The Sovereign Fund of Norway achieved an exceptional 2024, driven by its exposure to large technological and a dynamic stock market.

Norway’s sovereign backgroundthe largest in the world, won 2.5 billion crowns (about US $ 22,000 million) last year, which meant the greatest performance in its history in gross terms, largely driven by Technological valuesas reported on Wednesday.

The content you want to access is exclusive to subscribers.

The profitability was 13%, which contributed to increase its value to 19.7 billion crowns (US $1.75 billion) at the end of the year. In comparison, the Sovereign Fund of China (China Investment Corporation) has around US $1.35 billion, and that of Abu Dhabi (ADIA) is around US $ 993,000 million.

Although the Norwegian fund holds a 13% yield in 2024, other funds, such as Singapore (GIC), reported more modest yields, around 6-8%, due to lower exposure to technology and greater diversification in assets of less risk.

The increase was mainly due to investments in variable income, which represented 71.4% of their portfolio and paid 18% throughout the year. “The Fund achieved very good yields in 2024, thanks to a very dynamic stock market,” said his person in charge, Nicolai Tangen, in a statement.

“The actions of US technology companies, in particular, had very good performances“He added.

Investments for Fixed Income and Real Estate

While the variable income was the growth engine, the investments in fixed income (26.6% of the portfolio) only generated 1% of yield, reflecting the impact of the highest global interest rates.

Also, real estate investments (1.8% of the portfolio) fell 1%, in line with the global deceleration trend in the real estate market due to inflation and financing costs.

Renewable energy and sustainability

Investments in non -contributed renewable energy projects, although marginal (less than 2% of the portfolio), lost 10%. This contrasts with the growing global interest in clean energybut it reflects the challenges of profitability in long -term and not quoted projects.

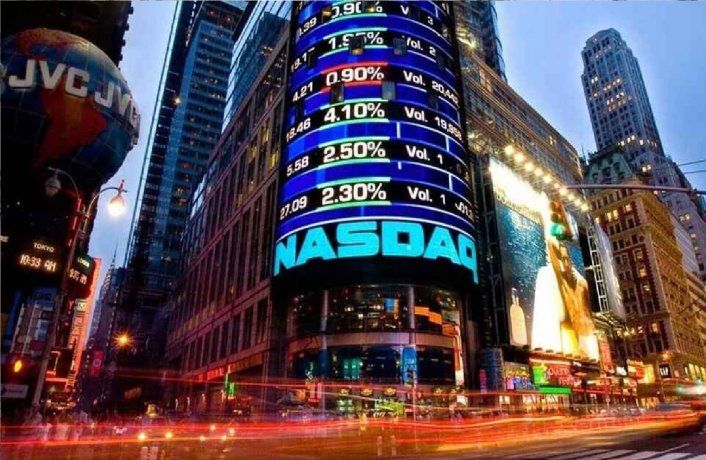

Nasdaq

Norway’s sovereign background achieves the greatest performance in its history thanks to technological ones.

Norway has been criticized for maintaining a great dependence on oil income to finance its fund, despite its sustainability approach. However, the fund has increased its investments in companies with ESG criteria (environmental, social and governance).

Grow national wealth to finance the expenses of the welfare state when hydrocarbon deposits are exhausted. It was formally created in 1990 and its value exceeded 10 billion crowns in 2019.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.