At the outset, it is worth remembering that the S&P 500 it boasts an average return of 10.7% in the year after an election since 1960, according to FactSet data. This is in line with the standard average performance of the Wall Street index over time. Therefore, it is one of the many signs that indicate that, although The elections may generate some turbulence in the markets in the coming daysparticularly if there is no clear winner, rarely stop the long-term trend.

And, although the crypto ecosystem began as a separate area, almost parallel to the traditional market, which initially attracted a niche of investors interested exclusively in digital assets, today, there is a clear interconnection, since Crypto topics are increasingly linked to the stock market with the arrival of ETFswhich facilitated this correlation, as it allows institutional investors to participate in the crypto industry.

Thus, today, an average investor has a portfolio that includes bonds, stocks and cryptocurrencies. This change in profile means that decisions in one market can influence the other; for example, a feeling of euphoria or a decline in the traditional market May Affect Investors’ Appetite for Crypto. This, in addition to the fact that platforms are increasingly emerging that offer both traditional market assets and virtual assets, further consolidates this connection.

Bitcoin, the S&P 500 and election cycles

In essence, one of the market readings is that the elections are no different from other risks for investorssuch as tensions in the Middle East, natural disasters or the mass disarmament of positions. The key question here is what a potential risk could mean for companies’ future earnings.

Regarding this matter, it is worth remembering that Bitcoin increased sharply in price in previous electoral cycles, with 42% the month following the 2020 elections and an increase of 336% six months later. Similarly, BTC saw gains following the 2016 and 2012 elections, driven by institutional adoption and growing global recognition of its value.

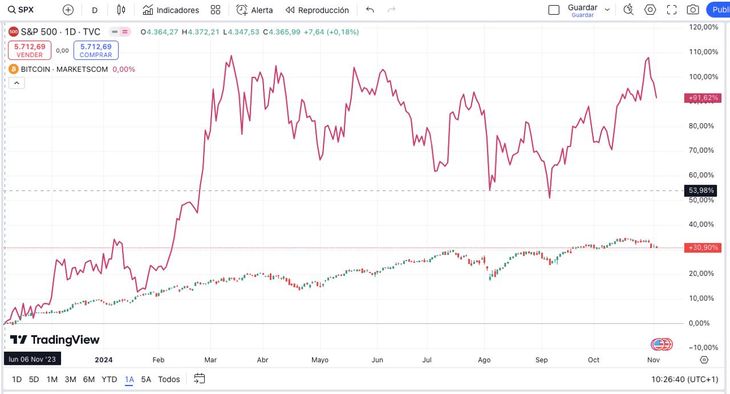

A report of GoodBit exposes that the Bitcoin and the S&P 500 They maintain a strong correlation over the years, especially during the bullish cycles of the largest cryptocurrency by market capitalization and periods of higher risk sentiment in traditional markets. “This phenomenon could come to an end as Bitcoin matures and ‘decouples’ from stocks and its narrative as a speculative asset. However, there is still no evidence that this is the case,” the document explains.

For Pablo MontiBrand Manager Europe and Latam for BingXthe relationship between the value of Bitcoin and the stock markets arose from the Covid-19 pandemic, as it indicates that before there was practically no correlation between the two. “After that fateful start to 2020, a correlation began between the value of Bitcoin and the stock markets, which is accentuated when there are bullish or bearish currents, since one increasingly affects the other,” he explains.

Monti assures that this makes clear the place that cryptocurrencies have for the world on a financial level, since today it plays a role in influencing the price of other assets.

For its part, Ramiro Rodriguez of Fiwind analyzes that the correlation between Bitcoin and the US stock market has fluctuated in recent years, with periods of high correlation and others in which Bitcoin broke away and had rallies independent of the behavior of the stock market.

“These variations are due to macroeconomic factors, relevant news and changes in market sentiment. In the last six months we observed a trend towards a greater correlation between Bitcoin and the S&P 500,” says the analyst.

Post-election performance

The S&P 500 shows a trend “typical positive” after the US presidential elections. This pattern has been consistent over the last few decades, with the stock market marking significant gains in the year following the electoral contest.

- 2012 election: In November 2012, the S&P 500 saw 11% year-over-year growth. A year later, this growth skyrocketed to around 32%, reflecting a strong post-election market rally.

- 2016 Election: In November 2016, the S&P 500 was up about 7% year over year. A year later, it had risen approximately 22% and again showed significant post-election momentum.

- 2020 Election: the pattern continued in 2020. S&P 500 growth was around 17%-18% in November 2020; by the following year, it had risen to almost 29%.

This is not just limited to the previous three elections, when Bitcoin already existed. To obtain a larger data set, e.g. the last four decades, or ten elections, the S&P 500 “only had negative returns one year, twelve months after election day, and it was in 2000, when the dotcom bubble burst.

How will Bitcoin react this time?

Thus, as he explains to this medium Fran Vázquez Noceti, from Rootstockit is difficult to predict what will happen to the price of Bitcoin, since experience shows that any hypothesis formulated with the previous day’s information can turn out to be wrong, even if it seems obvious or logical.

For Vázquez Noceti, the first impression could be that, in the hypothetical case that Trump wins, this should be good news for the markets and for those who speculate. However, the reality is that we do not know how they will react and we will only see it the day after the elections.

What he does claim to be clear about is that, regardless of the impact on the short-term price, “the long trend is upward. This is what leads many people to get involved in events like this and build strategies,” he slides. .

And it is interesting to analyze that each electoral event resulted in increasing returns of approximately 50% each time, so perhaps $125,000 for Bitcoin is a realistic goal by November 2025. It is also worth noting that in all of those cycles, Bitcoin Posted Even Bigger Cycle Peak Gains.

Bitcoin vs SP500.jpeg

On the other hand, Bitcoin ETFs Play Key Role in Recent Rally. In the last week, these ETFs saw record capital flows, driving the price of Bitcoin to near its all-time high. If this performance continues, there is a significant chance that Bitcoin will reach a new All Time High (ATH) above $74,000 in the coming weeks.

The data suggests that the period after a US presidential election It is usually bullish for both the stock market and Bitcoinso investors could have reason to be optimistic for the coming months.

However, since GoodBit They remember that, although the great demand seen in the market is a good omen, “we cannot rule out short-term corrections that, in our view, represent buying opportunities for investors” in the long run.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.