In November, and after maintaining the monetary policy rate at 40% for 118 daysthe monetary authority decided to cut it and set it at 35%. And, as the consulting firm points out Analyticsthis measure must be framed in the deceleration of inflation. So, with a projection of 2.7% for November, The monthly real interest rate would be 0.2%, lower than the 0.6% in Octoberwhen, for the first time in a year, I became positive.

The axes of credit recovery

The weekly monitor Quantum Financethe consulting firm that runs Daniel Marxanalyzes the impact of Argentina’s recent monetary policy after eliminating the BCRA’s remunerated liabilities. With a broad monetary base (BMA) ceiling of $48 billion and the neutralization of monetary expansions through net purchases of foreign currency, the Government closed the main emission sources.

Between July and November 2024, the monetary base (BM) grew by $3.6 trillion, 17.4% nominal (2.7% real), while the expanded base (BMA) barely rose 2% nominal and fell 9 % real. This is mainly attributed to net foreign currency purchases ($2.73 trillion) and operations by the Treasury, which used deposits to pay debt and reinforce bank liquidity.

This context favored the banks, that allocated more resources to LEFIs, public securities and credit to the private sector. Thus, there was a monthly boost of 9.1% in loans to the private sector and 6.1% in deposits in pesos. The convergence between BM and BMA, along with lower demand for interest ratesstrengthens credit in an environment of monetary stability.

Credit, under the magnifying glass of experts

The report of Analytics, dated November 21, indicates that there are three direct consequences of the rate reduction:

- Moderates the profitability of the “carry trade” by shortening the distance with the preset crawl of the exchange rate and the exchange expectations reflected in the future dollar.

- Allows take the nominal value one step lower by reducing the capitalization rate of Liquidity Fiscal Letters (LEFIs)which the BCRA is obliged to buy at technical values and

- Make credit cheaperby further boosting its recovery.

According to that study, In November, credit extended the recovery and grew 19.7% year-on-year in real terms (with information until 11/14). Meanwhile, in October, it was 14.2% above the level of a year ago and marked its monthly variation of 6.3% in real terms without seasonality. “The growth occurred in all lines, except for advances, which had a slight drop of 0.8% monthly,” he assures.

Credit in EcoGo pesos.jpeg

However, it stands out that the most relevant is the one with credit cardswhich represent 27% of the total and, in the month, increased 5.8% in real terms without seasonality. On the other hand, the 16.9% growth in the mortgage loans and in the pledgeswhich rose 7.2%, in line with the 6.3% increase in car registrations in October.

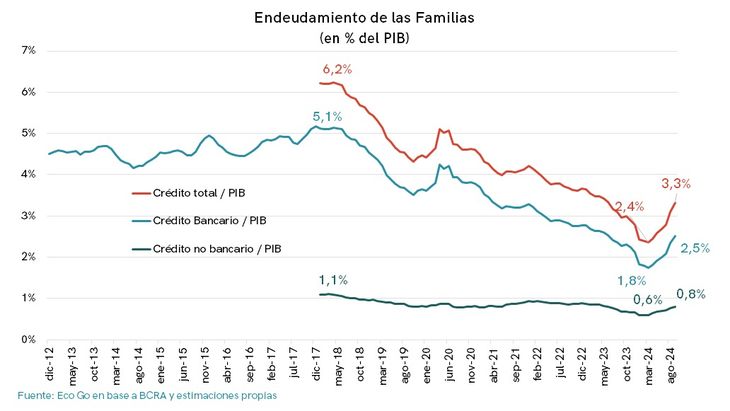

Sebastian Menescaldidirector of EcoGo, indicates in dialogue with Scope that, as of today, total credit in pesos registers a real increase of 24% compared to November 2023 and 84% compared to the minimum values of last April.

Credit to companies: the one that grew the most

The economist explains that The largest year-on-year increase is concentrated in loans to companies, that grew 32.6% year-on-year (yoy) and “were the first to react.” Then, there are consumer loans with 19% yoy, while those with guarantee register an increase of 7.4% yoy

And, although he recognizes that the loans to the private sector show a slowdown in recent days“real growth is very significant and is around 5/6% monthly”, which, annualized, translates into “flying”. A report of Econviews agrees with this view and points out that credit in pesos to the private sector is still growing, “but at a slower pace than in recent months.”

The consultant’s report Miguel Ángel Kiguel indicates that the impulse comes from the consumer credit side, where bank installments and promotions spring up “everywhere”. Commercial lending is a little more stagnant, but expect the latest rate drop to have an impact in the coming weeks. “The good news is that mortgage credit is growing at a very good pace, of 15% real per month, although from a very low floor”.

For Menescaldi, credit is going to be one of the drivers of the level of activity. “Greater predictability allows greater leverage for companies and familieswhich are, in general, with low levels of debt,” he points out.

For its part, Claudio Caprarulodirector of Analyticscomments in dialogue with this medium that there is still room for credit to continue rising. For the economist, this generates a virtuous circle which allows the consumption of durable goods to be stimulated, as observed in the patenting of cars, and in turn for the banks to reduce their position in Liquidity Bills (LEFIs).

The evolution of credit and “the time bomb”

Alan DaitchCEO and founder of Rate Ratepoints out in statements to this medium that Argentina is on the verge of a historic “boom” of credits in pesos. “Inflation is giving way and banks are in a frantic race to offer low rates and conditions never seen in recent decades,” he says.

For the expert, this can set up a financial revolution that can change the lives of tens of thousands of families, by allowing them to “fulfill the dream of owning your own home“. And he anticipates that, if economic stability accompanies, “it is not unreasonable to think about surpassing records of the last 25 years.”

However, he warns of a risk, “behind this optimism.” And it is that, in a country with a history of economic shocks“it is key that those who take these credits do it with information and responsibility“. Perhaps, in mention of those affected by UVA credits.

The economist Federico Glustein explains that there are three aspects to take into account for the evolution of credit and the impact on economic recovery. On the one hand, loans derived from families and agents who, “in the face of the fall in income, go into heavy debt for consumption, which represents a danger to their sustainability and is key to recovery in 2025,” he says.

EcoGo Debt.jpeg

Another aspect is that linked to mortgage credit, which Glustein confirms is at high levels as when there was UVA credit six or seven years ago and is important for the middle and upper class to move frozen funds.

And productive credit, which is necessary to “definitely get out of the recession and grow,” he maintains. For the economist, in these last two types of credit “is the key to reactivation, since they grow or above inflation”, a trend that will continue along that path in 2025.

However, there is a problem regarding family credit: Glustein warns that debt for short-term consumption “is a time bomb, since it would have to migrate to durable goods and not for immediate consumption.” To this end, he considers that “The purchasing power of the entire working segment must be recovered.” If that does not happen, “it could enter a spiral that will cause a further drop in consumption,” he warns.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.