According to IARAF, the elimination of these two taxes will have a significant impact on GDP, which will be key to the economic decisions made by the government, especially in the context of its focus on achieving a fiscal surplus.

In 2025 they anticipate two national tax reductions: one linked to inflation tax and another to the PAIS Tax, according to the analysis of the IARAF (Argentine Institute of Fiscal Analysis). The report presents two scenarios in which the elimination of these taxes modifies their impact on GDP.

The content you want to access is exclusive to subscribers.

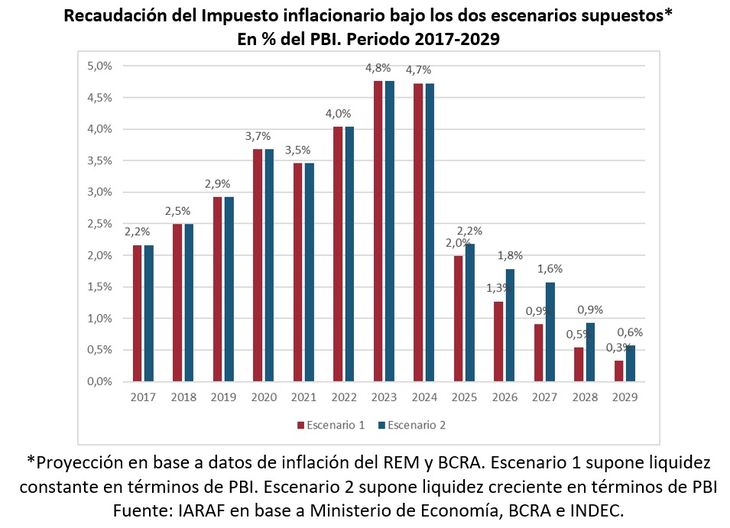

Regarding the inflation tax, two scenarios were projected. In the first scenarioa reduction of 2.7 points is expected percentages of GDP in 2025, while in the second scenario the decrease would be 2.5 percentage points of GDP. The analysis indicates that the relative weight of this tax will suffer a significant decrease in 2025.

On the other hand, The elimination of the PAIS Tax would imply a reduction of 1.1% of GDP. Together with the reduction of the inflation tax, this measure should generate a significant reduction in the tax burden. In fact, the decrease in the inflation tax could represent the first significant tax reduction in the coming years.

WhatsApp Image 2024-12-29 at 12.53.56 PM (1).jpeg

Collection will be key for the Government, since the elimination of the PAIS tax would imply a reduction of 1.1% of GDP.

Regarding whether the elimination of the PAIS Tax will guarantee a reduction in the tax burden in 2025the answer depends on the decisions made by the government. There are two key aspects to consider: the tax burden, which is related to the laws that determine the bases and rates of taxes, and the tax pressure, which refers to the effective collection generated by each tax.

If the government does not make changes to the legal tax rates in 2025 but manages to increase effective collection, it is possible that, although the legal tax burden decreasesthe effective tax pressure increases, which would be beneficial for the treasury. In summary, according to the IARAF report, the reduction of the tax burden will depend on the actions taken by the government in fiscal matters, although it is certain that The relative weight of the inflation tax will decrease in 2025 after reaching maximums in 2023 and 2024.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.