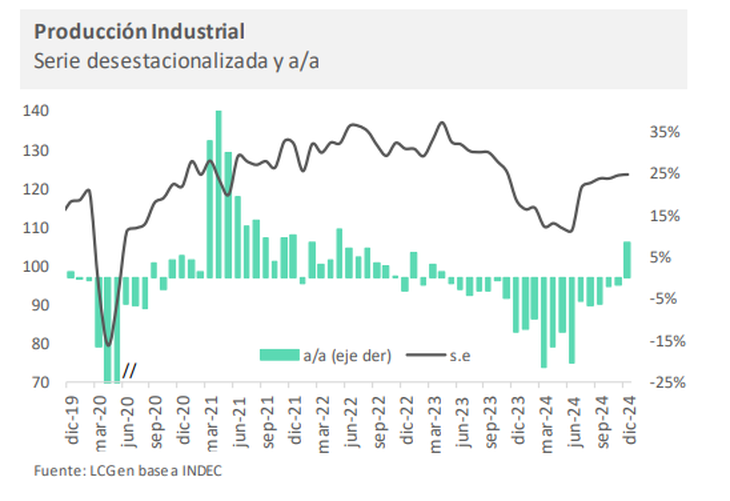

The manufacturing industry suffered in 2024 its deepest collapse since 2002affected by the fall in domestic consumption, the paralysis in the demand for construction supplies and problems paying imports in the first months of the year. Unlike other variables of the economy that show more vital signs, in this sector the recovery, month by month, is very limited.

INDEC Industrial Production Index (IPI) showed a Annual fall of 9.4%, even the one verified in 2020, the most critical year of the Covid-19 Pandemia. This happened despite the fact that in December there was an interannual improvement of 8.4%, given the low comparison base.

It is worth remembering that in December 2023, shortly after assuming the presidency, Javier Milei made the decision to devalue the currency, which generated a climate of strong uncertainty and led inflation to 25% monthly, thus causing a collapse in real wagesthat already started from low levels in historical terms.

He Effect of salary deterioration on domestic demandadded to the fiscal adjustment that supported largely in a Brutal trim in public works and infrastructure spending were translated into interannual contractions of more than 15% between March and June for the IPI.

What were the most affected industrial sectors in 2024?

Within the most relevant divisions within the IPI, The ones that fell most in 2024 were non-metallic mineral products (-24.3%), machinery and equipment (-18.6%) and basic metallic industries (-17.5%). The construction crisis impacted these sectors through the lowest demand for products such as cement or steel, while depressed consumption was reflected, for example, in the low dynamism of appliance production.

While Petroleum refining was the only activity that improved over 2023 (+2%)Food and drinks was the most limited loss (-0.8%). It is worth noting that in both cases these are items with export exit.

image.png

Since July the industry recovers, but at a low pace and with great heterogeneity

Only from July they began to be observed monthly recoveries. In December, the industry produced 0.2% more than the previous month, according to the Destationalized series of INDEC. This series was located still 0.5% behind the November 2023 levelbefore the arrival of Milei to Casa Rosada.

The Director of Productive Planning of Fundar, Daniel Schteingartsuggested to expect some more data to evaluate whether there is a slowdown in recovery. The specialist said The December data is not bad, although it is not to celebrate too much.

image.png

“Julio seemed to mark the floor for industrial activity, with a rebound sustained since then, but with very different results that show heterogeneity between branches. Facing the future, Credit reactivation and the probable scenario of disinflationary consolidation could underpin a more sustained improvement in the industry as a whole“They analyzed from the ACM consultant.

In the face of January, the LCG consultancy anticipated a report that “with the Technical stops which are usually applied at this height of the year and a very disparate growth between sectors we expect a very marginal up. “

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.