According to a BCRA report, transfers and use of the QR continue to reflect strong growth compared to last year. Meanwhile, debit beats the use of credit.

In October, the immediate transfers “push” type showed a notable year-on-year growth of 65.4% in the number of operations. 591 million transactions were carried out, totaling 52.4 billion pesos, reflecting increases of 65.4% in volume and 22.5% in amounts. Of these operations, the 68.8% involved accounts with CVU as origin and/or destination.

The content you want to access is exclusive to subscribers.

Besides, Money receipts through immediate transfers totaled 40.9 million operations, for a total of 2.2 trillion pesos, which represents an increase of 6.7% in quantity and 10.2% in amounts compared to September. This is stated in the Retail Payments report published by the Central Bank, which highlights the growing adoption of digital tools in economic transactions.

meansofpayment.png

Growth of digital wallets

With 65 digital wallets registered with the Central Bank, the interoperable QR reached 52.3 million operations: a increase of 144.2% compared to the same month of the previous yearwith an expense of 715.1 billion pesos, which represented an increase of 103.5% year-on-year. In October, 69.2% were made by clients who used their demand accounts and 30.8% with their payment accounts. Likewise, 49.8% of businesses credited demand accounts and 50.2% credited payment accounts.

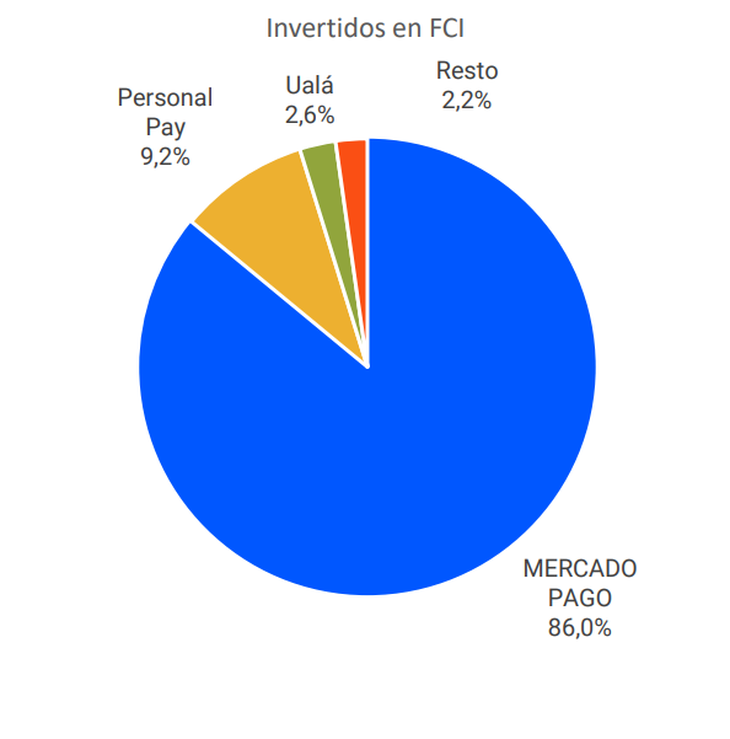

Payment accounts and funds invested through the PSPCP

In September, out of a total of 51.5 million accounts, 14.5 million payment accounts with a balance totaling 405.5 billion pesos were registered, while the Balances invested in FCI money reached 3.1 trillion pesos. Both concepts, considered together, represent 5.35% of total private sector deposits, which was $65.1 billion in the aforementioned month.

meansofpayment1.png

Use of cards: debit beats credit

In credit card payments, interannual variations of 20.9% in quantities and 6.4% in amounts are observed, with 162.3 million payments being made for 6.7 trillion pesos. Meanwhile, debit cards continue to outnumber credit cards, with 234.5 million transactions for 4.6 billion pesoswith variations of 6.7% in quantities and a reduction of 4.2% in amounts, both data measured in interannual terms.

On the other hand, 90% of money withdrawals were made from ATMs with 83.3 million money withdrawals from the 17,056 ATMs for a total amount of 2.8 billion pesos, with the average number of withdrawals in each ATM being 4,883. The average extraction amount reached 33.3 thousand pesos. AND non-banking with debit card 5.6 million for 223.5 billion, with an average amount of 40 thousand pesos.

In foreign currency The survey shows that there were 2.3 million operations with a year-on-year increase of 149.6%, for USD 4,082 million, a figure that indicates an increase of 166.7% compared to the same month of the previous year.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.