The industry of Common Investment Funds (FCIs) played a fundamental role in recent months and is consolidating itself, not only as a key vehicle for the regularization of assets, but also as one of the main destinations of the externalized capital through money laundering. In this scenario, brokerage houses facilitated the incorporation of new funds into the market, as a way of channeling the flow towards these instruments, among which the “money markets” in dollars stand out.

Furthermore, experts agree that investors sought, at that time, options that guarantee a secure fixed incomeadapted to the profile of each client and their objectives. In this scenario, FCIs were consolidated as versatile vehicles to optimize wealth management, combining flexibility, security and efficiency in a complex economic environment.

From the industry, they point out that The FCIs remain solid and present clear signs of the “post-money laundering” economy. And, on the one hand, the appetite for funds in pesos remains firm, with the focus on the “Cash Management” segment, that is, liquidity management. They also indicate that Money laundering gave a lot of dynamism to the dollar segment within those instruments. With the “money markets” in hard currency and without volatility, but with an injection of considerable volume. A clear example is the MegaQM Dollar Liquidity, which already manages about US$150 million and was launched in June.

FCIs: investor trends

Rodrigo Benitezchief economist of MegaQM, indicates in dialogue with Scope that, given such a traded volume, they identified some other market needs, such as instruments “a little longer, with low volatility and that offer a higher return.” Thus, a new player in the dollar industry was launched: the FCI de Renta Global, which invests in assets that operate in greenback in the local market with a “duration” that seeks to be below one year, so that the product has low volatility.

According to Benítez, this fund is made up of some Negotiable Obligations short-term local ONs or with a low residual period, fixed terms in dollars and Bopreales. This ensures the FCI a floor of performance and high liquidity and is already operational in more than 90 Settlement and Clearing Agents (Alycs).

Favorites: Lecaps funds

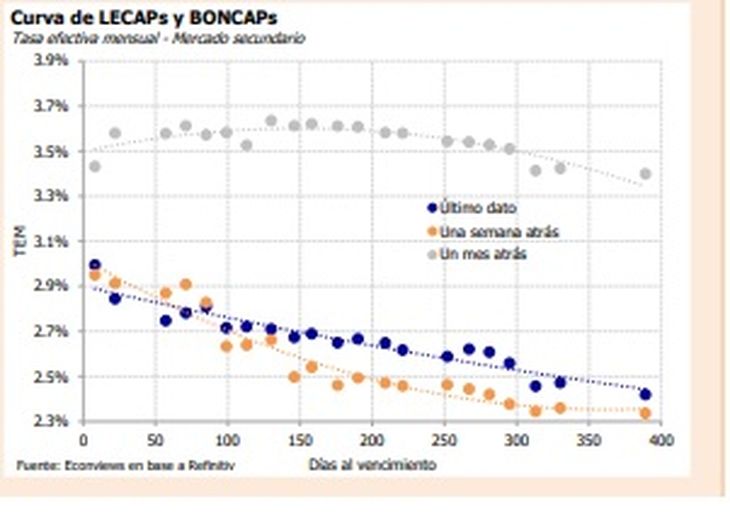

Benítez analyzes that facing the end of the year the opportunities offered by the market They come from the side of Lecaps fundswhich allow investing in fixed rate assets and taking advantage of the trend of decreasing inflationary expectations. “This has given very good results in recent weeks, because the lowering of rates by the Central Bank (BCRA), which was extended to the rest of the market, generated a strong compression (and gain) in these assets,” he says.

For its part, Matias Rossiportfolio manager Investing in the Stock Market – IEB Fundscomments in dialogue with this medium and in line with Benítez, that, in the last week, the flow of subscriptions was maintained in the Lecaps T+0 funds (immediate rescue) and also in the T+1 funds (24 hours). fixed rate.

According to the strategist, this is because, although fixed rate instruments extended the correction (Lecaps and, above all, Boncaps, which are longer), the exchange rate remains stable and with no movement. “It even cut 2% last week,” he says.

Econviews curve Lecaps.jpg

This resulted in investors’ favorite instruments be those with a fixed rate, even above the CERsince, although high-frequency inflation data anticipate a rebound so far in November (which pushed the correction in Lecaps rates), and Boncaps, The market remains optimistic with the Government’s plan and trusts in the control of inflation going forward.

And, as Rossi analyzes well, this Wednesday there is a tender from the Ministry of Economy and within the basket it offered CER and a fixed rate. There, the strategist highlights the Boncap as of February 2026, where he believes the eyes of the different market agents will be focused, an instrument in which the cut-off rate will be “key for the subsequent correction of the rest of the curve.”

By way of conclusion, Rossi slides that he projects a stable December in terms of the financial exchange ratewhich still gives rise to “carry trade” in pesos. This, despite the fact that the “spreads” are increasingly smaller and it seems that the rates are becoming less and less attractive.

FCIs: the strategy

Benítez then recommends the Balanced Quinquelawhich is a fund that invests in the shortest section of the Lecaps curve and seeks rate accrual with low volatility. It ensures that by paying ransoms on the day, it is optimal for short-term liquidity. And, for investors who have the pesos for a longer horizon, it offers the MegaQM Ahorro, which is a traditional T+1 fund, that is, it invests at a fixed rate and settles within 24 hours. In that case, what is sought is to stay longer and capture an eventual new drop in the interest rate.

Meanwhile, since Adcap Financial Groupa diversified strategy adapted to current market conditions is proposed, focusing on the following funds:

- FCI Adcap Coverage: A strategy oriented to the medium and long term is implemented, with the expectation of a normalization of the yield curve and nominality. This approach seeks to take advantage of opportunities that will arise as markets adjust their parameters following recent extraordinary conditions.

- FCI Adcap Lecaps (Balanced XVI): In this fund, the strategy focuses on the short end of the curve, motivated by the high levels reflected by high-frequency inflation indicators. This positioning is designed to capture returns adjusted to the inflationary situation, maintaining a conservative and efficient profile.

- FCI Adcap Shares: The performance of the stock fund has been remarkable, with a monthly return (MTM) of 19.5%, thanks to strategic positions in sectors such as energy and public services (utilities). These sectors showed outstanding performance and are still a solid bet within the portfolio.

Thus, with a December projected as stable in terms of exchange rate and with rates that still generate attractive opportunities, FCIs remain a solid instrument to optimize portfolios, by capturing the best of trends such as the “carry trade” in pesos and fixed rate instruments.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.