According to his gaze, Nvidia’s collapse is only the beginning of a deeper adjustment in the market, and that investors must prepare for possible unforeseen crises, protecting their portfolios against extreme risks.

Nassim Taleb, the author of The Black Swanwarns that the recent massive fall of Nvidiawhich suffered an unprecedented sale on Monday, it is only a warning of what is coming for those investors who immersed themselves thoughtlessly in the rally driven by artificial intelligence on Wall Street.

The content you want to access is exclusive to subscribers.

According to Taleb, future falls in the value of the shares could be two or even three times deeper than the 17% decrease experienced by NVIDIA this week. This collapse, which erased an impressive total of US $ 589,000 million of the company’s market capitalization, has become the largest in the history of the stock market.

Taleb declared that this event It is only the beginning of an adjustment processsince investors finally begin to realize that the situation is not as perfect as it seemed. In an interview with Bloomberg News during the week of coverage funds in Miami, Taleb compared the panorama with a crystal that, After this first blow, it shows a small splinter that could be broken more easily in the future.

The panic unleashed Nvidia

The panic that unleashed the sale of Nvidia was caused by the fear that the United States technological giants fail to maintain the expected dominance over the field of artificial intelligence. This fear arose after the appearance of Deepseeka Chinese startup that has presented a cheaper approach to the development of technology.

Investors interpreted this new actor as a threat to both the demand for advanced chips and for the dependence of NVIDIA in this sector. Taleb said that investors have been too focused on the narrative that Nvidia’s actions would continue to rise that the company maintained its leadership in AI. For him, Monday’s fall was nothing more than a small correctiongiven the magnitude of the risks inherent to the technology market.

In addition to his career as an author, Taleb Advisor to Universa Investments, a coverage fund specialized in the management of extreme risks, which functions as insurance to protect the portfolios of unpredictable events in the market. Throughout his career, Taleb has gained notoriety on Wall Street for his pessimistic forecasts, although not all have met the same precision.

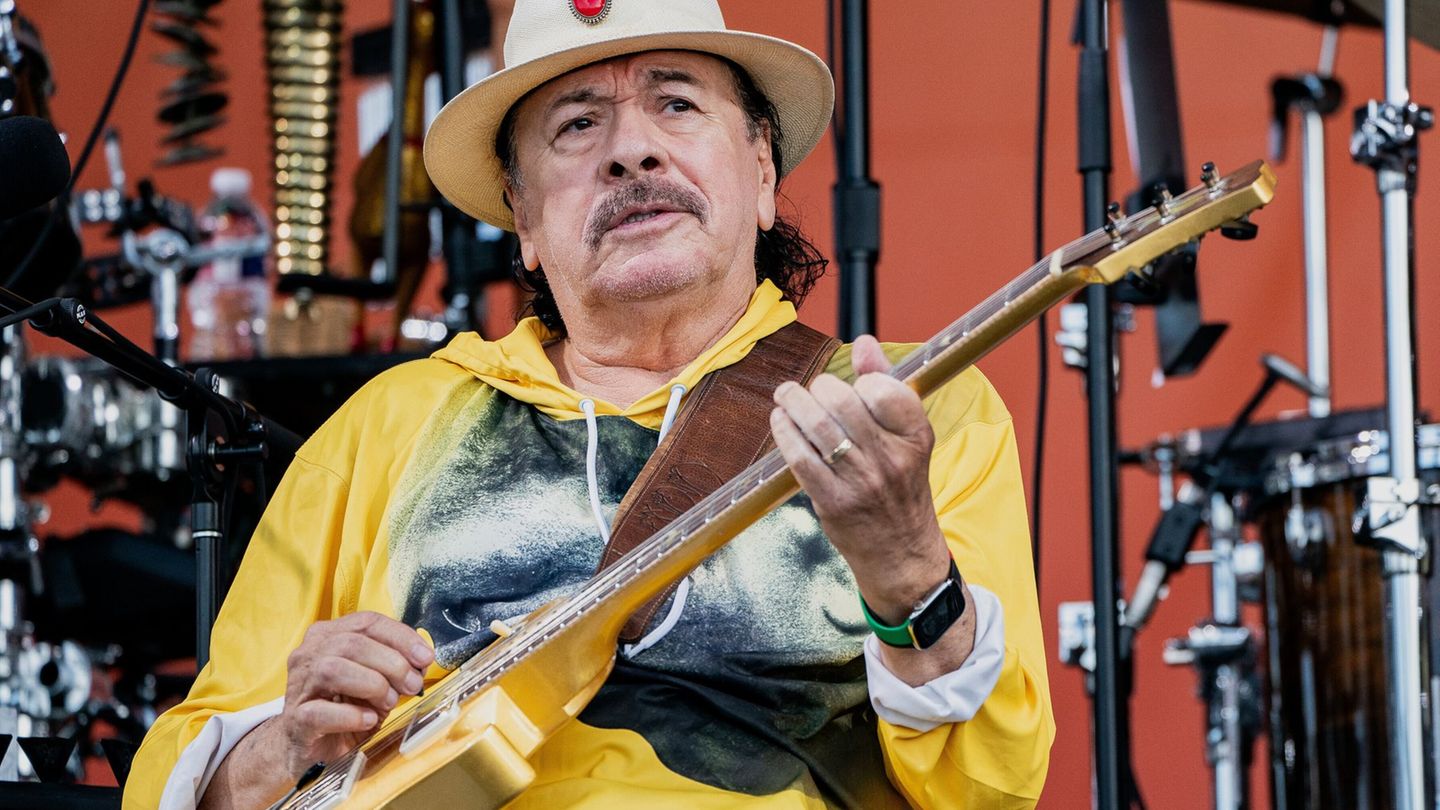

nassim-cabe.jpg

According to Taleb, future falls in the value of the shares could be two or even three times deeper than the 17% decrease experienced by NVIDIA this week.

For example, at the beginning of 2023, Taleb warned that many investors were not prepared to face an era of higher interest rates, where assets could no longer “inflate in an unbridled way.” Despite its warnings, the US actions index. UU. It has increased almost 50% since then, largely driven by enthusiasm for artificial intelligence.

The Taleb and Universa approach does not imply that investors must completely abandon the market, thus losing possible profits. Rather, its recommendation is that a small portfolio portion is destined to protect against possible unforeseen crises, a precautionary strategy that could be fundamental as the market continues to face uncertainties.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.