The Argentine economy went through the first half of July with a level of country risk of 1,500 and an average financial dollar level (CCL) of $1,430. The first half of November, that is, only four months later, is closing with a country risk of 769 points and a financial dollar of $1,140. That is to say that the country risk It fell by almost half and the financial dollar fell 20%.

It is important to understand what changed from July to today to identify which factors can be sustained or improved to consolidate the scenario and which are those that may imply some type of risk. In the last four months, the financial markets have shown a significant change in climate towards Argentine assets. The improvement has been noticeable. This is reflected in the fall in the exchange gap, the accumulation of BCRA reserves and the decrease in country risk. These are all indicators that show a much more favorable climate. The question is to identify the factors that generated this change in climate.

megaqm1.jpg

The level of country risk is a consequence of the risk assessment made by investors. If they assume that they have a risk of bad debt, the value of local assets falls and country risk rises.

The risk of bad debts depends fundamentally on 3 factors that we detail below:

Willingness to Pay

The first point involves the real interest and effort that a debtor is willing to make to comply with his obligations. In the case of Argentina, this was evidenced in the presidential vetoes of the two bills that Congress approved and that implied a fiscal cost (retirements and universities). They were two clear cases in which it was demonstrated that the Executive Branch was willing to assume high political costs in order to maintain fiscal balance. This is one of the aspects that improved in relation to the information available as of July 2024.

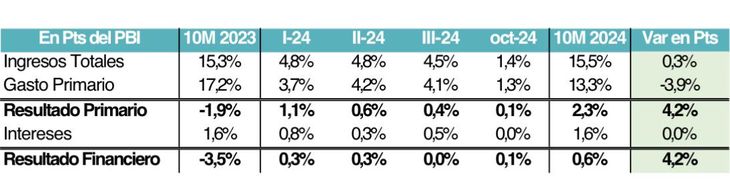

Payment Capacity

In addition to wanting to pay, it is necessary to demonstrate that “There is something to pay with.” That data is the fiscal surplus. That is to say: demonstrate that the positive results necessary to meet obligations can be generated. Last Friday it was announced that in October a financial surplus of $523,398 million. This way, They have gone 10 months with an accumulated financial surplus of 0.6% of GDP. In the same period of 2023, a deficit of 3.5% of GDP had been recorded. If we limit the analysis to the primary result, to avoid the distortion of accrual versus capitalization of interest, the data is also compelling. It went from a deficit of 1.9% of GDP to a surplus of 2.3%. A total adjustment of more than 4 points of GDP. Almost 95% of the adjustment is explained by lower expenses. These figures show that, beyond the elimination of the PAIS Tax, fiscal solvency is still present.

megaqm 2.jpg

Access to dollars

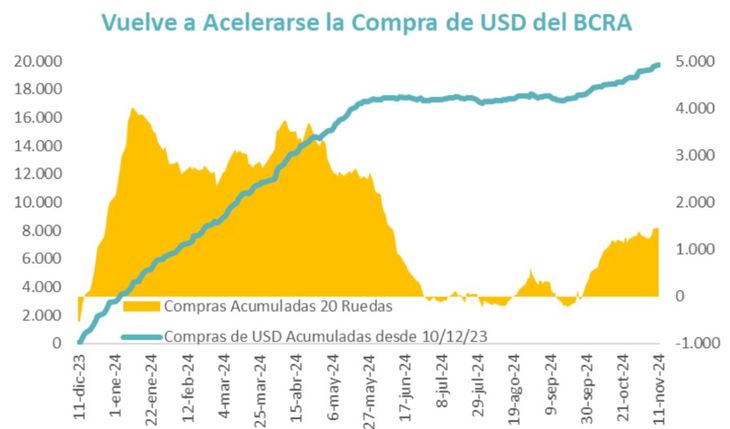

The third point involves understanding whether, beyond the willingness and ability to pay, the Treasury would be able to have access to the foreign currency necessary to meet maturities in foreign currency. The question was whether they had enough dollars.

After a window of almost three months of very few purchases, Between July and September, the BCRA managed to accumulate foreign currency again. This became a central factor to improve investor expectations, because the stock of international reserves began to recover.

megaqm 3.jpg

Bonds in dollars: changes in the yield curve

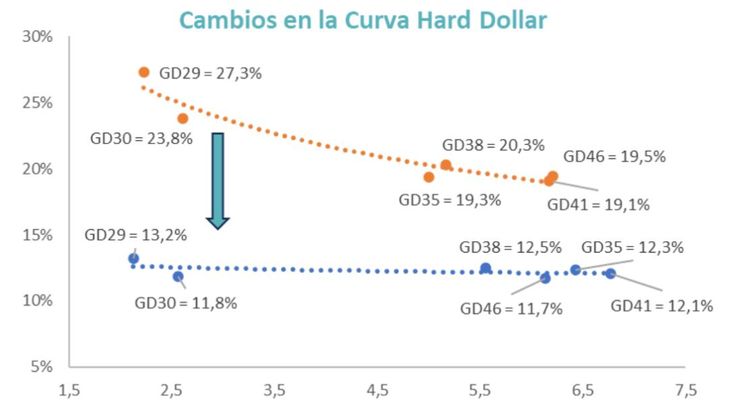

In the previous section we made it clear that there were very relevant changes in the three central fundamentals that make up the valuation by investors of Argentine assets. We are clear that the price of an asset arises from the combination of the aforementioned fundamentals, but that The valuation itself and the “sentiment” or market climate also have an impact. In terms of valuation, what was observed was a readjustment of the hard dollar curve to adapt to what comparable economies pay. Always taking into account that Argentine securities still have credit rating levels that for now leave them out of the portfolios of the main institutional investors globally.

In any case, the first relevant change is that the yield curve was flattening, which went from a strong negative slope, which was explained by the risk of non-payment in the first maturities to a current scheme much flatter and on a lower step. Current yields are already in line with those paid by other emerging economies, although possibly the local fundamentals are being better (surplus) than those of those comparable countries.

megaqm 4.jpg

The other factor that plays is the market climate (“sentiment”), where all the positive signals in recent weeks have maximized investors’ appetite to be positioned in Argentine assets and not to miss the last part of the positive rally they have had. This adds new investors, who despite the fact that a good part of the change in fundamentals and valuations were already visible several weeks ago, are only now encouraged to enter with the positive rally and the favorable market climate.

Conclusions

The main foundation, which is the fiscal balance, has been present for several months, but only in recent weeks has there been a substantial change, which is the feeling that The 3 necessary factors are aligned: willingness to pay, ability to pay and access to foreign currency. Especially this last point was the one that generated the greatest uncertainty.

The market consensus was that, without the elimination of exchange controls, it would be very difficult for the Argentine economy to accumulate foreign currency to meet the payment of its obligations. This It changed with money laundering and with the increase in bank credit in dollars, plus corporate debt issues also in foreign currency.

These factors meant that an economy that It was already less liquid in pesos, now it finds itself with a much higher level of liquidity in dollars. This can generate a virtuous circle that helps the BCRA improve its net reserve position. In short, The foreign currency position of the local economy was improved despite exchange controls still being in force.

Chief Economist at MegaQM

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.