The persistence of inflationary pressures responds to a combination of structural factors, such as inflationary inertia and exchange rate lag, and dynamic factors, such as recent monetary expansion and the stimulus to domestic demand.

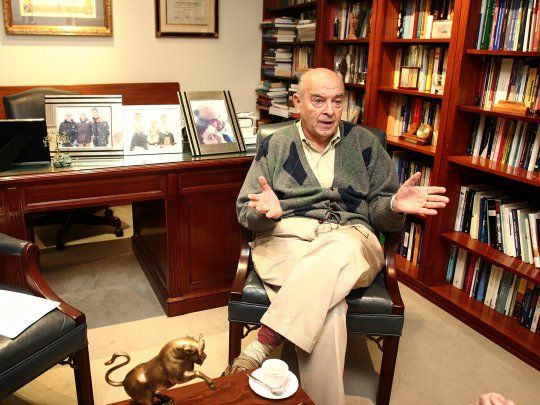

The former Minister of Economy and emblem of Convertibility, Domingo Cavallo, pointed out that “the success of the Government in the fight against inflation has its fundamental origin in fiscal adjustment and the elimination of monetary emission which was due to the fiscal deficit”, but he pointed out that it is also essential “the exchange rate control and gap reduction“. In that sense, he spoke about the prospects for the exchange rate and what will happen to the dollar once it is lifted.

The content you want to access is exclusive to subscribers.

According to the text, inflation in Argentina does not decrease completely due to a combination of structural and dynamic factors related to economic policy and exchange management. The main points that contribute to this phenomenon are explained below:

Dependence on exchange controls

As mentioned by Cavallo, the exchange rate trap and restrictions on access to the dollar allow the government to manage the official exchange rate and the exchange rate gap, but these controls also generate economic tensions. Although they have helped contain a sharp devaluation, these restrictions have delayed necessary adjustments in relative prices, which maintains inflationary pressures.

Monetary emission and monetary aggregates

Although the Government initially managed to control inflation through a more austere fiscal policy and a limited exchange rate adjustment, since June monetary policy became more expansive, with significant increases in monetary aggregates such as M2 and bank credit. This revived inflationary pressures.

Economic reactivation and increase in demand

The economic recovery observed since the third quarter of 2024, together with monetary stimulus, has generated a conflict between the objective of maintaining disinflation and boosting domestic demand and production. This clash of objectives complicates price stability.

Expectations and exchange rate delay

The fear of a devaluation jump, added to an official exchange rate considered backward, fuels inflationary expectations. This delay generates costs in dollars higher for some sectors, indirectly increasing prices.

Also the lack of a unified and free exchange market generates distortions that make full stabilization difficult. Although it is proposed to eliminate the stocks to consolidate exchange and monetary stability, this measure, according to the text, must be implemented with precautions and international agreements, such as those of the IMF.

He assures that the disinflation achieved initially was not consolidated due to inflationary inertia and the delay in completing relative price readjustments, which continues to impact price and wage expectations.

Cavallo maintains that although the Government has made progress in the fight against inflation, Factors such as monetary expansion, the reactivation of demand, exchange restrictions and expectations about future adjustments continue to keep inflation at high levels. To move towards greater stability, structural changes to the exchange rate regime, a credible stabilization plan, and a sustained reduction in devaluation expectations would be needed.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.