The refining sector closed September 2024 with a mixed outlook, characterized by slight monthly contractions and significant year-on-year contrasts.

According to the report prepared by the consulting firm Economy and Energy (EyE) of Nicolas Arceocrude oil processing stood at 516.2 thousand barrels per daya decrease in 0.8% compared to August, but with an increase of 5.1% compared to the same month in 2022.

Among the producing basins, the Neuquina was consolidated as the main source, processing 323.8 thousand barrels per daywhich represented an interannual growth of 16.1%although with a monthly drop in 5%.

image.png

In contrast, the San Jorge Gulf basin showed an interannual decrease in 7.7%although it rose a 8.9% compared to August. Other regions showed a general decline, with an annual decrease in 21.7%.

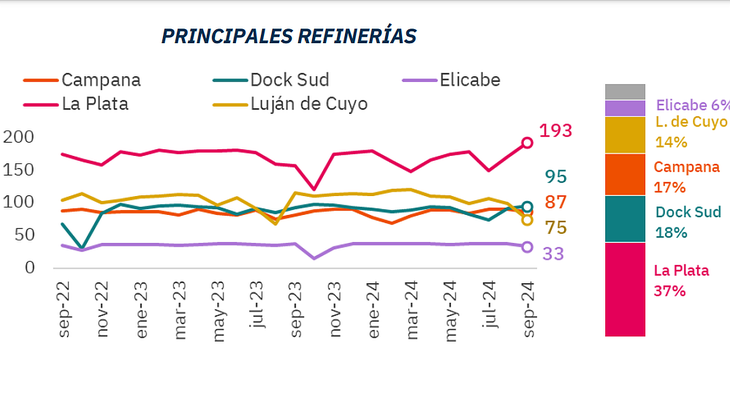

Production in refineries and companies

The production of gasoline and diesel reached 1,844 thousand cubic meterswith a monthly contraction of 4.6%although it rose a 3.6% in interannual terms.

By company, YPF maintained its leadership with 1,087 thousand cubic metersdespite registering falls in 3.6% monthly and 4.8% year-on-year. Shell and Axion exhibited mixed behavior: Shell reduced its production by 7% compared to August, but it grew a notable 24.1% year-on-year, while Axion recorded a rise of 4.7% compared to 2023.

image.png

At the refinery level, La Plata and Campana stood out with year-on-year increases in 6.4% and 4.7%respectively. However, other plants such as Luján de Cuyo and Dock Sud faced falls in 19.5% and 7% in annual terms.

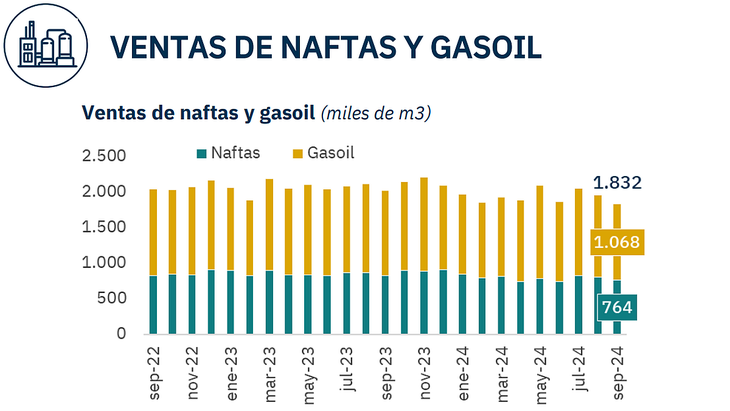

Fuel sales: general decline

Domestic fuel consumption in September showed a significant decline. Gasoline sales were located at 764 thousand cubic metersa 5.2% less than in August and a 6.9% below the September 2023 level.

YPF dominated the market with 427.7 thousand cubic metersbut reported a drop in 4.8% year-on-year. Shell and Axion, meanwhile, faced steeper declines, with declines in 10.7% and 6.9%respectively.

image.png

Diesel oil registered a similar trend, with sales of 1,068.1 thousand cubic metersmarking falls of 7.6% monthly and 11.5% year-on-year. Puma was the only exception to the rise, with a growth of 7.1% compared to September 2023.

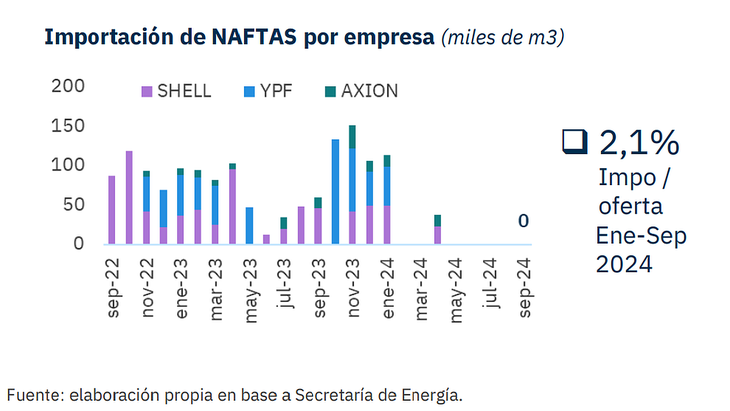

Fuel imports and prices

The internal supply of gasoline and diesel depended minimally on imports, which represented a 2.1% and a 6.2% of the total supply during the first nine months of the year.

image.png

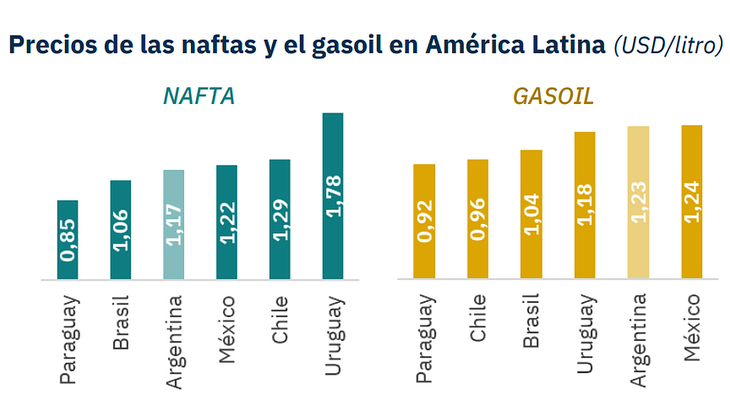

Regarding prices, the values in pesos showed constant variability, while in dollars, the cost of local fuels was at competitive levels within the Latin American context.

According to Arceo’s report that reached Energy Reportthe price of gasoline per liter ($1,164) rose 281% year-on-year until last September, while diesel increased 255% to reach $1,244.

However, if the same calculation is made at constant prices, the variation for gasoline was 23%, while diesel increased 15% in one year.

In the comparison in dollars, Argentina has an average price compared to other countries in the region. In this case, gasoline rose 38% and diesel rose 29%.

image.png

In conclusion, the refining sector faced a challenging scenario in September 2024, with drops in sales and monthly production, but with a significant rebound in oil processing compared to the previous year.

Although refineries and leading companies maintain a key role, year-on-year variations and pressure from domestic demand raise questions about market stability in the short term.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.