In a week marked by the awakening of the dollar and the intervention of the BCRA, debt in pesos at a fixed rate closed higher. What does it mean for inflation expectations?

The market was marked this week by the parallel dollar rallywhich forced the Central Bank to carry out a strong intervention to contain prices. Despite this, the Debt instruments in pesos at a fixed rate were in demand at the end of the week. The rise of the Lecap and the Boncapespecially in the long stretch, led to the yield curve will accentuate its negative slope.

The content you want to access is exclusive to subscribers.

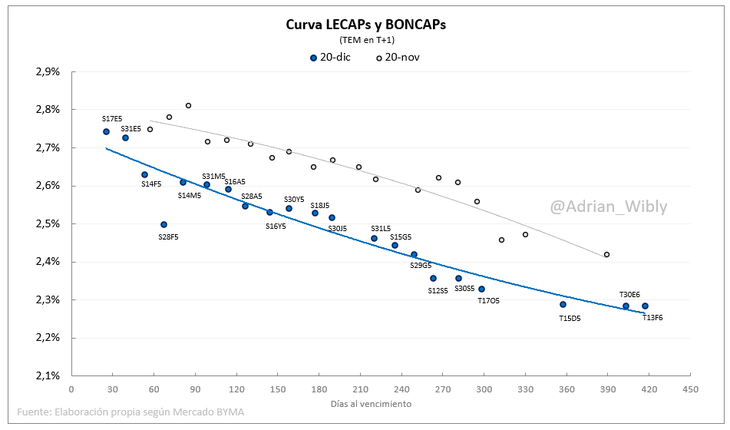

This Friday, The fixed rate segment rose 0.5% on average along the curvenoted the SBS Group. Thus, throughout the week it accumulated average increases of 0.3% in the short section and 1.2% in the long stretch. “At the closing prices, the Lecap and Boncap remained yielding at levels between 33.29% TNA (the bill that expires on January 17, 2025) and 32.29% TNA (the bond that expires on February 13, 2025). 2026),” the firm noted in a report for its clients.

This behavior led to an even steeper slope of the fixed rate yield curvewhich has been operating in an inverted manner for several weeks. This means that short securities have a higher rate than longer ones. What is it due to? It is a sign that the Investors expect the slowdown in inflation to continue its course and, therefore, nominal returns will be lower in the future. That is why they seek to fix returns for longer periods.

image.png

The signal is not minor in the context of the tensions that existed this week in the parallel exchange market and that raised the question in the city regarding whether the “carry trade” cycle would be closed. After several months of exchange rate pax and compression of the gap, financial quotes and the blue dollar woke up, and the BCRA intervened with about US$200 million (according to city calculations) to contain the escalation. Either way, the stage is open.

Lecap: rates and the inversion of the curve

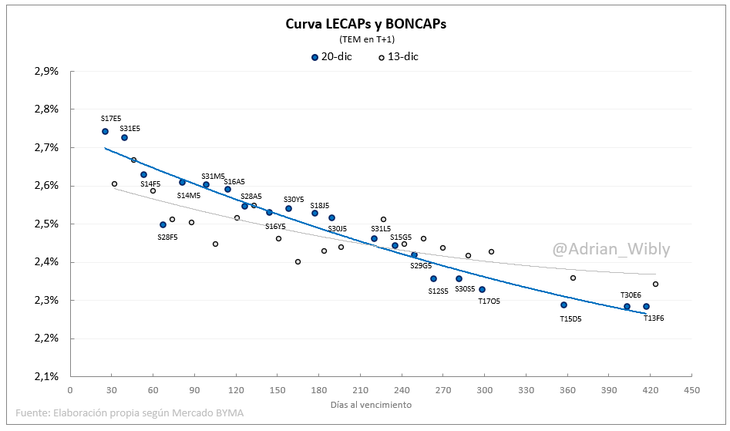

Based on this week’s movements, the trader Adrian Wibly estimated that monthly effective rates (TEM) of Lecap and Boncap They closed between 2.55% and 2.75% in the short section and between 2.25% and 2.45% in the long section. This implies a compression of yields of between 0.1% and 0.2% compared to the level they had 30 days ago.

Likewise, as the price of long securities has risen more than that of short securities, the negative slope became steeper when compared to the curve that was drawn at the close of the previous week (Friday, December 13). This raises a more optimistic scenario for investors regarding the slowdown in inflation in the medium term.

image.png

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.