For economist Nadin Argañaraz, head of the IARAF, the Nation will only be able to compensate for the drop in the PAIS Tax and some other taxes. He points out that the Government should propose a reform at the end of this year that will only have an impact in 2026.

The Government of Javier Milei will not have room to lower taxes in 2025 if the projections that were implicit in the budget project that was not discussed by Congress are met. This is because The drop in income from the PAIS Tax added to that of Personal Assets leaves no room to try some relief for taxpayers.

The content you want to access is exclusive to subscribers.

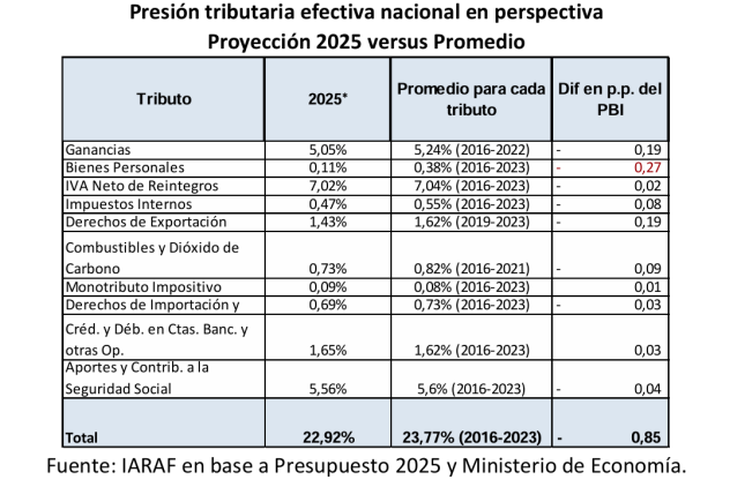

The analysis was done by the economist Nadin Argañarazhead of the Argentine Institute of Fiscal Analysis (IARAF). The report was prepared based on the income projections that appeared in the 2025 budget project, compared in turn with the average tax collection in the last 10 years. If official estimates were met, the behavior of collection would be similar to that of the last decade.

The challenge that the Secretary of the Treasury has to face, Carlos Guberman, is to recover the equivalent of 1.1% of the Gross Domestic Product (GDP) that will be lost due to the end of the COUNTRY Taxand the 0.3% that remains from the modifications to the Personal Property Tax. In 2024, the Special Personal Property Income Regime (REIBP) was in force, which anticipated the proceeds of 5 fiscal periods. On the other hand, there are the extra income from the moratorium and money laundering.

iaraf-taxes-2025.png

Argañaraz maintains that “the national government has the challenge of compensating part of the extra income for 2024 and all the income from the PAIS tax.”

For the director of the IARAF, “the most significant thing” about the year that is beginning is the loss of the PAIS Tax, because it was not co-shareable. Among the taxes that It is projected that they will rise to recover collections. Profitsdue to changes made last year. Others that are supposed to improve, but are not shared, are Withholdings on exports, Tariffs, Check Tax, Fuels and Contributions and Contributions to Social Security.

In this way, Argañaraz maintains that “The national government would not have fiscal margin to make new tax cuts that impact during 2025.”

“This It does not rule out the possibility that some reform could begin at the end of this year, with full impact on revenue collection during 2026. For decision-making the key is what is expected, hence the importance of confirming a specific reform,” he warned.

In fact, the Government announced that works on tax reform intended to simplify the current structure so that there are only about 6 taxes at the national level. To do this, in turn, requires that provinces and municipalities also reduce their tax burden.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.