The Nvidia stock continue to break records, and consolidate the company as the second most valuable on Wall Street, only behind Apple. Recently Its shares exceeded US$151maintaining strong momentum after an impressive annual growth over 170% in 2024. This phenomenon highlighted the semiconductor sector with significant gains in the year that ended, for all companies. However, the question arises for investors: is it worth continuing to invest in AI? Are there still prospects for a new rally?

In the last few hours, Microsoft announced an investment of $80 billion in AI-enabled data centers in 2025, raising expectations that the Demand for semiconductors will continue to increase. This announcement not only boosted the value of Microsoft, but also that of other companies in the sector, which reacted positively.

But if you look back to the close of 2024, you can see that chipmaker stocks led the gains after Apple supplier Foxconn to report record revenue in the fourth quarter of 2024, suggesting that the rise of AI will continue to be relevant.

Besides, Bank of America (BOFA) He maintained his Buy rating on Nvidia stock due to the company’s projected growth opportunities. Although Nvidia is trading near its all-time high, analysts remain confident in its potential. But it is not the only company that stands out: it is worth mentioning First Solar, Microchip Technology, Advanced Micro Devices (AMD), ON Semiconductor, Monolithic Power Systems and Micron Technology, which emerge as some of the main beneficiaries of this boom in the sector. , according to experts.

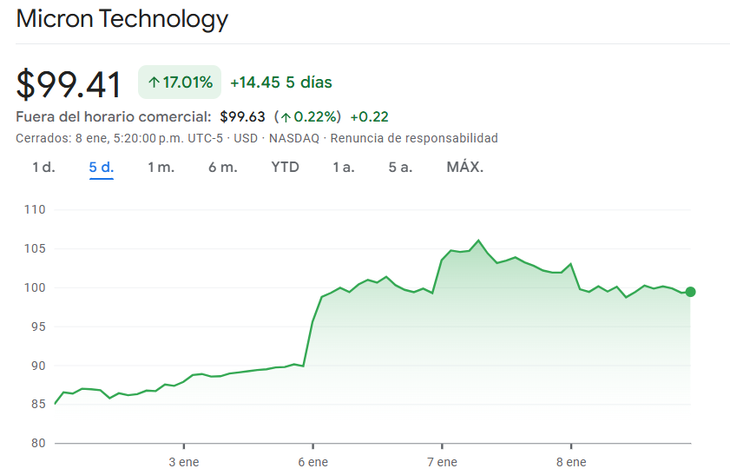

Despite the initial concerns about whether these stocks have peaked, Many analysts agree that there is still considerable upside potential. In fact, taking as a reference the values from the beginning of 2025 until January 7, Nvidia already rose 1.8%, First Solar rose 11.26%, AMD 6.7% and Micron Technology 14.5 %.

Screenshot 2025-01-08 192102.png

Semiconductors: the doubts for 2025

However, the technology sector faces uncertainties, especially since the rise to power of donald trump and the tensions arising from the technological “war” between the United States and China. Although both the US and China are leaders in the development of AI, the key will be to identify Which companies are best positioned to capitalize on technological advances in the coming years. In this context, to know the future projection of companies, it is key to closely follow corporate balance sheets.

Cedears: in which companies linked to AI should it be invested?

“AI still has an upward path and Nvidia remains the most disruptive. Companies linked to AI continue to transform the main sectors and industries that make up the economy, such as transportation, education and the financial sector to name a few. The upside potential is still enormous, The only disadvantage may be how regulations and standards around the world may impact as this industry takes on more prominence. However, as I always say, it is essential to have a portfolio diversified. And I consider that there are other very interesting niches to take into account such as cybersecurity (Crowdstrike, for example, is a company with great potential) and renewable energy and sustainability,” the financial analyst explained to Ámbito. Federico Izaguirre.

On the other hand, he argued that although it is a good idea to have stocks in the semiconductor industry in your portfolio, It is essential to be aware of the risks. In that sense, he stressed that a factor to consider are the trade restrictions between the US and China. “Rising tensions between the two nations may lead to tariffs and export restrictions that could affect semiconductor sales in China. Alternatives such as Nvidia and AMD have relatively low exposure to China, which could make them more attractive options. On the other hand, companies like Qualcomm and Broadcom have greater exposure to Chinawhich could make them more vulnerable to the effects of tariffs and restrictions,” he concluded.

Besides, Fernando Dirazar, investment advisor, agreed with Izaguirre about choosing Nvidia and AMD as alternatives: “It seems to me that the artificial intelligence boom still has a little more fuel to continue rising in companies like Nvidia or look for a company that is behind in terms of prices and that it is not close to maximums like AMD”. On the other hand, he highlighted that Nvidia differs from other companies because they are 100% disruptive companies, “Everything they earn is reinvested to grow” and it is for this reason that they also tend to be riskier companies.

Can stocks have a pullback in 2025?

Finally, Damián Palais, Cocos Capital Financial Advisor, He pointed out that to invest in Cedears it is important to take into account the annual income of the S&P500. The S&P500 rose in 2023 and 2024 more than 20% each year. “That is something that does not usually happen and for the third consecutive year, it does not usually happen. What the statistics say is that for the third consecutive year after increases like this, very calm years are coming,” he asserted.

That said, he added that taking a longer-term look, AI is still starting to show what it can do. In this sense, he pointed out that “in the long term, not only staying in the year 2025, Microsoft – after the announcement – can be a good investment taking into account that it is a very solid company with growth quarter after quarter and with very good financial results.” solids”.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.