With more than 30 years of experience in the Argentine financial system, the 55-year-old executive, will have the mission of promoting a new stage in the entity -8th largest among Argentina’s private equity banks in terms of loans-, focused on the growth and strengthening of the company, with the aim of becoming one of the main players in the banking ecosystem.

In this note, his vision of the Government’s economic plan, his projections on key variables of the macro and the financial sector, and what he intends for the entity of family origin, and with a great fintech imprint.

“Everything is going well and we are working very hard, supported by a country that has an important growth scenario for the coming years,” He said optimistically, to the point that, two weeks after taking office, he undertook his first trip to Neuquén to closely evaluate the bank’s operation in the province of Vaca Muerta. “I think there is a nice 2025 opportunity for the financial system,” projected the CEO of the entity that has been listed on Wall Street since May 2016.

Credit: the lines that were at the top, and those that are further behind

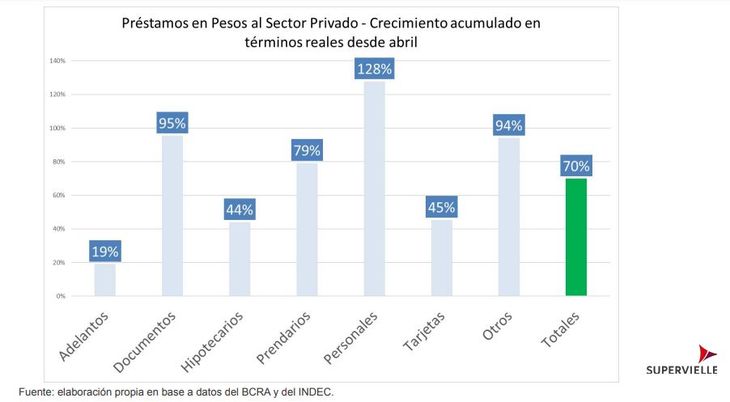

Manríquez praised the strong rebound in credits in real terms starting in May, and highlighted the lines with the highest rates of expansion in the financial system. “Those that grew the most are personal loans (+128% in real terms) and short-term working capital (+95%). Interest in long-term financing has not yet appeared, although it does “We see demand for loans in dollars,” Indian. In that sense, he stressed that the banks, through the dollars that came in through money laundering, “we have a good loanable capacity.” And he projected that, with current inflation levels, sooner or later, “long-term loans are going to appear.”

loans.jpg

“We see the recovery of the economy, through credits in the business segment, and in the Oil&Gas sectors, where we see a huge space, also mining, although it comes more slowly, and then everything that is working capital for SMEs. On the other hand, everything that is cards and consumption, they have to recover more,” he explained.

In relation to the mortgage loansthe executive expressed that the entity is “active”, although “Demand has gone down,” after the initial boom a few months ago, which sparked a large number of queries and requests. In any case, “we hope they will be reactivated, with low inflation. If it approaches 2%, I think it is a very good scenario for these loans. Not to mention, if the market discounts much lower inflation for 2025.” The entity has funding, and, if needed, does not rule out going into the capital market. “We analyze all liquidity and funding alternatives,” he admitted.

types of credits.jpg

Regarding the pesos, the system’s banks slowly began to divest the LEFIs (Liquidity Fiscal Letter, with a maximum term of one year, issued by the Treasury and which accrue daily the monetary policy rate, currently at 40 % annual), to obtain liquidity and lend to the financial sector, and Supervielle was no exception.

“We see this dynamic well, every day we measure liquidity, based on the growth of loans”said the executive. But, at the same time, the entities began to demand the lines of Active Passes of 45% from the Central Bank (BCRA). “They are a source of financing to avoid undoing a longer bond position. It is a good way to have short-term liquidity, and the BCRA encourages you to use it based on that”he said.

Interest rate: is a cut coming?

Although many market agents believe that, in the short term, a rate drop is coming (currently at 40% annually), given the slowdown in inflation in recent months, the extended exchange rate pax, and the rate cut of the Lecaps in the secondary market, The CEO of Supervielle ruled out a decision in that regard by the monetary authority.

“I don’t see her,” pointed out in response to a question from Scope, and he remembered when months ago, companies did not take long loans, waiting for a drop in rates. “Now we are in a scenario where the rate is stabilized”he emphasized.

Dollar: scenarios for exiting the stocks

According to projections by the Supervielle Research team, led by Walter Ramírez, the most likely scenario (around 60%) is that of continuity for the coming months of the “macroeconomic order” and the financial stability achieved, which that It could lead to the exit of the exchange rate, by “the end of the year” or “the first quarter of 2025.”

In this case, the Government should obtain “fresh dollars” for an amount close to US$15,000 million (multilateral organizations and REPOs with banks), thus avoiding a devaluation jump. In any case, they began to contemplate the possibility that The restrictions will not be lifted until after the 2025 legislative elections.

If the aforementioned foreign exchange income is not achieved, Ramírez foresees a possible exit from the stocks with a devaluation of 20%, although other key variables will also have to be closely monitored, such as the price of commodities, the political power of the Government, the magnitude of the economic recovery, and the sustainability of the spending adjustment, he commented.

The future of Supervielle’s financial business

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.