

What happened? The economic team defined that one of the pillars of its plan (along with the fiscal adjustment shock) would be the exchange anchor. For this, he defined that, after the devaluation jump in December, he would apply a little table: the official dollar would rise at a rate of 2% every month. And so he did. With the price of the dollar always below inflation, the exchange rate appreciated progressively.

Added to that was the devaluation of the currencies of some of the main trading partners from Argentina, with Brazil as a paradigmatic case. In fact, the bilateral exchange rate with the neighboring country has already pierced the level prior to Milei’s assumption and is at the lowest level in the last 22 years, with the exception of a few months in 2015.

The fact is key: Brazil is not only the largest trading partner, but also the main destination of industrial exportswhich lose exchange competitiveness. The local manufacturing sector faces a combo of adverse policies that is reflected in the productive crisis: collapse of domestic consumption, import opening with a more appreciated exchange rate, customs deregulation and lower tariffs.

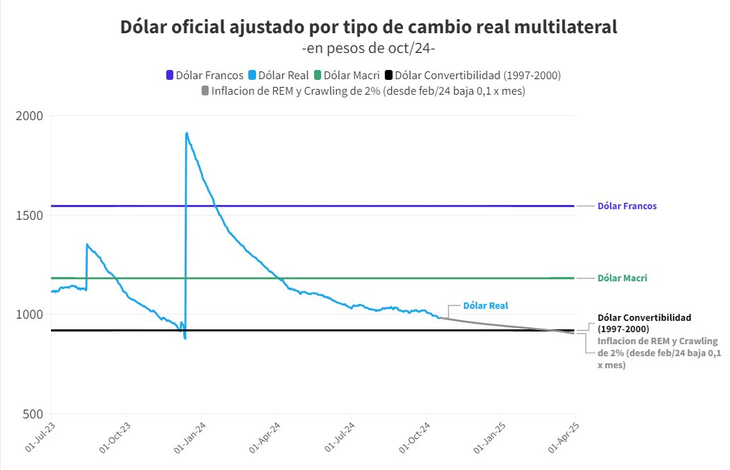

image.png

Source: Amílcar Collante

If the official exchange rate system continues, as discounted by market prices, the appreciation will continue its course. This is what the economist put it Hamilcar Collante: under the assumption of inflation projected in the latest BCRA Market Expectations Survey, if the “crawling peg” of 2% monthly is maintained until February and, from that moment on, the pace begins to decrease by 0.1 point per month, as Ricardo Arriazu suggested, In March the TCRM would reach the average level of the end of convertibility (1997-2000).

Dollar: the official plan, the city’s bet and the risks

The Government embraces the exchange rate anchor as a way to contain inflation and try to extend the deceleration path. It is the political credential that he wants to show for the next campaign. It happens that, despite the recessionary context, a devaluation jump would have an impact on internal prices. Economists and city operators agree that it was the main reason for the continuity of the stocks due to the lack of reserves in the BCRA to intervene.

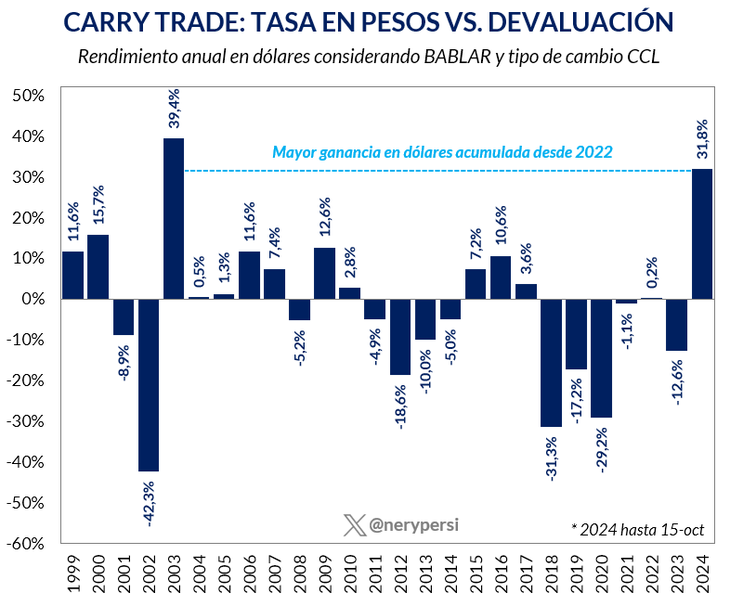

Furthermore, the official exchange rate table and the compression of the gap (helped by the validity of the blend dollar) is the Caputo tool to encourage bets on the “carry trade”, the so-called “financial bicycle”which consists of selling dollars to position oneself in assets in pesos that pay a rate higher than the evolution of the exchange rate and becoming dollarized again before the price skyrockets. For those who bet on the “carry”, the Caputo plan provided a juicy gain in dollars of 31.8% so far this yearaccording to economist calculations Nery Persichini.

image.png

The truth is that there are warnings regarding the Government’s strategy. “For us, the risk of keeping the exchange rate backward remains high. If at some point it had to be corrected, that should not be too traumatic in a context of fiscal surplus and exchange restrictions still in force. It will have some impact on prices and activity, and that is why it is always better to accommodate it prematurely, and preferably under an agreement with the IMF or with reserves available to manage overflows,” considered the consulting firm. LCG in a recent report.

Likewise, in the face of a negotiation with the International Monetary Fund looking for new debt to reinforce its plan, as the Government wants, the question of the exchange rate will be a central debate. In the IMF’s recipe book, the agreements come hand in hand with a devaluation: Washington wants the accumulation of net reserves to guarantee repayment and precisely the lack of foreign currency is the main macroeconomic Achilles heel of the Caputo scheme.

In relation to the “fundamentals”, LCG stated that the latest data show “one of two things” in the economic team’s scheme: September was another month with a fiscal surplus, but there was a jump in imports that compressed the balance. trade (which was also positive) even in a context of weakened economic activity. “The trend towards reducing the positive balance is clear, and to that we must add the balance for tourism, which becomes more deficient every month”said the consultant.

In fact, the tourist red is one of the pressure factors that gains ground as the dollar appreciates. Between January and August, it accumulated US$3,345 million, according to BCRA data, but half of that loss was concentrated in the last three months and it is assumed that it will continue to rise, despite the fact that the bulk of the credit card expenses were in abroad is paid with own dollars purchased in the MEP (cheaper than the tourist dollar).

Collante estimated that, for this level of TCRM, the service deficit could increase to $8 billion or $10 billion annually.. In that sense, the decision made by the economic team with the card dollar will also be key once the PAIS tax expires in December: will the application of a new perception on account of another tax be carried out to compensate it and prevent the price from falling? in nominal terms?

Yet, in the city optimism seems to prevail on the durability of the scheme during the coming months. This is attested, for example, to the placement of negotiable obligations in dollars by companies and the “carry” bets. “There is still no sign that this ‘carry trade’ will return, but we know that positions can be reversed quickly “If the news about the fundamentals or the advances in foreign financing lines do not turn out as anticipated,” he warned. LCG.

At this point, several factors appear to be considered: the political weakness or strength achieved by the Government, the campaign for the legislative elections, a possible pre-electoral dollarization, the climate impact on agrodollars in 2025 and the evolution of the currencies of the main trading partners. .

On the last point, two weeks before the presidential elections in USAfrom outside came a warning about an additional risk: the Trump factor. Robin Brooksa leading consultant on Wall Street, noted that, If the Republican candidate wins and imposes tougher tariffs as he promises, “that will put depreciation pressure on emerging markets.”making any type of parity with the dollar totally unsustainable.” And he gave some examples: Egypt, Pakistan, Ukraine, Türkiye and Argentina.

“The markets have not yet realized this, but We may be just weeks away from a major wave of devaluation in emerging markets”Brooks stated. If this scenario were to materialize, pressure on Milei and Caputo’s plan could be reinforced, beyond what it may imply for the negotiation with the IMF.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.