Among the companies most punished in January are Edenor (-15.3%), Ternium (-8.8%) and Central Port (-7.7%). then comes Black Hill (-5.6%). The truth is that red weighs in the earnings of the month. This scenario left a large part of equity investors with returns lower than those of the fixed term (2.5%).

And what Lentini is referring to is that “there are investors with large capital, who are in no hurry.” The same ones who bought shares in the Argentine stock market in 2023 and 2024. These investors, who saw their assets double in one year, are the ones who may begin to sell those positions. “This is important because the average portfolio typically doubles its wealth in eight years,” he explains.

For the expert, they are investors with a lot of knowledge and experience. “These are those who bought bonds at $25 and now they sell them to $75or those who acquired Banco Galicia for au$s7 and today they sell it for au$s70. It is no coincidence that the Galicia Financial Group go out to issue new shares right at this moment, when its price is at its highest. This movement is a sign that it could be time to dismantle positions, and this action by the bank confirms it,” analyzes Lentini.

Emilse Cordobadirector of Bell Stock Marketrecalls in statements to this medium that Argentine assets are coming from a very important bullish rally. “The healthy and expected profit-taking finally arrived and, according to the correction percentages, they perfectly respond to profit-taking,” says the strategist.

Córdoba slips that said profit taking occurs in a month where the volume of operations decreases due to seasonal issues. “January is the main vacation month“, so after collecting the return on investments, a change of direction towards more safe-haven assets is expected.”

A position that is almost one of survival in the financial world, since it coincides with a moment of caution at a global level before the inauguration of the new US president, donald trump“which from day one is agile and disruptive in its governance,” comments the expert.

S&P Merval: politics generates caution

Pablo LazzatiCEO of Insider Financecomments in dialogue with this medium that the current volatility of the Buenos Aires market is due to the fact that many stocks reached levels close to their historical highs, “such as those recorded during the government of Mauricio Macri.”

And as he explains, although the Argentine economy is going through a recovery process, “to achieve sustainable growth, structural adjustments, such as tax and labor reforms, are still necessary.” Furthermore, for Lazzati, “the elimination of the exchange rate and the continuity of economic policies aimed at achieving a fiscal surplus and reducing public spending They would be key factors to drive stock growth again“However, these changes require time, since their implementation and results usually take several months.

Therefore, regarding Argentine stocks, Lazzati recommends a cautious stance. “The recent downward adjustment in tax perceptions is a positive sign, since it points towards a possible tax reform, but we are still in a waiting stage to evaluate the concrete impact of these measures,” he analyzes.

The strategy recommended by the city in the midst of the correction

The title of this note carries a phrase left by Mr. Lentini who comments: “The phrase says that the stock market is a system that allows wealth to be transferred from the impatient to the patients. Those impatient people who sold in 2023 for fear of 2022, are precisely the same ones who are now attentive and afraid because there is a 10% drop in the market.”

A decrease that, as he explains, occurs after an increase of more than 100% for two years in a row. So, “while it is normal in the stock market to hear the idea that it is important to have money, patience and ballsmy suggestion is to rephrase that phrase: “You have to have patience, yes, but above all intelligence not to do what the newspapers say or what the pack does.”

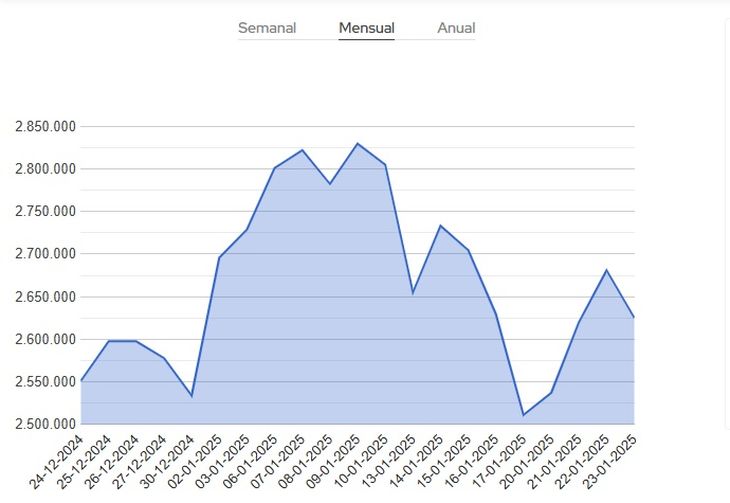

Mervalambio.jpg

For its part, Córdoba recommends Wait until the market in fixed rate assets in pesos stabilizes. This, with the aim of seeking to ensure the highest possible rates, such as the capitalizable Treasury Bills (Lecaps) in May. Something that agrees Mariano RicciardiCEO of BDI Consulting, who adds that lowering the “crawling peg” to 1% will play a key role as an anchor against inflation.

And it maintains that, Starting in February, with the “crawling peg” at 1%, inflation is expected to decrease gradually and that this index will function as an anchor that could take it to levels of 1.5% or 1.7%. Within 6 to 9 months, there is the possibility of completely eliminating the regulated exchange rate, along with the exit of the stocks, he maintains. This is a key component of a medium-term plan, which aims to reduce the nominal value of the economy and control inflation, which will reduce inflationary expectations.

“When you manage to get out of the trap, It will be crucial to maintain positive real rates to make holding pesos attractive“, analyzes Ricciardi. Otherwise, by opening the market, a flight towards the dollar could be generated, which is problematic given that the reserves are negative and, in the case of new loans, these would be short-lived if not controlled. the purchase of dollars.

Therefore, “It is a complex scenario where, for conservative and moderate investors, we recommend starting to dollarize their portfolios given the possibility of an adjustment of the dollar, due to the loss of competitiveness and the lag of the exchange rate.

Finally, Lazzati recommends a similar strategy focused on dollarized assets. Strictly speaking, focused on Brazil, where it sees opportunities in assets “undervalued due to the recent economic impact.” Among its recommendations are: Nubank, Banco Bradesco (BBD) and Vale.

In this way, the volatile behavior of the market throughout January reflects both a natural adjustment after a bullish period and the uncertainty generated by the political and economic context. Although profit-taking is a phenomenon that could arrive at any time and is also healthy in a prolonged economic cycle, the local market faces additional challenges, such as the need for structural reforms and the pressure to maintain competitiveness in the face of the devaluation of neighboring currencies. Given this scenario, caution seems to be the predominant strategy.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.