Domingo Cavallo was built a maze that resulted in a socioeconomic outbreak. More than twenty years later, Caputo seems to repeat the score.

The Argentine Economic History It offers few learning opportunities as clear as the 2001 debacle. Domingo Cavallothe architect of “Convertibility”he was caught in his own maze of orthodox measures, tax cuts, debt exchanges, “Carry Trade” and a dogmatism that ended up precipitating the Social and economic outbreak of the country.

The content you want to access is exclusive to subscribers.

However, more than two decades later, Luis Caputo It seems to repeat the same score, ignoring the alert signals that his own mentor left on the road. Today’s Cavallo is advising the Caputo tomorrow, what did he say?

Cavallo, conducted a detailed analysis in his blog about Argentina’s economic situation in the context of the reforms implemented by President Milei. And he left one that caught the attention: “Additional disbursements of the International Monetary Fund (IMF) would not allow out of the exchange rate, since they would not increase net external reserves sustainably”.

Let’s review the vertigo of only nine months of Cavallo

- March 21: Cavallo, who will occupy the Ministries of Foreign Affairs and Economics during the governments of Carlos Menem, presents the country its economic reactivation plan promising growth.

- March 23: The “Country Risk” qualification of Argentina exceeds the 1,000 basic points barrier.

- March 26 – 28: Low Risk Country: The risk of Argentine bonds is reduced by risk rating agencies Standard & Poor’s and Moody’s.

- March 29: Under the government of the government already reluctant, Congress grants special powers to Cavallo to boost the recovery of the economy.

- April 2: The government announces that it managed to exceed US $ 1 billion the fiscal deficit goal that had been drawn to the first quarter of the year (US $ 2,100 million).

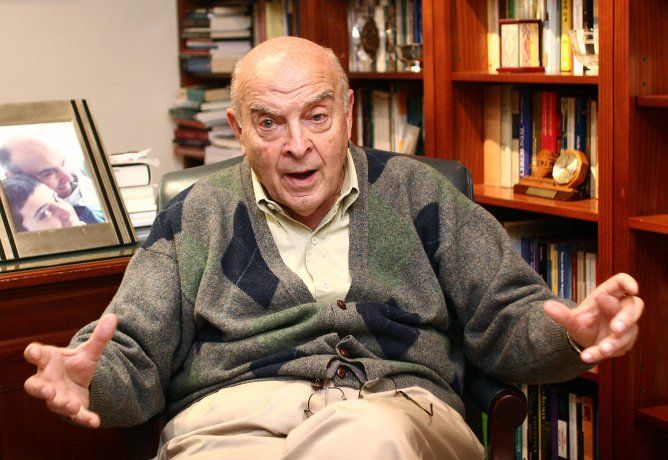

Domingo Cavallo former Foreign Minister of the Argentine Nation

Mariano Fuchila

- April 2: The IMF supports the current exchange system in Argentina since 1991; However, it reduces its growth forecast by 2001 from 2% to 1.0/1.5%.

- April 24: RETA: ARGENTINA offers investors to exchange bonds for new global papers payable in 2008, 2018 and 2031.

- June 3: Return: The Government makes known the result of its bond rescue plan in exchange for promissory notes and other financial instruments: US $ 29,477 million.

- July 10: Cavallo announces the “zero deficit” policy from deep public spending cuts

- July 30: The Senate accompanies him, dominated by the Peronist opposition, approves a law that establishes that the State cannot spend more than it collects. The measure includes a 13% cut in salaries and public pensions of more than 500 pesos (dollars).

- August 21: The IMF managing director, Horst Koehler, recommends that the credit line that the multilateral body maintains with Argentina be extended to US $ 8,000 million.

- October 14: Political reverse for the government. In the midst of a growing uncertainty about the future of the economy, the justicialist opposition is imposed on the legislative elections.

- October 16 – 17: The Standard & Poor’s and Moody’s qualifiers warn that Argentina could enter a technical payments if investors lose money with their bonds in debt restructuring proposed by the government of Fernando de la Rúa.

- October 30: The president of the Rúa tries to calm the markets stating that the participation in the restructuring of the debt will be “voluntary.” The “country risk” classification rises to 2,121 basic points.

- November 1: The Ministry of Economy begins the announced restructuring of public debt by means of the exchange of domestic and international bonds, in order to reduce the financial cost of the State.

- November 2: Nervousness in the markets is triggered, which close the doors to Argentina. The “country risk” rating goes beyond 2,500 basic points.

- November 6: To try to overcome the problem, local banks support the government with the exchange of domestic debt.

- November 7: The official governors of the provinces agree with the government one of the key elements to fulfill the “zero deficit” plan: a cut of the national funds that the central government sends them every month of the federal tax co -participation.

- November 8: However, the provincial governors of the justicialist opposition refuse to sign the tax adjustment pact. Fernando de la Rúa and Domingo Cavallo travel to the United States to meet with the US president, George Bush, and with investors. The North releases their hand.

- November 14: The justicialist governors of the provinces of Buenos Aires, Córdoba and Santa Fe finally sign the tax adjustment pact.

- November 18: Domingo Cavallo returns to Buenos Aires from Ottawa -Canada- empty -handed: the International Monetary Fund had denied her support for public debt restructuring.

- November 19: The government begins to receive offers for the exchange of domestic bonds.

- November 26: To stop a rise in interest rates, the Central Bank of the Republic establishes a stop to the interest paid by bank deposits.

- November 30: In the midst of a marked loss of bank deposits and insistent rumors about an imminent dollarization or confiscation of savings, the “country risk” classification according to the EMBI+ index of JP Morgan reaches a worrying record figure: 3,490 basic points.

- December 1: To stop the growing drop in deposits, the Government imposes for 90 days, among other measures, a weekly limit of US $ 2550 in bank retreats. It also allows dollarizing the deposits in pesos, restricts the shipments of foreign exchange, prohibits loans in pesos and fixes that financial operations are carried out only with the rates that are applied to dollars in dollars.

- December 1: The IMF announces that it will not release a disbursement agreed with Argentina of 1,264 million dollars. The decision leaves the country to the edge of the cessation of payments.

- December 6: The Government announces that it will force pension funds to transform their bank deposits into public titles to finance state expenses.

- December 7: Argentina resumes negotiations with the IMF in Washington, with the intention of unlocking financial assistance funds agreed with the agency.

- December 13: Unemployment reaches its maximum point in the country, with 2.53 million people (18.3 percent of the economically active population) unoccupied, according to official data. A general strike against economic policy to Argentina.

- December 14: Argentina manages to pay the maturities of its public debt and avoid the cessation of payments. The Deputy Minister of Economy, Daniel Marx. Impoverished citizens loot a supermarket from the center of the country in search of food.

In 4 days change of president

- December 17: The Government sends the 2002 budget project to Congress, which includes a strong cost cut of 19%.

- December 18: The chief economist of the IMF Kenneth Rogoff describes the “unsustainable” Cavallo plan.

- December 19: In the midst of a wave of looting to shops from all over the country, the Argentine government decrees the state of siege. The lower house partially repeals special powers of the Minister of Economy, who presents his resignation. Cacerolazo: Manifesters in the City of Buenos Aires challenge the emergency measure of the Government.

- December 19: The Cabinet in full renounce to allow De la Rúa a reorganization of the government. Thousands of protesters collide with the police for the second consecutive day. The dead number rises to 16 since the protest began.

- December 20: In the midst of strong protests, the president of the Rúa invites the Peronist opposition to form a national unity government. Peronists reject the proposal. Fernando de la Rúa sends his resignation to Congress. The dead exceeded the amount of 30.

- December 21: The provisional president of the Senate, the Peronist Ramón Puerta, interimly assumes power.

Failure is not an act in itself, but the consequence of not learning from history. Cavallo was not a victim of fatality, but of his own rigidity. If Caputo insists on traveling the same path, the outcome will be inevitable. Because in economics, as in life, crises are not isolated events, but circles that are repeated for those who refuse to listen.

Director of Esperanza Foundation. Postgraduate professor at UBA and private universities. Master in International Economic Policy, Doctor of Political Science, author of six books.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.