The financial markets They opted for a scenario of stability in the run-up to the elections 2024, with a dollar which moved somewhat calmly in recent weeks, after several days of volatility in mid-September.

At the same time, the country risk seems to be stabilizing after some shocks around the same time, perhaps a sign that investors are discounting that the plebiscite of social security will not prosper this Sunday.

Dollargraf.jpg

The dollar looks relatively stable two weeks ago

In the case of exchange rate, The dollar left behind the peak of a month ago, when it reached 42,254 pesos and reached a maximum in 30 months, in the heat of a climate where foreign investors got rid of their global bonds for more than 700 million dollars.

From that moment on, the US currency showed fluctuations that led it to oscillate close to returning to the range of 40 pesos, but finally in the last two weeks it stabilized around 41.5 pesos.

In fact, the current value of the greenback is similar to that predicted by the analysts consulted by the Central Bank of Uruguay (BCU) in its Economic Expectations Survey, with one dollar at 41.55 pesos by the end of the month and 41.70 by the end of the year.

Riskgog.jpg

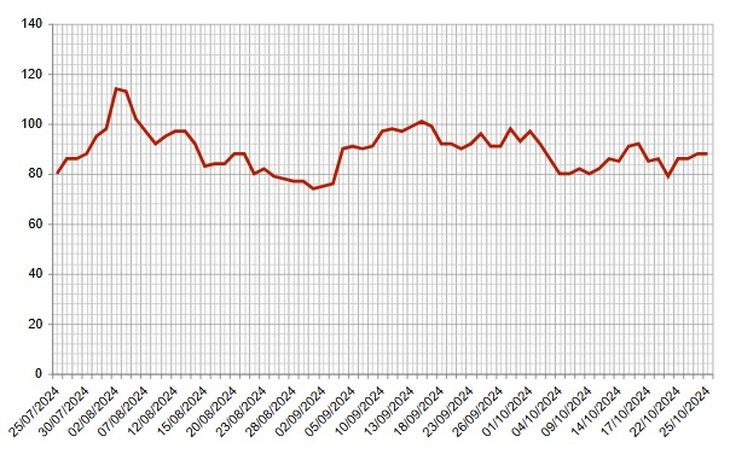

What happens with country risk?

Along the same lines, the country risk stabilized below 90 basis points, according to the Uruguay Risk Index (Irubevsa), which produces the Uruguayan Electronic Stock Exchange (Bevsa), falling 8.33% in the last 30 days.

The indicator, which measures the debt yield spread of Uruguay in dollars regarding the debt of USA (US Treasuries), stood at 88 basis points, rising from the 79 it reached on Monday.

Anyway, the Irubevsa It appears far from the 101 points that it reached in mid-September, at the height of the dollar’s rise, as well as from its maximum in recent months, which was 114 at the beginning of August.

In fact, the Uruguay Bond Index (UBI) of AFAP Republic It is located at a similar level, with 85 basis points, compared to the 92 it marked in September and the 102 at the beginning of August.

Finally, the Emerging Markets Bonds Index (EMBI), from JP Morgan, It stood at 0.87, far from the 1.06 at the beginning of August or the 0.99 it marked in the middle of last month.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.