However, the study indicates that – despite the fact that the real has significantly depreciated – Economic fundamentals, such as balanced external accounts and a solid level of international reserves, mitigate some of the risk. “Local rates have assimilated much of the economic shock, while the low level of debt in dollars limits exposure to local factors, keeping sovereign bonds in line with international trends,” Buenbit explains.

Brazil and the surprise for the markets

Marcelo Lezcanopresident of catallaxia, Global Investment Agency, comments in dialogue with Scope that 2024 brought significant surprises in the Brazilian market, with the depreciation of the real as the most resonant fact. “The price of the Brazilian currency began the year at 4.87 per dollar and closed at 6.17, which represented a devaluation of 21%,” he warns.

But Lezcano analyzes that, despite this adjustment in the exchange rate, Prices in the country showed a moderate increase of 4.8% during the same periodwhile the final production of goods and services registered a growth of 1.1%. This is a fact that seems unprecedented.

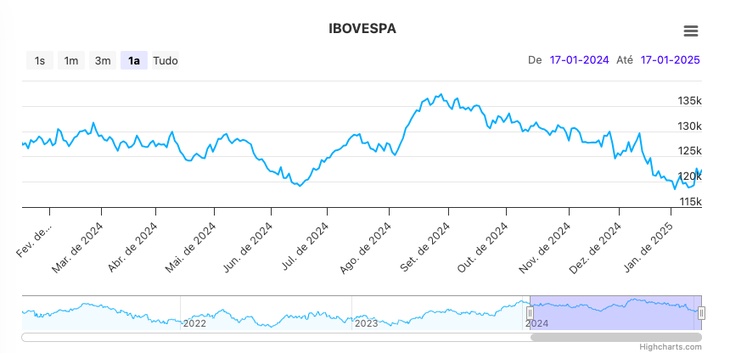

Lezcano then points out that, in financial terms, the reference stock index of the São Paulo Stock Exchange (Bovespa) fell 26% in dollars, and assures: “a significant drop always brings good buying opportunities”. As an example, it highlights items such as public services, health, basic consumption and energy, which have great potential for revaluation.

Bovespa.png

Despite fiscal challenges and the depreciation of the real, Brazil presents itself as an attractive investment opportunity.

Mariano SardansCEO of the FDI Asset Manageragrees with Lezcano and maintains that, with regard to the Brazilian market, “the opportunity lies in the stocks,” which are quoted in reais.

Sardans explains that, today, Brazil is at historic lows, even below the level reached during the pandemic and close to the lows of 2016, in the midst of Dilma Rousseff’s government. “This positions the Brazilian market as an excellent investment opportunity,” he analyzes.

And, as he explains well, Brazil faces a fiscal deficit problem, but not a balance of payments problem. In other words, the Brazilian economy is so depreciated that, “from the point of view of tourism, it is attractive for Argentines. In addition, the highly devalued real boosts the sales and exports of the country’s companies,” he maintains.

Investing in Brazil: an opportunity with high dividends

Lezcano stands out, for example, in the energy sector, Petrobras, which is currently trading at $6.12 and has a Price to Earnings Ratio (PER, in English, or price-earnings ratio) of 4.9, compared to a value normalized of 9.6, implies a revaluation potential of 95.9%.

“If we add to this the low levels of debt (1.24 debt to EBITDA), a dividend policy focused on the shareholder and oil above US$70, the only thing we have to do is wait,” he says. the strategist.

In the basic consumer segment, the president of Catalaxia likes the company São Martinho SA, dedicated to the production and sale of sugar, ethanol and other sugarcane byproducts in Brazil. “Currently, it is trading at 22.99 reais and, in the last year, it fell 16.2%. In terms of valuations by ratios, we see a PER of 7.9 against a historical average of 11.3, which leads us to think about a revaluation potential of over 40%,” he says.

The attractiveness of ETFs in Brazil

Sardans comments that an interesting option to invest in the neighboring country is through Exchange-Traded Funds (ETFs) that concentrate the country’s main stocks, such as the EWZ or the 4BRZ.

These tools happen to include highly profitable companies, many of which are multinational or at least regional. In particular, the ETF EWZ It currently projects an annual dividend of 8.5%, “which shows how cheap Brazilian companies are,” the expert analyzes and adds that this high dividend reflects that, despite the depreciation, the companies generate significant profits.

Sardans explains about the investment strategies to follow that he would avoid selecting a specific company due to the characteristics of the Brazilian market. Contrary to that, I would choose to invest in the index in a diversified way, which can be done from Argentina through a Cedear that replicates the EWZ.

The Bovespa accelerated its rise at the close after the attack on Bolsonaro

Despite fiscal challenges and the depreciation of the real, Brazil presents itself as an attractive investment opportunity.

However, it is important to remember that this Cedear implies a withholding of 30% on the projected dividend of 8.5%, applied by the US. “There are ways to avoid this withholding, such as investing in a cumulative ETF registered in Ireland, such as the 4BRZ. This ETF does not distribute dividends, but reinvests them, which allows you to accumulate more shares and avoids the withholding tax 30% American,” he maintains.

It is also important to note that these ETFs They pay dividends twice a yearand 8.5% is even higher than what an emerging bond offers. For example, Brazil’s 10-year bond currently pays about 6.7%. “This makes the Brazilian stock market an attractive option, even if the market does not appreciate in the short term or the real does not recover value against the dollar,” says Sardans.

Projections for Brazil, according to experts

For Lezcano, finally, given the context of inflation and rising rates, value companies (Value) are a great hedging instrument. “If we add to that the volatility of the market, we find a great opportunity to get real bargains”.

Catalaxia’s perspective for the macro is that the real continues its path of depreciation in the coming years, as a consequence of the growth of the expanded monetary base (BMA). In 2024 alone, the BMA grew 10.08% and given the exchange rate run, the Central Bank increased the reference rate (SELIC) to 12.25%, he concludes.

Meanwhile, from the FDI Asset Manager, they analyze that, from a political perspective, Brazil faces challenges similar to those that Argentina had in 2022. The next elections will be at the end of next year, and the main challenge of the Lula government is the fiscal deficit, “which requires a considerable adjustment, similar to the one implemented by Javier Milei.”

“If these measures are not taken, the market will punish the real and, consequently, the Brazilian economy”Sardans warns.

The expert recalls that, in his first presidency, Lula managed to incorporate 40 million Brazilians into the middle class, but today many have fallen back into poverty due to inflation and devaluation.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.