The indirect tax burden on the consumption of super gasoline In Argentina it continues to be a key component of the final price paid by consumers, although it has shown significant variations in recent years. A recent IARAF report reveals that, by November 2024, The weight of taxes on super gasoline reaches 55% in the Autonomous City of Buenos Aires (CABA) and 56% in the interior of the countryfigures that, although high, are lower than those recorded in 2018.

Decrease in the tax burden since 2018

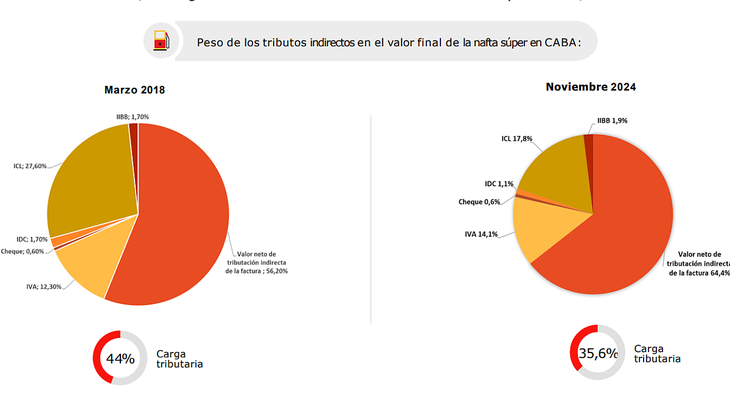

In CABA, the tax burden on the net value of gasoline was 78% in 2018, while in November 2024 it stands at 55.2%, which implies a drop of 29%. Similarly, in the interior of the country it went from 69% in 2018 to 56% currently, representing a decrease of 19%. These reductions mainly reflect changes in national taxes, especially fixed taxes such as the Capital Tax. Liquid Fuels (ICL) and the Carbon Dioxide Tax (IDC).

image.png

During 2023, the indirect tax burden decreased due to the freezing of the nominal value of fixed taxes in a context of growing inflation. However, in 2024, with the update of these values, taxes recovered part of the lost ground. In April 2024, the government implemented an increase in the nominal amount of the fixed tax, placing it at $203.7 per liter, which represents a 47% drop in real terms compared to March 2018.

In the comparative analysis between CABA and the interior of the country, important differences emerge. Consumers in the interior must face a greater tax burden, since, in addition to national and provincial taxes, they face the so-called “Road Tax” or “Tax for maintenance of the road network”, which represents an additional 2% on the net sales price in many locations.

Fuels: evolution of taxes in CABA

In the City of Buenos Aires, the indirect tax burden on the final price of gasoline fell from 44% in 2018 to 35.6% in November 2024. Within the tax structure, the ICL went from representing 63% of the tax burden in 2018 to 50% in 2024, while VAT and other taxes such as the tax on bank debits and credits maintained shares stable.

image.png

In the interior, the fiscal impact on the final price also reduced, going from 41% in 2018 to 36% in 2024. However, a slight increase is observed in the incidence of municipal taxes due to the implementation of the Road Tax in some districts.

The ICL continues to be the tax with the greatest weight in the tax burden, although its participation has decreased in all regions. In CABA, it represented 49% of the tax burden in 2018, while in 2024 it is 27.5%. Inside, it went from 39% to 25.5% in the same period.

The indirect tax burden continues to be a determining factor in the price of fuel in Argentina. Although it has reduced in relative terms since 2018, the fiscal impact remains high compared to other countries in the region.

According to the IARAF, this panorama reflects the importance of fiscal policies in shaping fuel prices and their impact on consumers. Future decisions on updating taxes and incorporating new taxes will determine how the tax burden will evolve in the coming years.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.