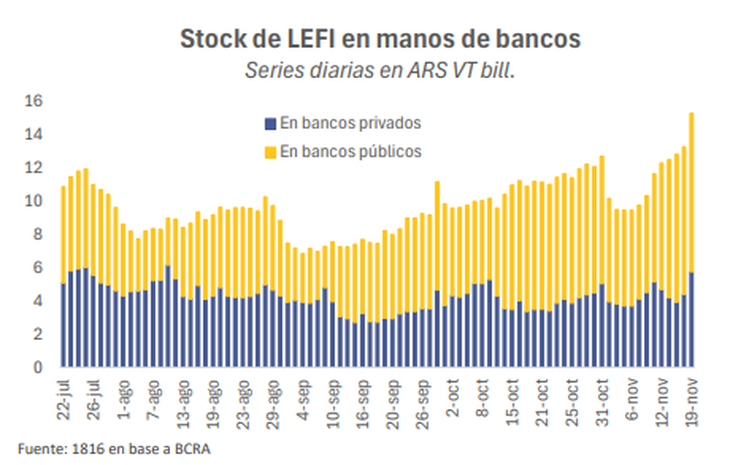

This Wednesday, the amount of Liquidity Tax Letters held by financial entities rose to $15.35 billion. The reasons and possible impacts.

On the last wheels, Financial entities went out to buy a significant amount of Liquidity Fiscal Letters (LEFI) from the Central Bank.. So, this Wednesday, the stock in the banks’ portfolio of this monetary regulation instrument, issued by the Treasury, reached its maximum level since the economic team put it into operation: $15.35 billion.

The content you want to access is exclusive to subscribers.

The day before, banks bought more than $2 billion in LEFI from the BCRA and the total portfolio amounted to $15.27 trillion, according to data published by the monetary authority itself. This jump, in practice, meant an intensification of what happened during the previous seven rounds. Between November 5 (when the stock held by banks had dropped to $9.4 trillion) and last Tuesday, entities acquired $5.8 trillion, which implied a rapid increase in their holdings of 61.9%. On Wednesday, they added another $77,393 million to reach the current amount.

The LEFI are the instrument that the Government launched on July 22 to replace the Central Bank’s passive repos and complete the migration of paid debt from the BCRA to the Treasury. These are letters issued by the Economy, but that are administered by the entity that presides Santiago Bausili.

In total, $20 billion was issued that, at the time, the Treasury exchanged to the BCRA in exchange for other public securities. Starting at the end of July, when the Central Bank suspended the placement of overnight repos, it began to manage the liquidity of the financial system on a daily basis through LEFI purchase and sale operations with banks. Basically, the bills work in a similar way to passive repos (they have daily liquidity and accrue the monetary policy rate), but the cost of interest must be covered by the Treasury through fiscal adjustment. It was the way that the economic team found to close the endogenous emission tap that represented the payment of interest by the BCRA.

image.png

Since its launch, the stock of LEFI held by banks shows significant fluctuations. But it had never reached the current level. They debuted with $10.85 billion. From that moment, there was a see-saw that responded to the management of the financial entities’ own liquidity, to the demand for credit from their clients and to tactical movements between public securities listed on the market and the Fiscal Letters administered by the Central. The lowest level was reached on September 4 ($6.8 trillion) and the peak is the current $15.3 trillion. When the stock grows it implies a monetary contraction and when it decreases it results in an expansion of the base.

Why did the banks go out and buy LEFI?

“What is happening is that The latest Treasury tenders were expansive and there the LEFI stock already rose by around $1.5 billion (on November 11). AND Then there are the BCRA dollar purchases (which involve an issuance of pesos), which have a large MEP component, that is, they are financing, and those are pesos that are directly deposited in the banks. The entities have to place them on something and at least The first stop is at the LEFI. Those are the two reasons for the growth,” he told Area Gabriel Caamaño Gómezeconomist at the consulting firm Outlier.

In the city, Some sources indicated that it could also respond to the narrowing of the yield differential between the LEFI and the Lecapwhich usually favors the latter. The fact is that, after the last reduction in the monetary policy rate (the one that remunerates the LEFI) to 35% nominal annual rate carried out by the BCRA, the yield curve of the Treasury’s fixed-rate securities compressed strongly to a range of 43% in the shortest part and 34% in the longest. “Will the market drag the Central Bank into another rate cut?”an operator asked in conversation with this medium.

Banks, LEFI and the next debt tender in pesos

However, in the market they are already looking at the next debt tender in pesos of the Ministry of Finance, which will take place next week. Some analysts and investors point out that the high stock of LEFI held by banks could mean that the same thing as in the last two auctions will not happen this time.

On those occasions, financial entities that needed liquidity (for example, to supply their clients’ credit demand or to migrate pesos to LEFI) let part of their holdings in Lecap expire without renewing them and the Treasury (which had decided not to offer fixed rate securities; only inflation-indexed bonds) achieved a roll over of less than 100%. This time, as the banks have a greater amount of Fiscal Bills, from which they can extract the liquidity they need, will the bidding have a different dynamic?

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.