The Bill & Melinda Gates Foundation Trust bought shares in two key companies in logistics and heavy transportation.

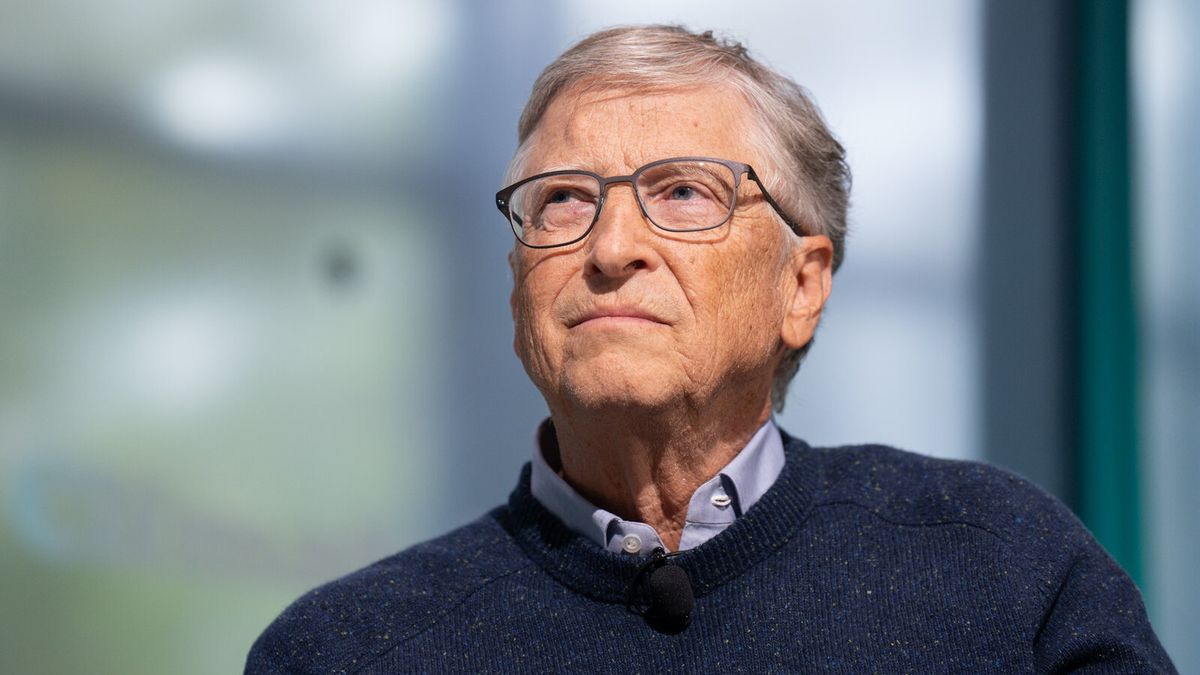

The renowned billionaire and philanthropist Bill Gates surprised with a strategic move by betting US$373 million in the transportation sector, an industry that currently faces significant challenges.

The content you want to access is exclusive to subscribers.

Through the Bill & Melinda Gates Foundation TrustGates acquired shares in FedEx and Paccartwo key companies in logistics and heavy transportation, which highlights their optimistic vision about a possible economic recovery in the short term.

A sector in difficulty

The transportation sector has been hit by the global economic slowdown, with declines in freight demand and revenues for leading companies. In 2024, the index S&P 500 Transportation descended a 0.5%contrasting with the growth of 23% in the general S&P 500 index.

- FedExone of the main logistics companies, increased its stock market value by 10% the last year. However, it revised downwards its forecasts for 2025 due to the economic challenges and costs associated with its restructuring plan. DRIVEdesigned to save u$s2.2 billion.

- Paccara manufacturer of heavy trucks with iconic brands such as Peterbilt and Kenworth, also reported a decline in 5.2% in its revenue for the third quarter of 2024. Despite this, the company showed signs of recovery with an increase in 21% in truck orders in November, which could mark the start of a recovery in the industry.

Bill Gates’ strategy

Gates acquired 1 million shares of FedEx at an average price of $273 per share and 1 million shares of Paccar for $100 each. This decision highlights their confidence that these transportation giants will be able to overcome the current crisis and emerge stronger thanks to factors such as:

- Economic improvements: The possible decrease in interest rates could stimulate credit and investment in infrastructure.

- Logistical importance: Heavy transportation and logistics are essential for the reactivation of global supply chains.

- Corporate restructuring: Both FedEx and Paccar are implementing strategies that could strengthen their position in the market.

Optimistic projections

Market analysts interpret this investment as a long-term commitment to a critical sector for the world economy.

- FedEx plans to separate its FedEx Freight division, which generated $9.4 billion in revenue in 2023, allowing it to focus on improving its core operations.

- Paccar, for its part, continues to lead the class 8 truck market, with a 31.1% global share.

A strategic vision in uncertain times

Gates’ decision reflects his ability to identify opportunities even in crisis sectors. As co-founder of Microsoft, Gates transformed the technology industry, and now uses his experience and resources to influence other key sectors.

With this investment, Gates not only sends a message of confidence to the market, but also reaffirms the importance of the transportation and logistics industries in the global economic recovery, anticipating their relevance in a scenario of commercial and industrial reactivation.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.