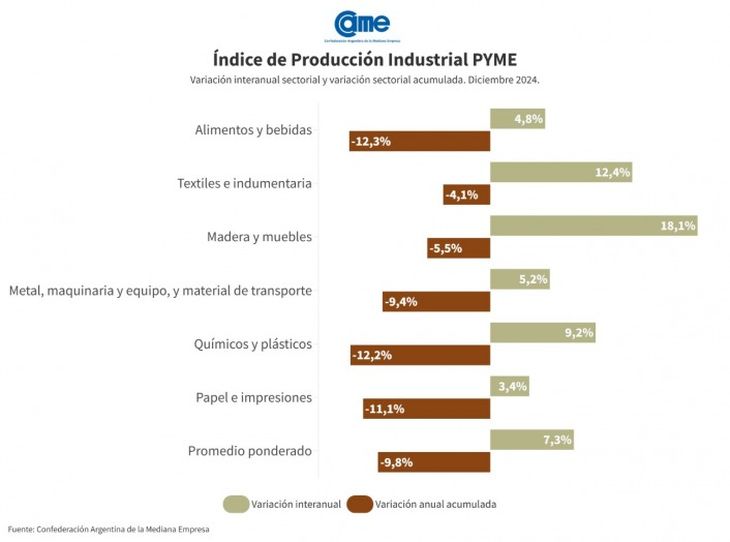

The manufacturing activity of SMEs It grew 7.3% year-on-year in December – on the same date in 2023 the decrease was 26.9% – and closed 2024 with an accumulated fall of 9.8% compared to 2023. It should be noted that in the Last month of the year, all the sectors surveyed presented positive variations in their interannual comparisons.

On a monthly basis, the activity of industrial SMEs registered a growth of 4.3% in the seasonally adjusted measurement compared to the month of November. Regarding the industrial capacity used An average of 62% was recorded, marking a drop of 1.1 points compared to November.

678ce84a11594_706x436.jpg

Monthly, the activity of industrial SMEs registered a growth of 4.3%

SME industry: sector analysis

In the annual comparison, all items showed an increase compared to the previous year. The items stand out Wood and furniturewith a year-on-year growth of 18.1%, followed by Textiles and clothingwhose activity established an increase of 12.4% in December.

In the accumulated of the year, all sectors closed with negative values. With falls of 12.3% and 12.2%, Food and drinks and Chemicals and plasticsrespectively, were the most affected during 2024.

The sector recorded growth of 4.8% year-on-year at constant prices in December, and an improvement of 4.3% in the month-on-month comparison. During 2024, a cumulative decrease of 12.3% was recorded. In the last month of the year, the industries in the sector worked with a used capacity of 62.1%, which marked a reduction of 3.5 points compared to November.

Production rose 12.4% year-on-year in December and 4.1% compared to November. The textile sector closed 2024 with an accumulated interannual variation of -4.1%. Regarding the industrial capacity used, in December it remained the same level as in November with 59.6%.

In December, the sector grew 18.1% year-on-year at constant prices and 4.7% in the seasonally adjusted month-on-month comparison. In 2024, activity fell 5.5% compared to 2023. Labor, tax and service costs are factors that affect competitiveness against imports.

- Metal, machinery and equipment, and transportation material

The sector had a year-on-year recovery that amounted to 5.2% in December, at constant prices, and grew 2.6% in the seasonally adjusted month-on-month comparison. The accumulated variation in 2024 marked a decrease of 9.4% compared to 2023. The industries operated at 60.8% of their installed capacity.

In December, the sector experienced growth of 9.2% year-on-year at constant prices and a rebound of 6.7% in the month-on-month comparison. 2024 accumulated a drop of 12.2% compared to 2023. During this month, industries operated with 62.9% of their installed capacity, compared to 65% in November.

Activity showed a recovery of 3.4% annually at constant prices in December. In monthly terms it had an increase of 7.8%. The sector ended the year with a cumulative fall of 11.1% compared to 2023. Companies operated with 64.2% of their installed capacity.

678ce84a16ab6_706x524.jpg

In the annual comparison, all items showed an increase compared to the previous year.

Qualitative survey: what companies think

The SMEs maintained their position and again indicated that the main measure that should be implemented in the short term is the reduction of taxes, both national, provincial and municipal. This claim captured 64.9% of the responses (3.1 percentage points above November). Second place was held by stimulation of internal demand with 11.2% of responses.

In turn, bureaucratic simplification ranked third among the measures considered most effective for SMEs in the short term, with 8.5% of the responses, just 0.4 points above incentives for hiring of personnel, which obtained 8.1% of the responses.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.