The risk rating agency Moody’s foresees a reprofiling scenario of the Argentine debt that is maintained with external creditors before or after the legislative elections, and anticipates that there will be no changes to the gradewhich remains at “Ca” after the 2020 default. What is the base scenario and what expectations do you have with the dollar.

At the annual conference Moody’s Inside LatAm Argentina 2024, Jaime Reusche, Vice President – Senior Credit Officer of Moody’s Ratings, Moody’s Ratings’ main analyst for the country, assured that Moody’s will maintain the country’s rating due to the tight situation of external finances.

“With the previous government we saw a situation of repayment or restructuring, with the current administration we see a reprofile,” Reusche remarked. In turn, the economist highlighted the fiscal adjustment carried out by the Ministry of Economy, headed by Luis Caputo, and admitted: “It’s stronger than we expected.”

moodys34.PNG

Reusche maintained that the Argentine government’s proposal to bondholders will be reprofiling to give greater oxygen to the accounts and “limit losses.” That is, what in financial jargon is called a “friendly reprofiling.”

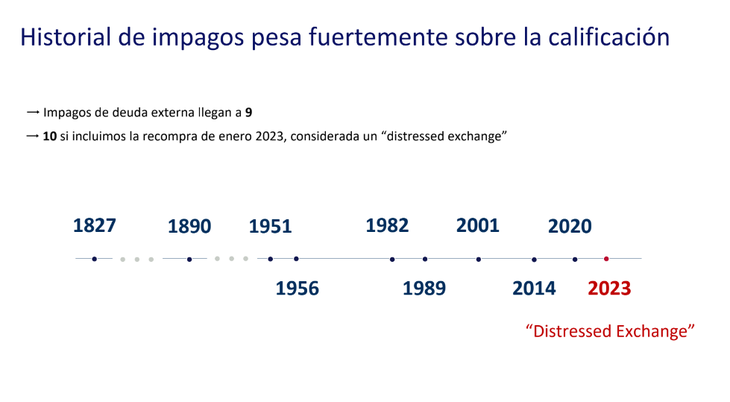

From the side of the bondholders, the analyst added that the ideological position of the Government and the fiscal efforts it has been making so far in the mandate and its credibility, improves the negotiation that must be carried out. “Although it is expected that the losses will be limited, for us it falls as a non-compliance event,” Reusche explained.

Another point to be noted by the specialist is that beyond the REPO confirmed on Tuesday by Caputo, the scenario of The tension of the external accounts will remain for the next three years and ruled out the significant entry of capital into the country, for the moment.

Reserves and dollar: the two variables that explain the “distressed exchange” scenario

Throughout this year, Argentina’s debt payments in foreign currency reach US$2,000 million for private bondholders. In 2025, maturities increase to $5 billion, a profile that remains complex, taking into account that the net reserves this year could remain negative, despite the Central Bank’s daily purchasing effort in the month of September and October, within the framework of money laundering.

In that sense, Reusche assured that it is most likely that reserves do not reach positive territory in 2024 and highlighted that the Government accumulated reserves especially in the first part of the year, but also liabilities in local currency through Bopreales. “That bought time,” he added.

As for the dollar, The economist warned that he sees a certain “delay” in the exchange rate but that it was not necessary so far to make a correction due to credibility and especially money laundering.

However, he avoided answering what dollar level is appropriate, although he stressed that at $987 (current value) subtracts “competitiveness to the economy” and impact on the services and manufacturing sector. Almost along the same lines as that of President Javier Milei regarding the goal of moving towards a floating exchange rate, I affirm that there would be a “exchange rate intervened by market forces, equilibrium would be found and there would be fewer distortions.

moodys.PNG

The limits of fiscal adjustment

Finally, when asked about the share capital maintained by the Government, Moody’s highlighted that the slowdown in inflation was a essential factor to sustain fiscal adjustment carried so far. “The slowdown in inflation is affecting the population with a reduction in food prices.”

“The great test will be the legislative elections. It can give the Government some breathing room,” he asserted. In this way, the Government is gaining time in the social area due to the credibility it generated with the fiscal adjustment and the drop in inflation.

In turn, faced with the possibility of a devaluation, he concluded: “The Government understands that any type of exchange rate adjustment is going to have an impact on inflation but feels the pressure to show results. But any time you make an exchange rate adjustment you are going to have a return in terms of inflation that is not going to be favorable and eventually from the structural point of view, it is going to have to occur in the short or medium term so as not to reduce the competitiveness of the economy”.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.